1.

January 21, 1933

Modesto News-Herald

Modesto, CA

Click image to open full size in new tab

Article Text

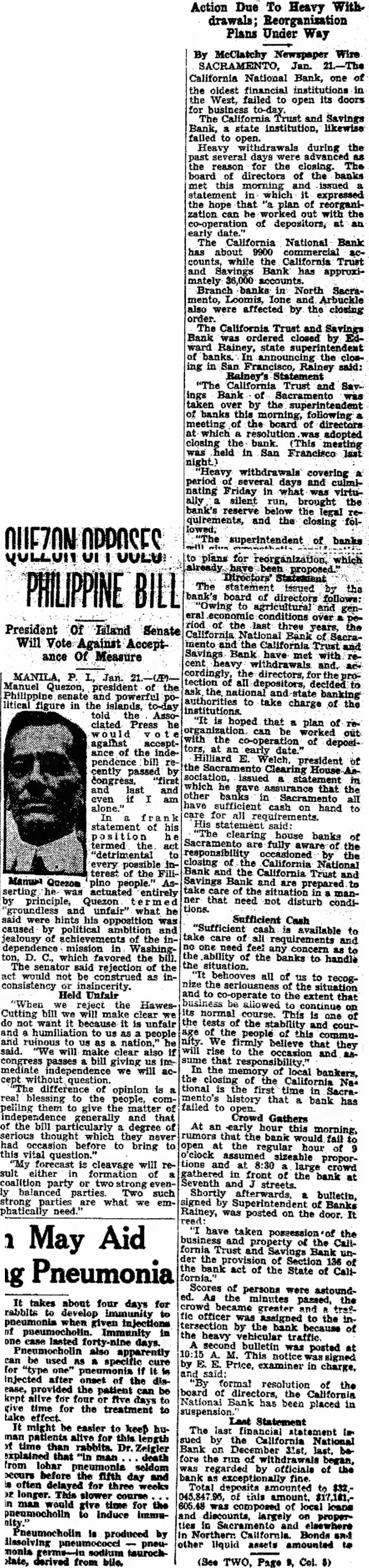

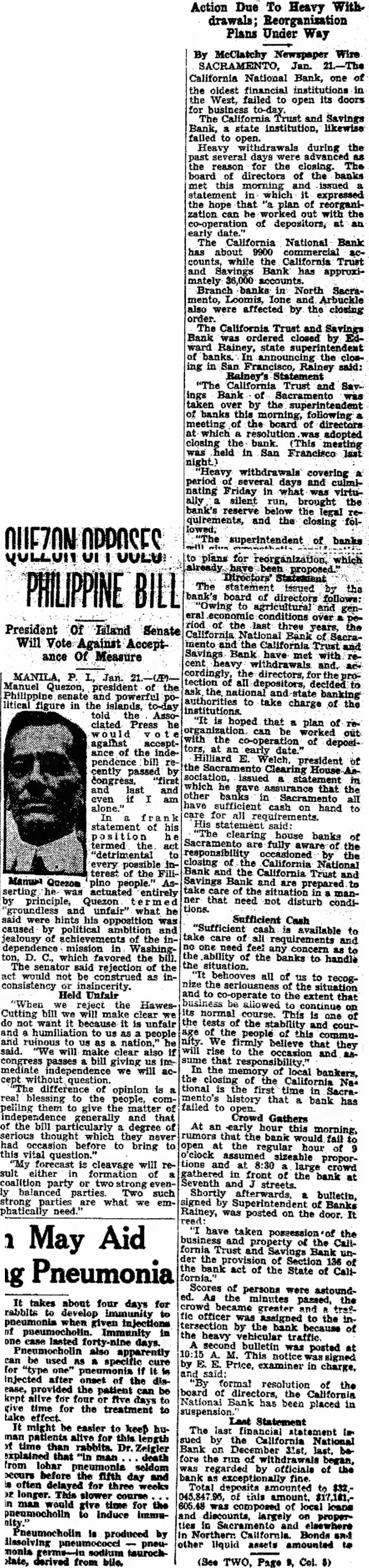

PHILIPPINE

President Of Island Senate Will Vote Against Acceptance Of Measure

Jan. Manuel Quezon, the senate litical figure in the islands, to-day Associated against ance of the pendence bill cently passed "first last statement termed every terest the Manual Quezon pino entirely principle, Quezon unfair' said were opposition caused political jealousy achievements the dependence mission which favored the bill. The senator rejection of the act would not be construed consistency insincerity. Held Unfair "When the HawesCutting bill we clear do not want is unfair humiliation to us people ruinous make clear also congress passes bill giving mediate independence we will without question. difference of opinion is blessing the people, pelling them to the generally the bill degree which they before to bring vital question." "My forecast is cleavage sult either coalition party or evenbalanced Two such strong parties what phatically need.

Action Due To Heavy With Plans Under Way

By McClatchy Newspaper Wire Jan. California National Bank, one of oldest financial institutions in the West, failed to open its doors business California and Savings Bank, state institution, likewise open. Heavy withdrawals during the several advanced reason the closing The board directors of the banks this morning and issued statement which expressed the hope that of reorganization with the of depositors, an The California National Bank about commercial counts, while the California Trust Savings Bank approximately 36,000 accounts Branch banks North mento, Arbuckle were affected by the closing order. California Trust and Savings Bank was closed by Rainey, state the ing in Francisco, Rainey said: Rainey's California Trust Savings Bank Sacramento over by the superintendent banks this morning, following meeting of the board of directors which resolution adopted closing the (This mesting held in San Francisco last night.) withdrawals covering period several days and culminating Friday silent run, brought bank's below the legal quirements, and the closing folsuperintendent of banks plans for reorganization which have proposed.' Statement The statement issued the bank's board of directors follows: "Owing agricultural and over of the last three years, Bank Sacramento and the Savings Bank have cent withdrawals cordingly, the directors, tection decided the state authorities to take charge of the institutions "It hoped that plan of organization can worked the of deposian date.' Hilliard president the House issued statement which that other banks in sufficient on hand to for all said: clearing house responsibility Sacramento are fully aware banks the occasioned closing the California National Bank the California Trust Savings are prepared that need not disturb conditions.

Sufficient Cash "Sufficient cash available to take all requirements need feel ability the banks to handle behooves all of us to the seriousness the situation and to extent that allowed the tests of the and courthe of this We firmly believe that they will rise occasion and that In the of memory local bankers, of the Na. tional first time Sacrafailed history that bank has to Crowd Gathers At an early morning, the bank fail at the regular hour of o'clock tions and crowd gathered in front bank at Seventh and Shortly bulletin, signed Superintendent Banks Rainey, was posted on the door. have taken possession the the Callfornia Trust and Bank fornia.' bank act of the State of CallScores of persons were astoundAs minutes passed, the crowd became greater fic officer assigned the tersection bank because of the heavy vehicular second bulletin was posted This notice Price, examiner charge, formal resolution of the board of National Bank has been placed in suspension

Statement The last financial statement sued by the California Bank December fore the run withdrawals began, regarded by officials of the bank fine of this of local leans largely properCalifornia. Bonds and other liquid assets amounted (See TWO, Page Col.

2.

