Article Text

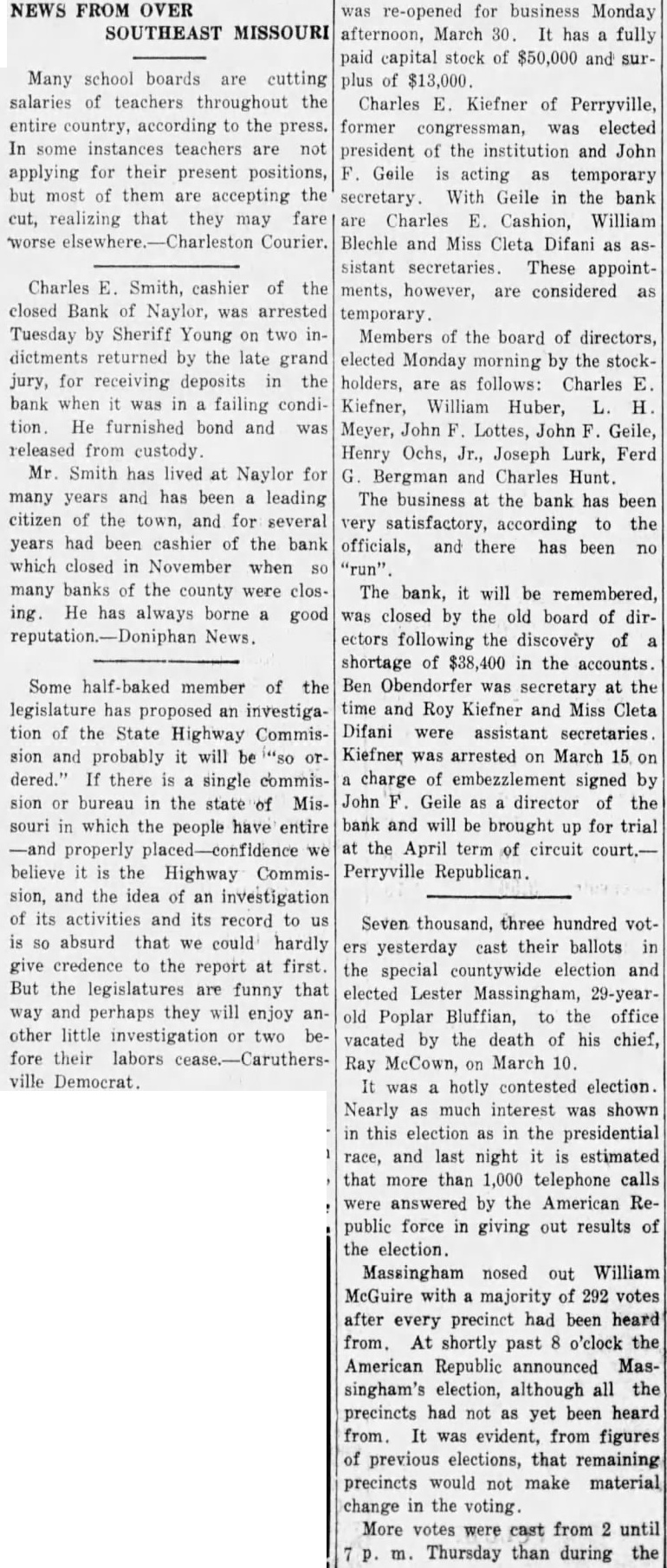

NEWS FROM OVER SOUTHEAST MISSOURI Many school boards are cutting salaries of teachers throughout the entire country, according to the press. In some instances teachers are not applying for their present positions, but most of them are accepting the cut, realizing that they may fare Charles E. Smith, cashier of the closed Bank of Naylor, was arrested Tuesday by Sheriff Young on two indictments returned by the late grand jury, for receiving deposits in the bank when it was in a failing condition. He furnished bond and was released from custody. Mr Smith has lived at Naylor for many years and has been a leading citizen of the town, and for several years had been cashier of the bank which closed in November when SO many banks of the county were closing. He has always borne a good Some half-baked member of the legislature has proposed an investigation of the State Highway Commission and probably it will be "so ordered." If there is a single commission or bureau in the state of Missouri in which the people have entire -and properly placed-confidence we believe it is the Highway Commission, and the idea of an investigation of its activities and its record to us is SO absurd that we could hardly give credence to the report at first. But the legislatures are funny that way and perhaps they will enjoy another little investigation or two before their labors cease.-Caruthersville Democrat. was re-opened for business Monday afternoon, March 30. It has a fully paid capital stock of $50,000 and surplus of $13,000. Charles E. Kiefner of Perryville, former congressman, was elected president of the institution and John F. Geile is acting as temporary secretary. With Geile in the bank are Charles E. Cashion, William Blechle and Miss Cleta Difani as assistant secretaries. These appointments, however, are considered as temporary. Members of the board of directors, elected Monday morning by the stockholders, are as follows: Charles E. Kiefner, William Huber, L. H. Meyer, John F. Lottes, John F. Geile, Henry Ochs, Jr., Joseph Lurk, Ferd G. Bergman and Charles Hunt. The business at the bank has been very satisfactory, according to the officials, and there has been no "run". The bank, it will be remembered, was closed by the old board of directors following the discovery of a shortage of $38,400 in the accounts. Ben Obendorfer was secretary at the time and Roy Kiefner and Miss Cleta Difani were assistant secretaries. Kiefner was arrested on March 15 on a charge of embezzlement signed by John F. Geile as a director of the bank and will be brought up for trial at the April term of circuit court.Perryville Republican. Seven thousand, three hundred voters yesterday cast their ballots in the special countywide election and elected Lester Massingham, 29-yearold Poplar Bluffian, to the office vacated by the death of his chief, Ray McCown, on March 10. It was a hotly contested election. Nearly as much interest was shown in this election as in the presidential race, and last night it is estimated that more than 1,000 telephone calls were answered by the American Republic force in giving out results of the election. Massingham nosed out William McGuire with a majority of 292 votes after every precinct had been heard from. At shortly past 8 o'clock the American Republic announced Massingham's election, although all the precincts had not as yet been heard from. It was evident, from figures of previous elections, that remaining precincts would not make material change in the voting. More votes were cast from 2 until m. Thursday than during the