Click image to open full size in new tab

Article Text

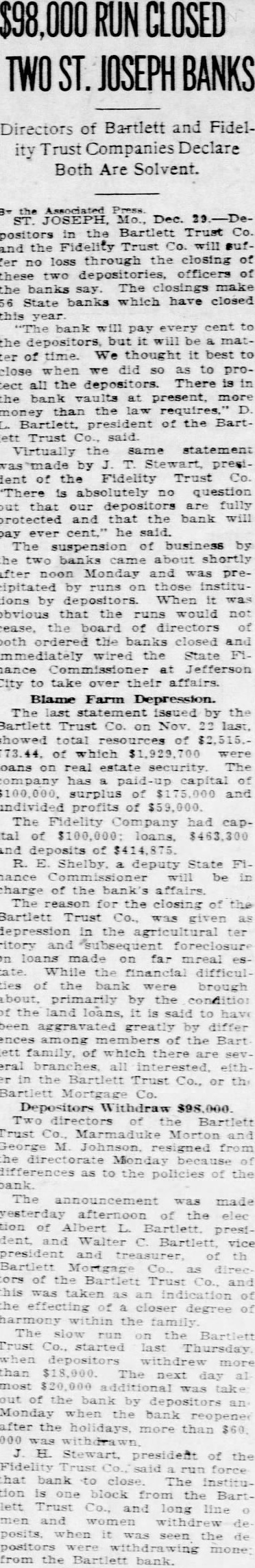

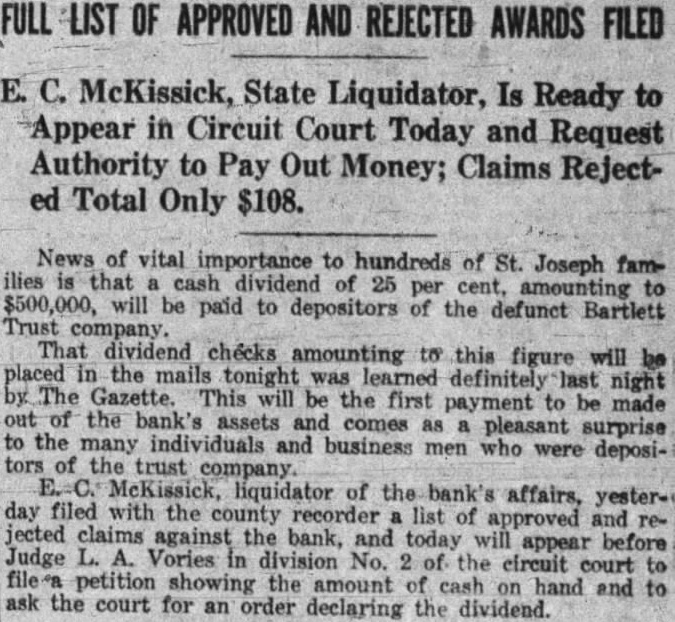

SAY DEPOSITORS ARE PROTECTED

Both Bartlett and Fidelity Trust Companies Will Pay All Claims, They Say

(Continued from Page One) denositors withdrew more than $18 000. The next day almost additional was taken out of the bank by depositors. and Monday, when the bank re-opened after the holidays. more than $60,000 was withdrawn. The St. Joseph Clearing House association was appealed to last week by members of the Bartlett family and Thursday a committee of the clearing house met with members of the Bartlett family and discussed matters of straightening out the finances of the trust company. Christmas day the committee in. formed the bank that It was willing to assist in the liquidation If the Bartlett family would put up $500.000 in collateral or This condition was not met It is said. because the Bartletts could not raise the necessary amount at that time Ask Tootle's Advice