January 21, 1933

The Modesto Bee

Modesto, CA

Click image to open full size in new tab

Article Text

SILENT RUN REVEALED

Action Due To Heavy Withdrawals; Reorganization Plans Under Way

By McClatchy Newspaper Wire SACRAMENTO, California National Bank, one of "The California Trust Savings Bank taken over by the superintendent banks this morning, following meeting of the board of directors which adopted bank. in San Francisco last "Heavy withdrawals covering period several days and culminating Friday what was virtusilent run, brought the bank's reserve below legal quirements, and the closing followed. superintendent of banks will give consideration plans for which have been proposed. Directors' The statement issued the bank's board directors "Owing to agricultural and over riod of the last three years, Bank Sacramento and the Trust Savings Bank have met cent cordingly, the directors tection all depositors, decided ask the national state authorities to take charge of the institutions hoped that plan of the of deposidate." Hilliard president the Clearing House sociation, issued statement which assurance the other banks in Sacramento cash on hand for all clearing house banks Sacramento are fully the responsibility closing of the California National Bank and the California Trust and Savings Bank are prepared ner that need not disturb conditions.

Sufficient Cash "Sufficient cash available take and one feel concern the ability the banks to handle situation. behooves all of to recogthe seriousness co-operate the extent that business be allowed continue its normal course. is one the tests of the stability and courpeople this commuWe believe they will occasion and In the of local bankers, the of the California tional first time mento's history that bank failed to open. Crowd Gathers At an bank fail open the regular hour o'clock proportions at large crowd gathered front bank at Seventh streets. Shortly bulletin, signed Rainey, posted on the door. have taken the the fornia Trust and Bank unthe Section act of the State of CaliScores persons were astoundthe greater fic officer the by the bank because the heavy traffic. second bulletin was posted notice Price, examiner in charge, formal resolution the board directors, the California National Bank placed in effect. Last Statement might easier to keep hu- The the time than Dr Zeigler Bank 31st, that death fore the of from lobar seldom officials of occurs before the fifth day often delayed for three weeks Total deposits amounted longer. slower course time loans Pneumocholin produced by California Bonds and dissolving pneu- liquid assets monia olate, derived from bile. (See Page Col.

3.

January 22, 1933

Oakland Tribune

Oakland, CA

Click image to open full size in new tab

Article Text

for 2 Sought Reorganization Sacramento Banks Closed

(Special to SACRAMENTO, effect California Bank and the affiliates. Trust its which closed Savings here this were being put today. placed in the The hands and state banking the boards of directors of the in North Ione and Arbuckle STATEMENT ISSUED The statement of the directors "Owing to agricultural and genthe last three years, the ifornia Bank Sacramento the California Trust and Savings Bank have with recent heavy accordthe directors, for the protecingly, tion decided ask the and state thorities take charge of the plan of organization the cooperation the

Tribune) State deposits to the extent are protected by bond deposit, according State Treasurer Gus Johnson. Other deposits by departments, in some cases, RUN E NCOUNTERED Shorly after the made public started the Capital National located opposite closed President Alden addressed and assured them they could secure their money shipment from the San Federal Bank received by this bank during morning. California National has about commercial accounts and the California Trust Savings proximately The statements the two banks December 1932, showed that deposits totaled resources of the date reported This included loans bonds other than federal, and in and

4.

January 22, 1933

Modesto News-Herald

Modesto, CA

Click image to open full size in new tab

Article Text

RUSHED TO CAPITAL AS BANKS CLOSE

California National And California Trust And Savings Fail To Open

FUNDS WILL PROTECT OTHERS AGAINST RUN

Due To Heavy WithAction drawals; Reorganization Plans Under Way

Nearly fifteen dollars of the largest monmade the rushed to SacraFar West, was late day by armored mento banks airplane against the CaliforExcited news California Trust and Bank closing, frenzied the and other started withdrawing counts Immediately, officials at the from inbolster the "cash to on hand armored car made the ninetrip one million dollars Reserve Bank the Federal National Shortly the Capitol another arrived terward, the Capitol National, for $10,000,000 Bank brought of America for Glannini Sends Funds possibility of serious the Bank keep the banks here the mands Other banks their money follow the planned their officers insisting cedure they sound ready to handle any kind of

TWO BANKS CLOSE Newspaper Wire By California National Bank, one oldest financial institutions the West, failed open its doors business and Savings state likewise Bank, failed withdrawals during the Heavy the reason for the closing The directors of the banks board this morning and Issued which expressed statement the that reorganihope worked out with the zation of depositors, at California National Bank The about 9900 the California Trust counts, while Savings Bank has approxiand mately accounts Branch banks North Sacraand Arbuckle also were affected by the closing The California Trust and Savings Bank closed by ward Rainey, state of banks the closing in San Francisco, Rainey said. Statement The California Trust and SavBank taken by the superintendent of banks following of the board of directors which resolution adopted closing the bank (This meeting he'd in San Francisco Heavy withdrawals covering period several days and culminating Friday what was silent run, brought the banks the legal quirements, and the closing lowed superintendent of banks will give sympathetic plans for reorganization which already have been proposed.' Directors' Statement The statement issued by the directors follows Owing to corditions over of the last three years, California National Bank Sacramento the California Trust and Savings Bank have met with heavy withdrav and, cordingly the directors, tection depositors, decided the and to take charge of the institutions hoped that plan of with the co-operation of deposi Hilliard Welch, president the Sacramento House sociation which gave that the other banks sufficient cash on hand for His statement The clearing house banks Sacramento ale fully aware responsibility occasioned closing of the California National Bank the California Trust Bank and are that need not disturb conditions

Sufficient Cash cash available care requirements and one need concern ability the banks to handle situation behooves all of to recogthe seriousness co-operate to the extent that

(See TWO, Page 9, Col. 3)

5.

