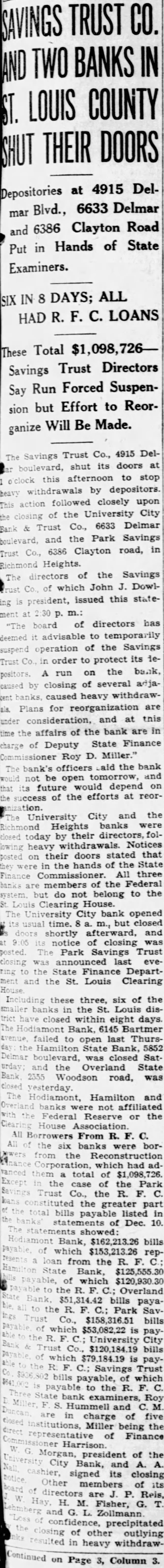

Article Text

TRUST BANKS LOUIS COUNTY DOORS at 4915 Del6633 Delmar Blvd., Clayton Road 6386 and Hands of State in Examiners. ALL LOANS HAD Total Trust Directors Savings Run Forced SuspenSay Effort to Reorbut Will Be Made. ganize Trust 4915 Delshut its doors afternoon to stop by depositors. followed closely upon University City Co., 6633 Delmar the Park Savings 6386 Clayton road, in Heights. directors of the Savings which John Dowlissued this stateof directors has advisable to temporarily of the Savings order to protect its on the bank, closing of several caused heavy withdrawfor reorganization are consideration, and at this of the bank in affairs State Finance Deputy Roy D. Miller." officers the bank be tomorrow, and open future would depend on of the efforts at and the University City Heights banks today by their directors, withdrawals. Notices heavy their doors stated that the hands of the State Commissioner. All three of the Federal members do not belong to the Clearing House. City bank opened time. but closed shortly and notice of closing was Park Savings Trust announced last eveState Finance DepartSt. Louis Clearing these three, six of the banks in the St. Louis closed within eight days. Bank, Bartmer failed to open last ThursState Bank, 5852 boulevard, was closed the Overland State Woodson road, was Hamilton and were affiliated Federal Reserve the House Association From R. C. banks borthe which had total of the case of the Park Co., the the greater part listed in of Dec. 10. Bank, $162,213.26 bills $153,213.26 from the Bank, which Overland $51,314.42 bills payaPark Sav$158,316.51 bills which $53,082.22 University $120,184.19 bills Savings Trust payable, which the examiners, Roy Hummell and charge of five Miller being the of Finance Harrison. president the City Bank, and signed its members of Reis, Fisher, Zollmann precipitated of other outlying heavy withdraw- Column