Milton Tootle, Jr. president of the Tootle bank. was appealed to Sunday for advice and suggestions. He suggested that the Bartlett fam12, ily buy the bank's real estate hold. ings amounting to about $120,000. and $225,000 in mortgages that the bank owned on which interest had not been paid. With this cash at the bank's command, Mr. Tootle believed, together with the Bartletts' guarantee that all depositors would be paid. would stop the run on she bank, and save the institution. This second effort to save the bank proved fruitless. It is said, because the family could not raise the amount to buy the real estate loans and mortgages. The following statement was made by Mr. Bartlett following the clos. ing of the bank: "The Bartlett Trust company closed its doors at 12:15 p. m. to. day by order of its board' of directors, and wired the commissioner of finance at Jefferson City to take charge. The trust company is savings institution, established 20 years ago by David L. Bartlett and associates, and has been a very suecessful savings institution. paying Its depositors more than $1,000,000 interest on their accounts. Practically all of its funds have been invested in farm loans in the territory tributary to St. Joseph. Up to year ago the company had had no losses on its investments, and has always been in fact one of the cleanest banking institutions in the state, The depression in agriculture and unprosperous condition of the farmers has resulted in foreclosures and the company has acquired approximately in This did not feet its solvency because the company has paid up capital of $100,000, surplus of $175,000. and un. divided profits of over $59,000. The depositors are protected by this fund. which will be mere than ample to take of any possible losses. Recent have been alarming and to protect its depositors the board of directors de cided at noon today, in view of the continued run, to place the Institution in the hands of the commis sioner of finance."

Will Pay Every Cent

A. L. Bartlett, vice president and director of the Bartlett Trust com pany. had the following statement to make relative to the closing of the institution: "The bank will every cent to the depositors, but be matter of time," said Mr. Bartlett "We thought It best close now. with number of people pulling their monthan to wait until lot of money was drawn out and then find necessa to make those wait who had money in the bank. There is now in the bank vaults more, money than the law requires. "Every loan in the bank is cured except about $10,000 Much of this security is in real estate loans and because of the condition of the farm loans the present situation was brought about. The real estate loans are practically all first mortgages and are all good. "Considerable of the money is secured by good collateral Practically all of the $10,000 not secured is good. "There has been gradual pulling out of money from for the last year and a half There has not been what you could call a run but the money has been taken out in small Recently more was taken and above was withdrawn. So we decided to close all the people could get their money at the same time. rather than to have some get their money now and have others walt. "Not only does the bank have practically all of Its money loaned well secured. but It has no borrowed bills payable This is something that probably no other bank here can say "The bank last examined by representative of the state bank commissioner's office about Dec. 6. He reported the condition good ex cept that the real estate joans were too heavy. The directors of the Bartlett Trust company are listed as David L. Bartlett, Albert L. Bartiett. Jerome Bart. lett. J. D. Barrow, Robert G. Clayton George M. Johnson. Marmaduke M Morton, W. A. Petree and Walker Mr. Johnson and Mr. Morton resigned from the directorate Monday A. Bartlett also is president of the Bartlett Mortgage company, which has no connection with the trust company in any way. company was formed some two years ago and maintain offices on the fourth floor the Partlett Trust at Eighth street and Frederick avenue. Other officers of the Bartlett Mortgage company are D. L. Bart. vice president and treasurer; and A. L. Bartlett, Jr., secretary.