January 22, 1933

The Los Angeles Times

Los Angeles, CA

Click image to open full size in new tab

Article Text

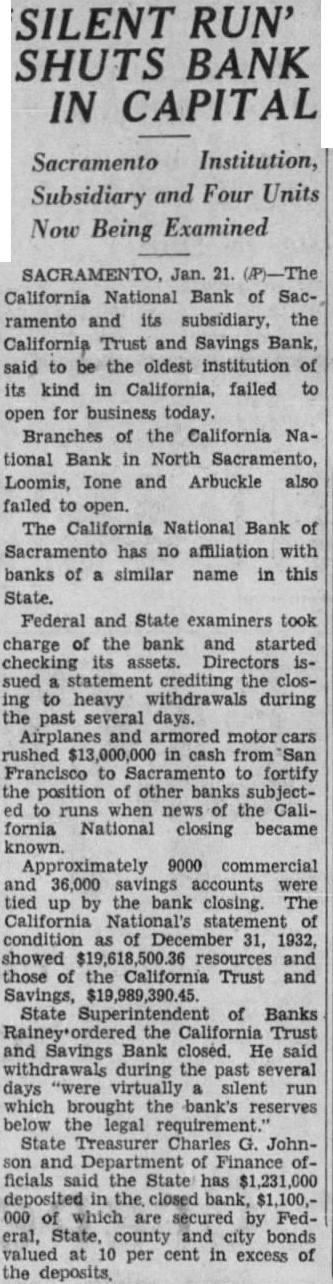

SILENT RUN' SHUTS BANK IN CAPITAL

Sacramento Institution, Subsidiary and Four Units Now Being Examined

SACRAMENTO, Jan 21. (P)-The California National Bank of Sacramento and its subsidiary, the California Trust and Savings Bank, said to be the oldest institution of its kind in California, failed to open for business today. Branches of the California National Bank in North Sacramento, Loomis, Ione and Arbuckle also failed to open. The California National Bank of Sacramento has no affiliation with banks of a similar name in this State. Federal and State examiners took charge of the bank and started checking its assets. Directors issued a statement crediting the closing to heavy withdrawals during the past several days. Airplanes and armored motor cars rushed $13,000,000 in cash from San Francisco to Sacramento to fortify the position of other banks subjected to runs when news of the Callfornia National closing became known. Approximately 9000 commercial and 36,000 savings accounts were tied up by the bank closing. The California statement of condition as of December 31, 1932, showed and those of the California Trust and Savings, $19,989,390.45 State Superintendent of Banks Rainey'ordered the California Trust and Savings Bank closed. He said withdrawals during the past several days "were virtually silent run which brought the bank's reserves below the legal requirement." State Treasurer Charles G. Johnson and Department of Finance officials said the State has $1,231,000 deposited in the closed bank, $1,100,000 of which are secured by Federal, State, county and city bonds valued at 10 per cent in excess of the

6.

January 22, 1933

The San Francisco Examiner

San Francisco, CA

Click image to open full size in new tab

Article Text

BANKS

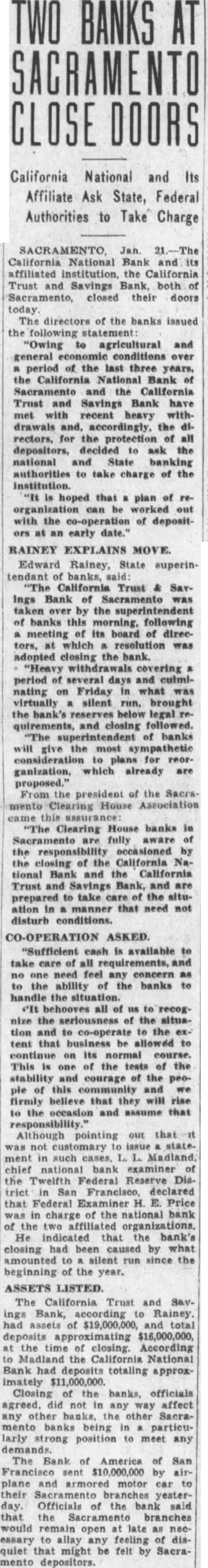

California National and Its Affiliate Ask State, Federal Authorities to Take Charge

California National Bank and its affiliated institution, the California Trust and Savings both Sacramento, closed their doors today. The directors of the banks issued the following statement: "Owing agricultural and general conditions period of the last three years, the California National Bank Sacramento and the California Trust and Savings Bank have met with recent heavy withdrawals and, accordingly, rectors, for the protection of all depositors, decided to ask the national and State banking authorities to take charge of the institution. hoped that plan of worked out with the of depositan early

RAINEY EXPLAINS MOVE Edward Rainey, State superintendant banks, California Trust SavIngs Bank of Sacramento taken over by the superintendent of banks this morning, following meeting of its board of directors, which resolution adopted closing the bank. withdrawals covering period of several days and culmlnating Friday what virtually silent run. brought the bank's below and closing of banks give the most consideration to plans for reorganization, which already are proposed." From the president of the Clearing House Association this assurance: Clearing House banks Sacramento fully aware the responsibility occasioned by the closing of the California National Bank and the California Trust and Savings Bank, and are take of the situation in manner that need not disturb conditions.

CO-OPERATION ASKED. "Sufficient cash available take care of need feel any concern the ability of the banks handle the situation. behooves all of recognize the seriousness of the tion and to co-operate to the tent that business be allowed to continue its normal course. This one of the tests of the stability and courage of the this community and firmly believe that they will rise to the occasion and assume that responsibility.' Although pointing out not issue statement such chief national bank examiner of the Twelfth Federal Reserve San Francisco, declared that Federal Examiner Price was in charge of the national bank of the affiliated organizations. He indicated that bank's closing had been caused by what amounted silent run since the beginning the year. ASSETS LISTED. The California Trust and Savings Bank, according Rainey. had assets $19,000,000, and total deposits approximating $16,000,000, the time of closing. According Madland the California National Bank had deposits totaling approximately $11,000,000. Closing of the banks, officials agreed. did not in any way affect any other the other mento being in particularly strong position meet any demands. The Bank of America of San Francisco $10,000,000 by plane and armored motor car their Sacramento branches yesterday. Officials of the bank said that the Sacramento branches would remain open late essary allay any feeling disquiet that might be felt by Sacramento depositors.

7.

January 22, 1933

Hanford Morning Journal

Hanford, CA

Click image to open full size in new tab

Article Text

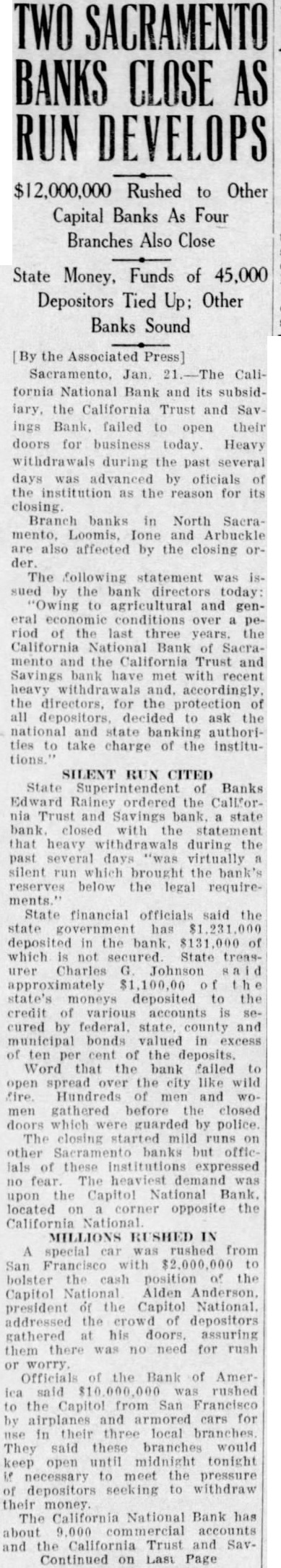

TWO SACRAMENTO BANKS CLOSE AS RUN DEVELOPS

$12,000,000 Rushed to Other Capital Banks As Four Branches Also Close

State Money, Funds of 45,000 Depositors Tied Up; Other Banks Sound

[By the Associated Press] Sacramento, Jan. California National Bank and its subsidiary, the California Trust and Savings Bank. failed to open their doors for business today. Heavy withdrawals during the past several days was advanced by oficials of the institution as the reason for its Branch banks in North Sacramento, Loomis, Ione and Arbuckle are also affected by the closing orThe following statement was issued by the bank directors today: "Owing to agricultural and general economic conditions over period of last three years. the California National Bank of Sacramento and the California Trust and Savings bank have met with recent heavy and. accordingly. the directors, for the protection of all depositors, decided to ask the national and state banking authorities to take charge of the institutions.'

