Article Text

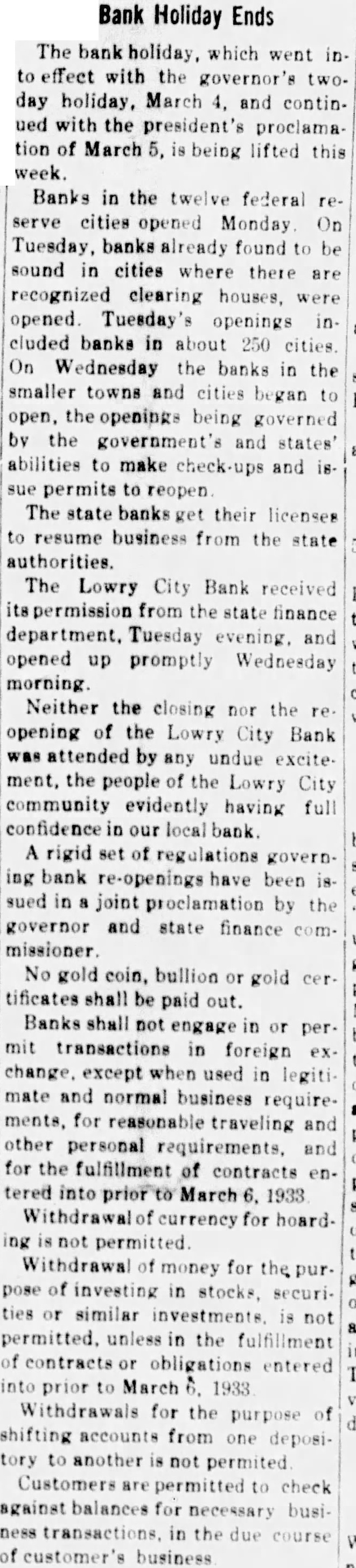

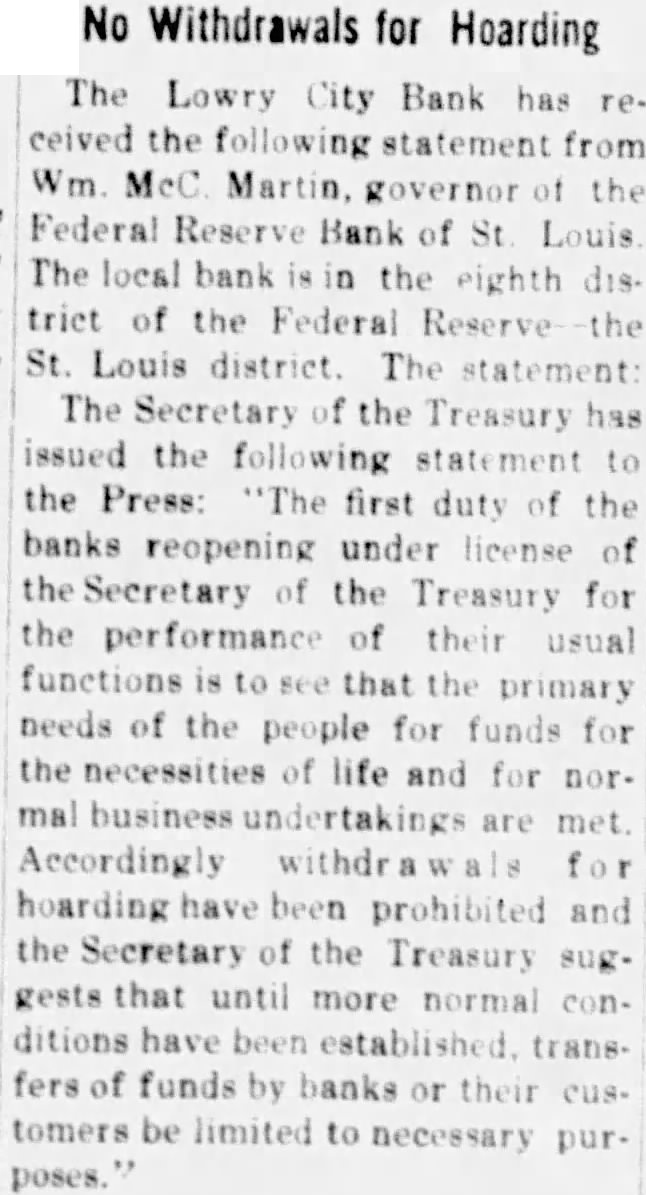

Bank Holiday Ends The bank holiday, which went into effect with the governor's twoday holiday, March 4, and continued with the president's proclamation of March 5, is being lifted this week. Banks in the twelve federal reserve cities opened Monday On Tuesday, banks already found to be sound in cities where there are recognized clearing houses, were opened. Tuesday's openings included banks in about 250 cities. On Wednesday the banks in the smaller towns and cities began to open, the openings being governed by the government's and states' abilities to make check-ups and is. sue permits to reopen The state banks get their licenses to resume business from the state authorities. The Lowry City Bank received permission from the state finance department. Tuesday evening. and opened up promptly Wednesday morning. Neither the closing nor the re. opening of the Lowry City Bank was attended by any undue excitement, the people of the Lowry City community evidently having full confidence in our local bank. A rigid set of regulations governing bank re-openings have been is sued in a joint proclamation by the governor and state finance commissioner. No gold coin, bullion or gold certificates shall be paid out. Banks shall not engage in or permit transactions in foreign exchange. except when used in legitimate and normal business requirements, for reasonable traveling and other personal requirements, and for the fulfillment of contracts entered into prior to March 6, 1933 Withdrawalof currency for hoard. ing is not permitted. Withdrawal of money for the purpose of investing in stocks, securities or similar investments. is not permitted. unless in the fulfillment of contracts or obligations entered into prior to March 6. 1933 Withdrawals for the purpose of shifting accounts from one depository to another is not permited Customers are permitted to check against balances for necessary business transactions, in the due course of customer's business