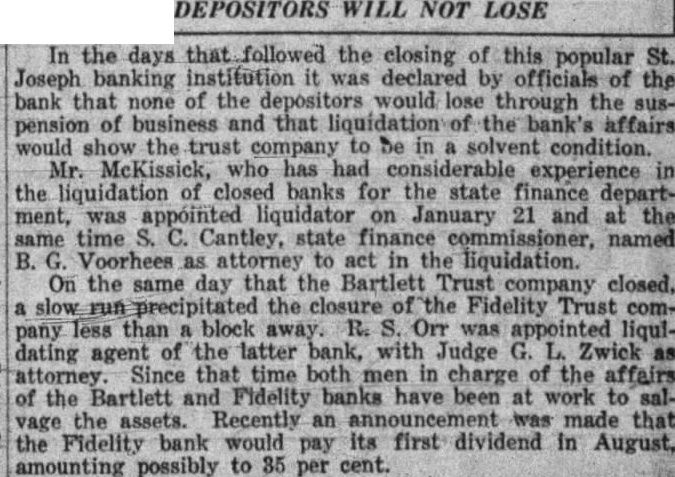

Fidelity Resources $566,300

The total resources of the Fidelity Trust company are listed as $566,300 in the last statement sent to the state banking commissioner The total deposits are $414,875. including $284.070 demond deposits and $130,805 time deposits. This statement also lists as bank loans and 8.42500 in bills payable. The capital of the institution is $100,000. all of which paid up. The officers of the Fidelity Trust company are Stewart, prestdent: N. S. Hillyard, vice president: W. Power, vice president: J. H Stewart, treasurer; and C. E. Grable secretary Mr. Hillyard declared that he no longer was an officer of the bank having resigned about six months ago. The list of directors is as of June last. The members of the board of directors are Stewart, R. E. Davies, B. T. Quigley. C. E. Grable. J. Yocum and J. H. Stewart.

City Depositor

At the time of the closing of the Fidelity Trust company the city had on deposit in that institution about $95,000. but according to James S. Burris, city comptroller, this amount It protected by $500,000 penal bond signed by N. S. Hillyard and R. Bilby. Mr. Bilby also was one of the signers of the Indemnity bond se. curing the city's deposits of $85,000 which It had in the Security Bank of South Park when It closed May last. C. O. Cornellus, president of the Farmers & Traders bank at Nineteenth street and Frederick avenue. said last night that his institution has no connection with the two banks that closed. He declared he believed that the Farmers & Traders bank is located "on the avenue" as is the Fidelity Trust company, when rumors first came out relative to the closing of the Fidelity Trust company, there was some misunderstanding, and similar rumor was started concerning the Farmers & Traders' bank. Late yesterday afternoon there were rumors circulating about that the Wells-Hine Trust company of Savannah, Mo., had closed its doors because of the failure of the FidelIty Trust company here. The WellsHine institution is in an excellent condition and is not in any way connected with the Fidelity Trust company, Walter B. Wells. president of that bank said last night. Aside from its connection with the First National bank and the National bank, Mr. Wells. declared the Savannah bank was not connected with any other banks or trust cony. panies in St, Joseph.

The Bank's Statement

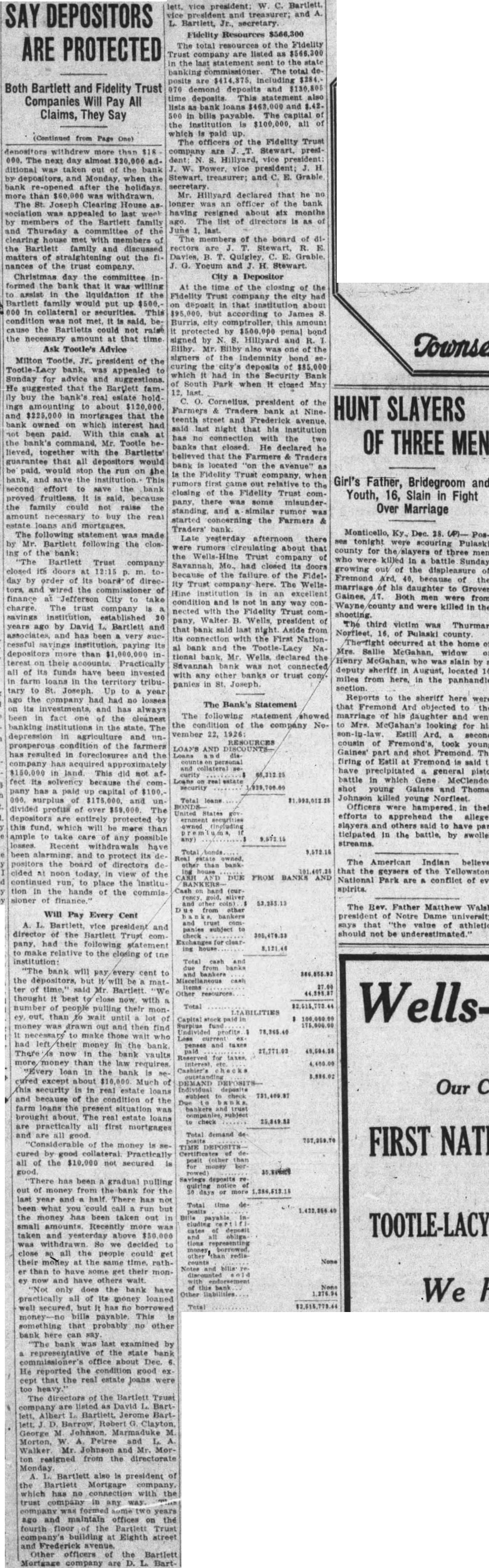

757,259.70

Total time payable cluding deposit tions representing other counts Notes and bank None Other liabilities 1,276.94 Total