SILENT RUN CITED State Superintendent of Banks Edward Rainey ordered the Callfornia Trust and Savings bank. state bank. closed with the statement that heavy withdrawals during the past several days "was virtually silent run which brought the bank's reserves below the legal requirements." State financial officials said the state has deposited in the bank. of which is not State treasurer Charles G. Johnson approximately state's moneys deposited to the credit of various accounts is cured by federal. state. county and municipal bonds valued in excess of ten per cent of the deposits. Word that the bank failed to open spread over the city like wild fire Hundreds of men and men gathered before the closed doors which guarded by police The closing started mild runs on other Sacramento banks but offic. lals of these institutions expressed no fear The heaviest demand was upon the Capitol National Bank. located on corner opposite the California National MILLIONS IN A special was rushed from San Francisco with $2,000,000 bolster cash position the Capitol National Alden Anderson. president of the Capitol National. addressed the crowd of depositors gathered at his doors. assuring them there was no need for rush or Officials of the Bank of America said was rushed to the Capitol from San Francisco by airplanes and armored cars for in their three local branches They said these branches would keep open until midnight tonight if necessary meet the pressure of depositors seeking to withdraw their money The California National Bank has about 9.000 commercial accounts and the California Trust and SavContinued on Last Page

8.

January 22, 1933

Napa Journal

Napa, CA

Click image to open full size in new tab

Article Text

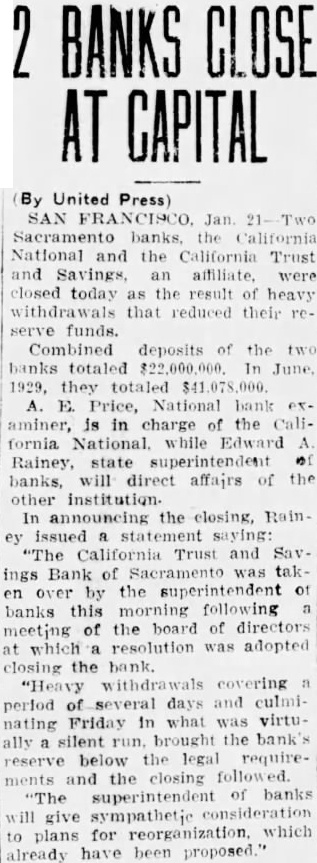

2 BANKS CLOSE AT CAPITAL

By United Press) Sacramento banks. the California National and the California Trust and Savings, an affiliate, were closed today as the result of heavy withdrawals that reduced their reserve funds. Combined deposits of the two banks totaled $22,000,000. In June, 1929, they totaled $41 A. E. Price, National bank examiner, is in charge of the California National while Edward Rainey, state superintendent of banks, will direct affairs of the other In announcing the closing, Rain ey issued statement saying: "The California Trust and Savings Bank of Sacramento was taken over by the superintendent of banks this morning following meeting of the board of directors at which resolution was adopted closing the bank. "Heavy withdrawals covering period of several days and culminating Friday in what was virtually silent run. brought the bank's reserve below the legal requirements and the closing followed. "The superintendent of banks will give sympathetje to plans for reorganization. which already have been proposed.'

9.

January 23, 1933

The Sacramento Bee

Sacramento, CA

Click image to open full size in new tab

Article Text

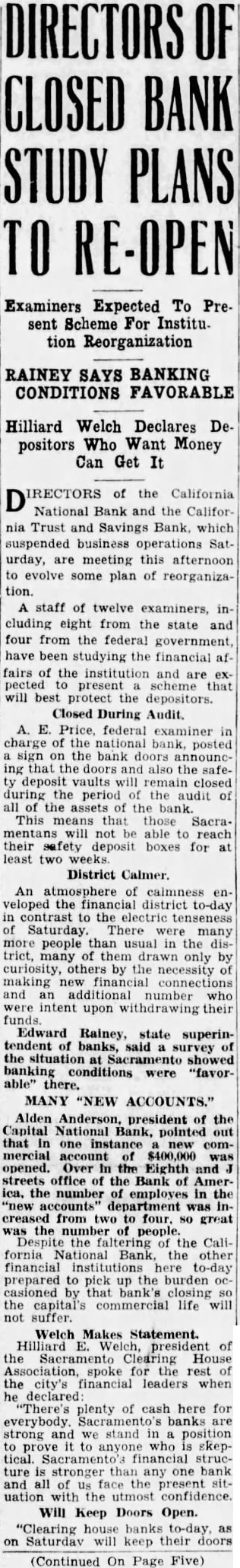

DIRECTORS OF CLOSED BANK STUDY PLANS RE-OPEN

Examiners Expected To Present Scheme For Institu. tion Reorganization

RAINEY SAYS BANKING CONDITIONS FAVORABLE

Hilliard Welch Declares Depositors Who Want Money Can Get It of the California National Bank the California Trust and Savings Bank, which suspended business operations Saturday, are meeting this afternoon to evolve some plan of reorganization. staff of twelve examiners, in cluding eight from the state and four from federal government, have been studying financial affairs the institution and are pected scheme will best protect the depositors. Closed During Audit. E. Price, federal examiner in charge the national bank, posted sign the bank doors announcing the deposit vaults will during the period the audit of the This that Sacramentans will not reach their safety deposit boxes for at District Calmer. An atmosphere calmness veloped the financial district to-day contrast to the electric tenseness Saturday. There were many people than usual in the district, many only by curiosity, by the necessity making connections and an additional number who were intent upon withdrawing their Edward Rainey, state superintendent banks, said survey of Sacramento showed banking were "favorable" MANY 'NEW ACCOUNTS." Alden Anderson, president the Capital Bank, pointed out that one commercial account $400,000 opened. Over the Eighth and streets office the Bank of America, the number of employes in the "new department was Infrom two four, great the the California Bank the other financial institutions here to-day prepared to pick up the burden casioned that bank's closing the capital's commercial life not suffer.

Welch Makes Statement. Hilliard of Association, spoke for the city's financial leaders when declared "There's plenty of cash here for everybody. Sacramento's banks are strong and we stand who skeptical. structure stronger than any one bank all the present uation with the utmost confidence. Will Keep Doors Open. "Clearing house banks to-day, on keep their doors (Continued On Page Five)

10.

