Article Text

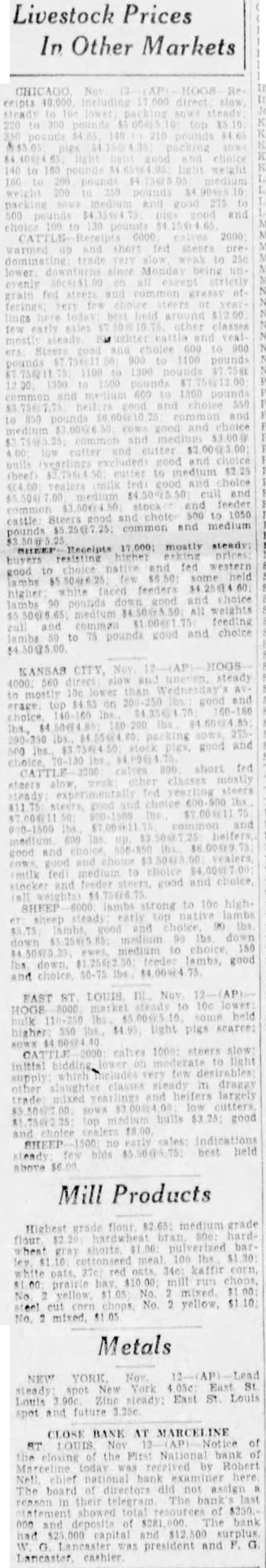

Livestock Prices In Other Markets and medium Receipts mostly good and and choice KANSAS on good good and ted CATTLE good and EAST light pigs steers low good SHEEP held Mill Products Highest mixed No Metals NEW spot New York Louis East St Louis spot CLOSE BANK AT MARCELINE ST by here The board of directors not showed of The bank had 000 and 500 was president and