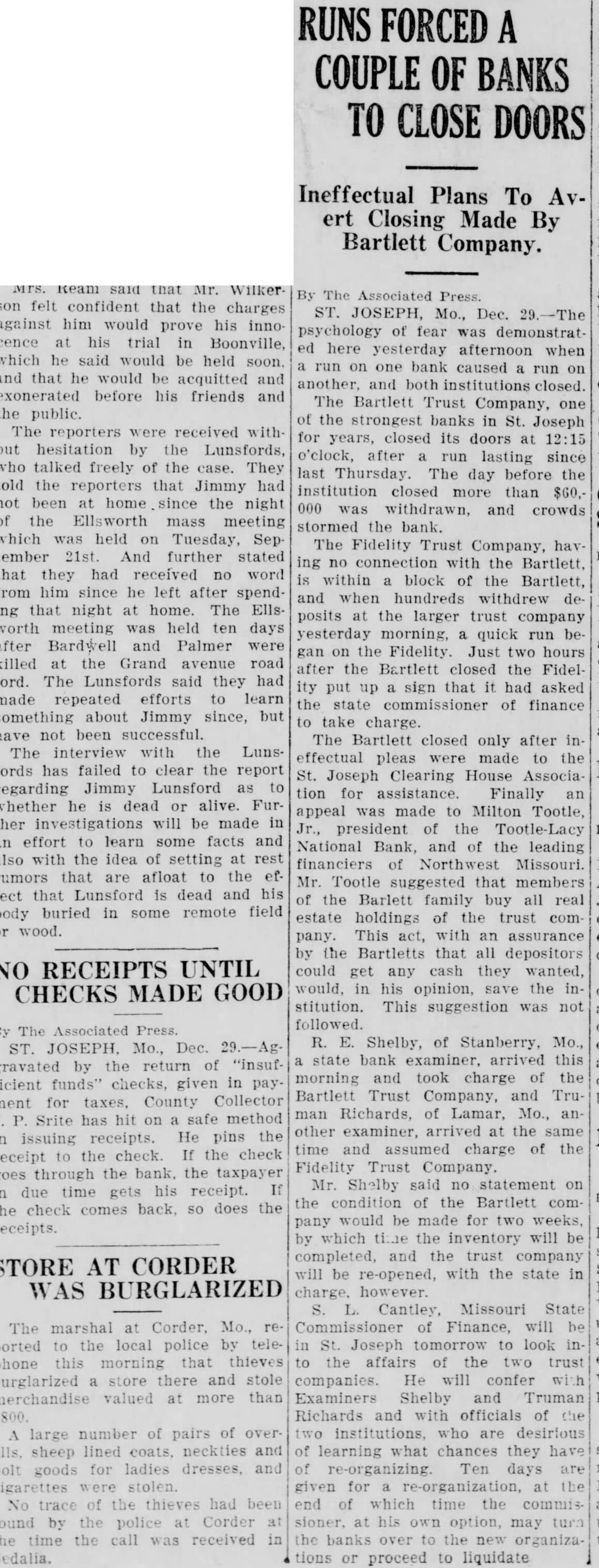

The following statement showed the condition of the company No. vember 22, 1926: RESOURCES LOANS AND Loans and collateral curity Loans on security Total United States owned any) Total Real other than bank. CASH DUE FROM BANKS AND Cash hand and from other bankers and subject check Exchanges ing house Total due from banks and bankers Items 27.00 Other resources Total LIABILITIES Capital stock Surplus 175,000.00 Undivided profits 78,365.40 penses 49,594.38 Reserved Cashier's subject bankers to check Total demand TIME Certificates money Savings deposits or more