January 23, 1933

The Corning Daily Observer

Corning, CA

Click image to open full size in new tab

Article Text

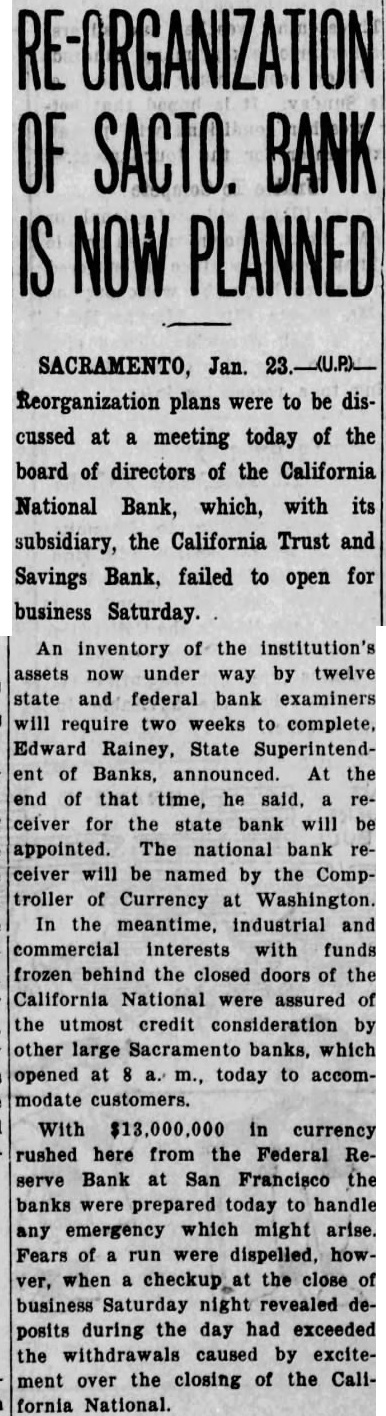

RE-ORGANIZATION OF SACTO. BANK IS NOW PLANNED

Reorganization plans were to be discussed at a meeting today of the board of directors of the California National Bank, which, with its subsidiary, the California Trust and Savings Bank, failed to open for business Saturday.

An inventory of the institution's assets now under way by twelve state and federal bank examiners will require two weeks to complete, Edward Rainey, State Superintendent of Banks, announced. At the end of that time, he said. a receiver for the state bank will be appointed. The national bank receiver will be named by the Comptroller of Currency at Washington. In the meantime, industrial and commercial interests with funds frozen behind the closed doors of the California National were assured of the utmost credit consideration by other large Sacramento banks, which opened at 8 a. m., today to accommodate customers. With $13,000,000 in currency rushed here from the Federal Reserve Bank at San Francisco the banks were prepared today to handle any emergency which might arise. Fears of a run were dispelled, howver, when a checkup the close of business Saturday night revealed deposits during the day had exceeded the withdrawals caused by excitement over the closing of the Callfornia National.

11.

February 6, 1933

The Sacramento Union

Sacramento, CA

Click image to open full size in new tab

Article Text

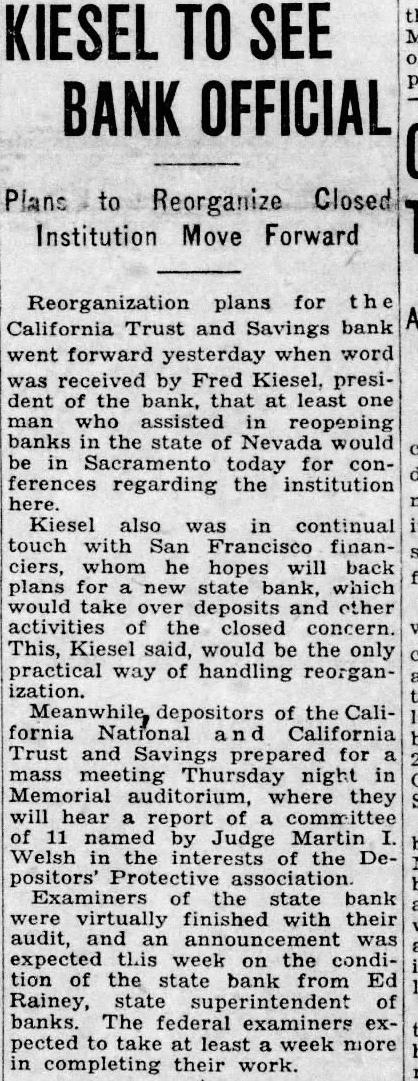

KIESEL BANK OFFICIAL

Plans Reorganize Closed Institution Move Forward

Reorganization plans for California Trust and Savings bank went forward yesterday when word was received by Fred Kiesel, president of the bank, that at least one man who assisted reopening banks in the state of Nevada would be Sacramento today conferences regarding the institution here. Kiesel also was in continual touch with San Francisco financiers, whom he hopes will back plans for state bank, which would take over deposits and other activities the closed concern. This, Kiesel said, would be the only practical way of handling reorganization. Meanwhile, depositors of the fornia National California Trust and Savings prepared for Thursday night Memorial auditorium, where they will hear report named by Judge Martin Welsh of the positors' Protective Examiners the state bank were virtually finished with their audit, and an expected week on the condition of the state bank from Rainey, state of banks. The federal examiners pected to take at least week more completing their work.

12.

May 6, 1933

The Sacramento Bee

Sacramento, CA

Click image to open full size in new tab

Article Text

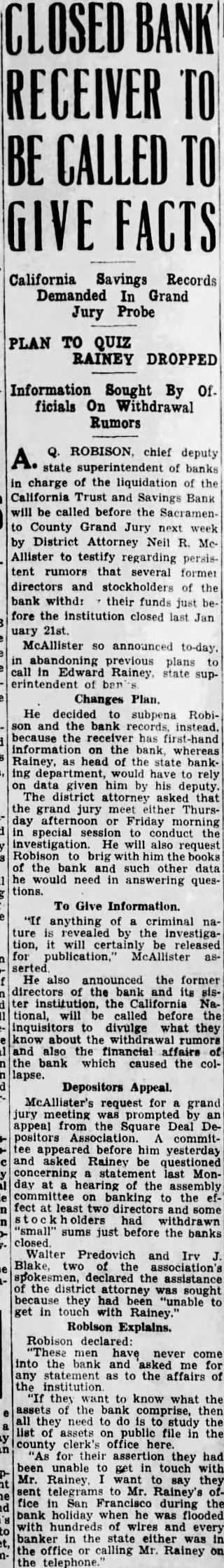

CLOSED BANK RECEIVER TO BE GIVE FACTS

California Savings Records Demanded In Grand Jury Probe

PLAN TO QUIZ RAINEY DROPPED

Information Sought By Of. ficials On Withdrawal Rumors

Q. ROBISON, chief deputy A. state superintendent of banks charge the liquidation of the California Trust and Savings Bank will be called before the SacramenCounty Grand Jury next week by District Attorney Neil R. McAllister to testify regarding persistent rumors several former directors stockholders of the bank withd: their funds just fore the institution closed last Jan uary 21st. McAllister announced plans call in Edward state supof

Changes Plan. He to subpena Robiand the records. instead. because the receiver has information on the whereas Rainey, head of state banking department, would to on given by his district attorney asked the grand jury either Thursday Friday special conduct the He will also Robison books the bank such data would questions.

To Give Information. "If anything criminal ture revealed the investigacertainly released for McAllister He also announced the former bank its ter institution, the California tional, be called before the inquisitors divulge what they know about the rumors and financial affairs the bank which caused the collapse.

Depositors Appeal. McAllister's request for grand meeting prompted by appeal from the Deal Decommitbefore him yesterday and asked Rainey be questioned last Monday hearing the assembly committee on banking to the fect directors and some withdrawn "small" sums before the banks Walter Predovich association's spokesmen, declared the assistance the attorney sought "unable get in touch with Rainey.' Robison Explains. Robison declared: men never come into and any statement to the affairs institution want know what the assets the bank comprise, they need study the list assets public file the county clerk's office their they had unable get with Rainey they telegrams to Mr. Rainey's in San Francisco during bank holiday was flooded with and every the either the office calling Mr. Rainey on the

13.

