Article Text

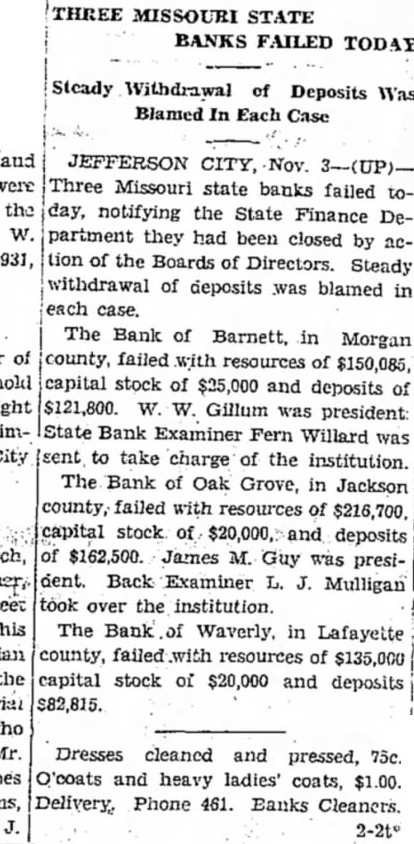

THREE MISSOURI STATE BANKS FAILED TODAY Steady Withdrawal of Deposits Was Blamed In Each Case JEFFERSON CITY, Nov. 3-(UP)Three Missouri state banks failed today, notifying the State Finance Department they had been closed by action of the Boards of Directors. Steady withdrawal of deposits was blamed in each case. The Bank of Barnett, in Morgan county, failed with resources of $150,085, capital stock of $25,000 and deposits of $121,800. W. W. Gillum was president State Bank Examiner Fern Willard was (sent to take charge of the institution. The Bank of Oak Grove, in Jackson county, failed with resources of $216,700. capital stock of $20,000, and deposits of $162,500. James M. Guy was president. Back Examiner L. J. Mulligan took over the institution. The Bank of Waverly. in Lafayette county, failed with resources of $135,000 capital stock of $20,000 and deposits $82,815. Dresses cleaned and pressed, 75c. O'coats and heavy ladies' coats, $1.00. Delivery. Phone 461. Banks Cleaners.