May 11, 1933

Tribune-Progress

North Sacramento, CA

Click image to open full size in new tab

Article Text

Grand Jury Will Quiz Closed Bank Receiver

SACRAMENTO-In compliance with the request of the Square Deal Depositors Association of the

A. W. Sweet, foreman of the grand jury, probably will disqualify himself and resign on account of suit filed this week by Edward Rainey for the bank to recover $5,000 on a promissory note, it was announced last night. defunct California National and California Trust and Savings Bnks, the Sacramento County grand jury will conduct an investigation into the banking situation starting at 10 o'clock tomorrow morning. Neil R. McAllister, district attorney, has summoned A. Q. Robinson. special deputy of the state banking department in charge of the liquidation of the savings bank, to explain to the inquisitorial body certain alleged withdrawals of money by directors and stockholders of the closed bank before it failed.

14.

May 16, 1933

The Californian

Salinas, CA

Click image to open full size in new tab

Article Text

Closed Bank Raps Rainey

Sacramento Banker Says State Acted Hastily In Dooming His Firm

SACRAMENTO, May 16 (U.P.) Charges that the state banking department acted "hastily" and precipitated the closing of the California Trust and Savings Bank and the California National Bank were under consideration today by the Sacramento county grand jury following testimony of Fred W. Kiesel, bank president. In appearing before the grand jury to deny he withdrew any of his own funds from the bank or that there were any irregularities, Kiesel said the financial institutions could have "weathered the storm" had Edward Rainey, state superintendent of banks, allowed the Trust and Savings Bank to remain open. Looking back to the closing of one of Northern California's largest financial institutions, Kiesel declared he had no knowledge that the bank's funds had fallen below the "margin of safety" or where Rainey learned of withdrawals which prompted closing of the bank's doors. Kiesel was reported as having said he felt no concern over these "seasonal" withdrawals. The bank president also criticised A. Q. Robison, deputy in Rainey's office, who had been acting as bank receiver. Kiesel declared Robison was only 29 years old and unfamiliar with valley agricultural affairs so that he was not in a position to speak authoritatively in saying that reorganization of the banks would be "impossible."

15.

May 16, 1933

Oroville Mercury Register

Oroville, CA

Click image to open full size in new tab

Article Text

Rainey Will Testify On Bank Closing

Fred Kiesel, President of Bank, Blames Rainey for Turn of Events perintendent of Banks Edward T. Rainey was to appear before the Sacramento county grand jury today to testify concerning affairs of the California Trust and Savings Bank which closed last January 21. At yesterday's session Fred W Kiesel, president of the bank, told the jury he did not know the bank was to be closed until SO informed by Rainey on January 20.

SACRAMENTO Asserting the California Trust and Savings bank could have been kept open and blaming its close on Edward Rainey, state superintendent of banks, Fred W. Kiesel, bank president, appeared before the county grand jury late yesterday to deny withdrawing any of his own funds or that any irregularities took place. Kiesel was before the jury for several hours and brisk questioning at the hands of Niel R. McAllister, district attorney. The substance of Kiesel's testimony was that the California Trust Savings could have weathered the financial crisis had Rainey permitted it to remain open and that Rainey's action compelled the California National bank also to close. Kiesel testified that he felt no concern over heavy withdrawals from the bank. that they were seasonal in character, and that the bank could have outridden the storm.

Criticizes Deputy Kiesel attacked not only Rainey's action, but criticized A. Q. Robison, deputy in Rainey's office, who has been acting as bank receiver. Kiesel said Robison is only 29 years old and that the state banking department is unfamiliar with valley and river agriculture affairs. For that reason he said that Robison could not speak authoritatively in saying that a reorganization now would be impossible. In testimony before the grand jury Robison had made clear that he believed it was hopeless to attempt to reopen the bank. Kiesel took sharp exception to Robison's statement. When asked by Foreman A. W. Sweet if there was anything that could be done that would make reorganization possible, Kiesel answered that if the 100 per cent assessment ordered against stockholders of both banks were forestalled at least 60 days, enough money probably could be subscribed to assure reorganization of the institutions.

16.

May 16, 1933

The Sacramento Bee

Sacramento, CA

Click image to open full size in new tab

Article Text

Banks Juggling Of Bonds To Beat Closing Revealed

Rainey Charges Kiesel And Stockholders Warned Time And Again Assessment Necessary To Save Institution

TARTLING revelations that securities were juggled between the California Trust and Savings Bank and the California National Bank over 8 period of years to deceive state federal bank examiners were made to the county grand and jury this afternoon by Edward Rainey, state bank superintendent. Rainey told the jury that the bank officials had carried on the practice of shifting securities from one bank to the other just prior to the time when examinations were made by the state or federal auditors. Rainey Says Some Securities Were of Doubtful Value As to Prices Paid.

Some of the securities transferred were of doubtful value as compared to the price paid for them, while others, Rainey testified. were not legal investments for savings banks. The bank superintendent became suspicious that all was not right with the affairs of the bank during the late Spring of 1931, and in June of that year he ordered an audit of the state bank at the same time the federal examiner was on the job. Bank Chief Charges $750,000 Worth of Securities Switched During Audits.

Incidentally, this was the first time that a state bank superintendent had obtained the consent of federal bank examiners to make an audit simultaneously with state bank examiners. The amount of bonds that were transferred from one bank to another to "sweeten" the condition of the bank, as Rainey puts it, total approximately $750,000. It was revealed that one large block of Chicago, Milwaukee St. Paul Railway bonds, having book value of $300,000, but an actual value far below that sum, was transferred back and forth as examinations occurred periodically and sound securities listed in their

In other words, when the federal auditors were making an examination all the of the placed in the records the federad bank, *and when the state bank being examined Its poor securtities were shifted to the federal and the sound securities of that bank were transferred the state bank. When by the state and federal uncovered this shifting of curities. federal and state officials suspicious the institutions and their ultimate failure really from BANK OWNERS WARNED. Rainey also brought out to-day that officers and directors of the bank were told repeatedly by him beginning as that assessment on the would the The was ig. Rainey's statement was in direct testimony Fred Kiesel, president the closed banks. that he did not the dition o'clock of the day before KIESEL'S STORY REFUTED "Klesel," Rainey testified, "had all the warning Rainey said frequent meetings with Kiesel, members the board directors, representaof the federal reserve bank and the chief national bank examKiesel, he was told with stockhold"must do share' by paying

ASSESSMENT NEEDED "There had been need sessments the stock since Rainey testified. the moment, he said, the done nothing hold the Rainey take $1,250 the bank Frank previoustestified $1,000,000 had been pledged. told the jury of meet and Harris, federal bank now dead at which the assessment was rec Rainey the both the time, testified. the organization went far board of directors passed tion which the national would the state bank All reorganization fell BANK RUN FEARED Rainey said he was informed time stock assessment levied because the officers an might cause the bank. said rumors about prevalent six months before closed. Secret service men were brought Sacramento Rainey's office the could not traced to definite Rainev the bank was because of heavy January that (Continued on Page 5. Column first been obtained subscription in the new ital for the formation of In the quirements stockholders' committee immediate proceeded with solicitatio subscriptions, and scriptions the sum tha already been cured.

Ten Days Required. Upon showing to Mr Rainey of this success obtaining subscriptions of new capital. he has agreed examination and the assets the trust (Continued on Page 5, Column 2)

17.

May 17, 1933

The Sacramento Bee

Sacramento, CA

Click image to open full size in new tab

Article Text

Bank Opening Backed By Chamber Committee

The executive committee of the Sacramento Chamber of to-day statement in which it pledged the civic organization "to do everything within its power to bring about the opening of bank to function and render service such as performed by the California National and California Trust and Savings banks. Earl O. Schnetz, president of chamber. contacted other members of the committee to ascertain their views about the bank tion and the statement represented their unanimous opinion. doesn't say 100 per cent on the ket price was when boughtis

Certification Questioned "Has the certification Hart bonds ever been approved by the superintendent banks asked Guy P. Johnson, assistant district attorney "No, this not the latest, but this list.' declared: "If your department can tell how you are going to pay 100 cents on the dollar out that $160,000 investment in Hart bonds. you can beat to turn over the bonds which belongs to the estate Adams

Not Worth 15 Cents. "They be are not worth 15 cents the dollar to-day district attorney replied. "These Hart Brothers bonds first mortgage on the property the Land Hotel at Tenth and and they have held up think. than any other bonds that character, Adams said. "There are lot of hungry heirs around this county when they come to eating Hart bonds, can tell you that," replied McAllister. Yearly Profit Shown. Adams revealed the average profits of the trust department over the last five years have been $30,000 or $40,000 yearly, with original investment of The assets were said to have been increased through the addition of profits from the trust funds Adams that prior to January 21st he had no intimation the bank might close.

18.

May 18, 1933

Woodland Daily Democrat

Woodland, CA

Click image to open full size in new tab

Article Text

Sacramento grand jury's probe Out of the the affairs of the defunct California Trust can't help but draw and Savings Bank one the conclusion that President Kiesel lacked the mental capacity to operate bank of that size. Also the conviction comes naturally that the directors, themselves, evinced too interest in what was going on, or else they were dominated by the officers in active charge. Banks and other business organizafor their boards of ditions which draft men rectors who cannot, or will not give sufficient unfair to their stockattention to the are holders and investors and the men who take do not do themselves these responsibilities else justice. aynone While Mr. Kiesel subsequently is reported to have told the State Banking Department that he was misunderstood and did not mean to find fault with Mr. Rainey and his assistants, nevertheless the criticism was implied when Mr. Kiesel, according to the Sacramenthat Mr. Rainey had to newspapers, charged business closing his California Trust and Savings Bank and Robison, assistant to Rainey, is too young to know the score. The insinuations cannot be justified. Mr. Kiesel, according to the printed testimony, that he, himself, did not told the grand jury know that his bank was in such a precarious The admission was reflection on condition. business ability even though his integrity may be unquestioned. Mr. Rainey followed Mr. Kiesel to the stand and when he finished the evidence was conclusive that Mr. Kiesel and his directors had been fully warned and either they were terribly dumb and incompetent in not heeding that warning or they were careless and indifferent toward putting their house order to avert collapse. Mr. Kiesel apparently is in a mood to blame most anyone but himself for his findifficulties. It was the last word, or ancial something or other, when he attributed the runs on his bank to the failure of banks in Yolo Ed. Wynn, the "perfect county. never appeared more foolish than Mr. Kiesel did before his home county grand jury. Strikingly absurd and inconsistent were the intimations that Mr. Rainey and his able Mr. Robison, have deliberately assistant, tried to block the attempts to reorganize and banks. The State Banking Dethe re-open partment has shown commendable willingness to co-operate to the limit in making it possible to rehabilitate all closed banks in California, but the extent of that co-operation is very properly governed by what they deem is necessary to safeguard the investments of the depositors. the financial arrangements can be SO arranged as to guarantee safety to the men and women whose money is at stake, then all banks now closed in California can rest assured they will receive permission from Mr. Rainey and his Department to re-open. The liberal but sound policy of Mr. Rainey toward all banks now in the process of liquidation or reorganization has been clearly manifested here in Yolo county. stockholders and depositors alike apprecia. the sympathetic and intelligent co-operation they have received from Mr. Rainey and his Mr. Kiesel certainly lost prestige when he provoked Mr. Rainey to disclose to the grand how bonds and securities were "juggled" to deceive the examiners. Usually grand jury inquisitions are waste of taxpayers' money, but in this case, even though nothing definite may be accomplished to help the depositors of the closed Sacramento banks, possibly the running down of lot of exaggerated rumors and reports and the revelations of how stupidly and carelessthe Kiesel institution was operated, may do some lasting good for the future.

19.

June 8, 1933

The Sacramento Bee

Sacramento, CA

Click image to open full size in new tab

Article Text

the law and listening To Take Sour Loans. understand from Carter that the California was organized frozen or loans the California National Bank the California Trust and SavBank could take them over from bank. Well, did from either over loans taken from savings bank. We taken some real but not sure about would have look up the see whether there were savings bank by the national wondering what the take of aggregatthe bank to take same

Not Bank Property. That done. propwhich the corporation money from savings never owned by the they were The borrowed, and Sav National taking over those loans benefit Savings Bank, was the with That my point. The National Corporation loans over with the money California Trust and Bank and am trying the benefit accruTrust and ings the California Corhad been taking which had been ordered the portfolio of the bank by the bank with the California Corporation's see wherein the California Corporation was of benefit to the California Trust and ings but if the California National is taking sour or frozen loan with the money the California Trust and Savings Bank then think that detriment to the bank. That not the case altogether Mr. Referring to $65,000 loan which the corporation secured from the California Trust and money didn't go the California National for the purpose taking sour loans from the bank the National for the purpose of refinancing legitimate loan. Q. Refinancing it from whom? From Sacramento Guar anty Building Loan Association Trust Saves Deal. Q. Don't know that but for the fact Mr. Keisel and yourself and Mr. Martin held the stock of the stockholders of the California Trust and Savings Bank in trust, that your California Na tional Corporation could from the California Trust Savings Bank don't know Well, that Well, that point of law you know and don't know. Wasn't that the purpose holding the stock in not that know of. That done twenty years Your statement that you had borrowed from the Reconstruction Finance Corporation and from the Chase National Bank New York something $600,000. What those amounts, those moneys for, Mr Carter? Well, when the reserve began to show shrinkage was necessary to turn the into money we therefore took various loans of the bank various bonds the bank and hypothecated them cash to keep our cash position That on account of heavy assume? Yes. Were any of those moneys used for No, not that know of. Explains Closing. Grand Juror: Would you mind telling the jurors what you honestly believe to be the real cause of the bank's closing its doors? Well, there were several contributing causes. the first place bank subject steady incipient Nothing that noticeable the outside but steady decline deposits all the time. Rumors started that would get the people exercised and naturally they just began to quietly draw their money out. We know that going on. This where the real estate values went down and urally our savings bank loans came more less frozen. Farmers were unable to pay their interest We were doing anything we stop that situation but kept Hoping, as from day that would stop, it just kept going and of that there we felt we first loan from the Reconstruction Finance Corporation that would straighten up our cash position. We were position to pay people as they came in and hoping would eventually but It kept right on until finally came alarming. Of course know nothing about what happened the last days because left the bank in the middle of November and went to the knew nothing about it, but know that that condition existing every officer and employe of bank doing everything they could to stop the condition and bolster that to keep proper All sorts of plans were talked of and thing done by with everything that could doneto the situation but those continued bank the world can stand that they keep on running it: particularly where you have real estate loans that you can't go right out and collect. Those are the things in my estimation that were the rent cause, that an explanation A Grand Juror: Mr. Carter this had been thirty days so, the bank would have saved and the conditions the state, those conditions prevailing around there the could have been declared soonerA. Interposing: That is my opinion, yes. understand one-third of the banks of the State of California the banks, in the hands the banking examiner of the state, the condition was serious there was nothing to be done to declare general moratorium? A. That is correct.

HUNGARY ACQUITS NAZL June first Nazi trial ended yesterday the acquittal the four who were cused fomenting revolutionary activities in the Tisza

20.

June 9, 1933

Modesto News-Herald

Modesto, CA

Click image to open full size in new tab

Article Text

RECESS ORDERED IN JURY'S PROBE OF BANK FAILURE

Investigation Of Affairs Of Sacramento Institution Adjourned Indefinitely

SACRAMENTO, Cal., June IP-Investigation of affairs of the closed California Trust and Savings Bank by the Sacramento County Grand Jury to-day stood recessed indefinitely at request of District Attorney Neil R. McAllister. 80 that he could "study the testimony." The recess was ordered at conclusion of testimony by Fred W. Keisel president of the closed in stitution, in which he explained contradicted statements previously made to the grand jury. Defends Act Kiesel aserted he had committed no wrong in $342.000 worth of securities of the Kiesel Estate Company to Ogden. Utah, last May. The securities were not his personal property, he explained, were held only in trust for the company, and were returned at the request of the estate manager under permission granted by the bank receiver. In a previous appearance Kiesel had denied transfer of any property to Utah. When this statement was made, he said, he was referring solely to his personal property. The investigation will not be resumed until the grand jury expert has completed his report on an audit of the bank's books, which will probably be late next week, it was stated.

21.

June 9, 1933

The Modesto Bee

Modesto, CA

Click image to open full size in new tab

Article Text

RECESS ORDERED IN JURY'S PROBE OF BANK FAILURE

Investigation Of Affairs Of Sacramento Institution Adjourned Indefinitely

SACRAMENTO, Cal., June (P-Investigation of affairs of the closed California Trust and Savings Bank by the Sacramento County Grand Jury to-day stood recessed indefinitely at request of District Attorney Neil R. McAllister. 80 that he could "study the testimony.' The recess was ordered at conclusion of testimony by Fred W. Keisel, president of the closed institution, in which he explained contradicted statements previously made to the grand jury. Defends Act Kiesel aserted he had committed no wrong in $342,000 worth of securities of the Kiesel Estate Company to Ogden, Utah, last May. The securities were not his personal property, he explained, were held only in trust for the company, and were returned at the request of the estate under permission granted by the bank receiver. In previous appearance Kiesel had denied transfer of any property to Utah. When this statement was made, he said, he was referring solely to his personal property. The investigation will not be resumed until the grand jury expert has completed his report on an audit of the bank's books, which will probably be late next week, it was stated.

22.

June 9, 1933

The Record

Stockton, CA

Click image to open full size in new tab

Article Text

BANK INQUIRY RECESSES FOR STUDY PERIOD ed Press gation of affairs of the closed California Trust and Savings Bank by the Sacramento County Grand Jury today stood recessed indefinitely at request District Attorney Neil R. McAllis ter. so that he could "study the testimony The was ordered at conclusion of testimony by Fred W Kiesel, president of the closed institution. in which he explained con tradicted statements previously made to the Grand Jury Kiesel asserted he had committed no wrong in shipping $342,000 worth of securities of the Kiesel Estate Company to Ogden. Utah. last May The securities were not his per sonal property. he explained. were held only in trust for the company and were returned at the request of the estate manager under per mission granted by the bank receiver.

23.

August 3, 1933

The Sacramento Union

Sacramento, CA

Click image to open full size in new tab

Article Text

JURORS TRACING CHARGES

Sweet Threatens to Call Any One Linked to Rumors

Determined to put an end rumors and "bribery' current since they failed indict officials the California Trust and Savings bank, county grand yesterday its investigation to determine the source reports. Although two witnesses called for the hearing only one, Gaff, 1120 24th street, real tate man, appeared during the two-hour session. Compliments Jurors Grand jurors had been informed that Gaff, who handling sales county real estate for the receiver the defunct bank, had some formation concerning the rumors. After the meeting, however, learned that Gaff had been unable to assist in the probe and had, the other hand, "complimented" the jurors upon their handling of the bank investigation. Force determined force showdown these rumors," declared Sweet, grand jury foreman. will continue to call before anyone who have may the persons responsible for their Gaff remained closeted with the grand jury but 15 minutes and fused to his testimony the of his visit being upon excused.

24.

August 28, 1933

The Sacramento Bee

Sacramento, CA

Click image to open full size in new tab

Article Text

NEW 'RUN' STARTS ON BANK AFTER FIRST DIVIDEND

Depositors Crowd Defunct Institution For Initial Payment

"Blue Monday" sunny Monday for 8,000 depositors of the closed California National Distribution of Initial liquidating of the institution started at 10 o'clock this morning, with steady stream of depositors seeking their 20 per cent share of $1,500,000 Nearly 500 depositors crowded the bank building as soon as the doors opened and the only who happy who thought the California Trust and Savings Bank likewise paying Women There At 7:45 Two women were at the entrance the bank early An fainted in the doorway 2414 Montgomery Way, proprietor the Washington Wood Coal Yard, was the first An immediate investigation of check reported in favor for and Douglass, large receiver the bank the 1933 pack Cali- sented him Mrs. Minnie fornia cling peaches asked in 4442 Seventh Avenue, was telegram sent to-day by Congress- ond. man Frank Buck Dr. Fifteen Employed. Tolley special administrator of the Fifteen persons have temporary agricultural adjustment adminisassist Douglass in tration San Francisco. the distribution the checks. "Break" Reported. Robison, receiver of the telegram hastened California Trust and Savings Bank, Buck's was by discloses for reports of between plication the RFC for loan resentatives of co-operative help that institution pay initial dependent canning interests and liquidating dividend deposithe peach board comtors completion, Koster, Robert application expected to Alex Johnson, secre filed in about ten days. the California Farm Bureau Federation the board had Long Time down 15,180,000 cases applied for The receiver declares months by about canners, the will be the required issue checks maximum pack 10,000,000 cases and the when loan approved specified industry agreement Twenty thousand Hits Discrimination. the state bank claims filed

His reads: strongly protest reported disagainst smaller ners pack by fornia Cling Peach Allocation Committee urge that you immediwith ward preventing such unfair practice Independent co-operative executives to the limit agreement me they have been allotted per cent their (Continued on Page 12, Column