Article Text

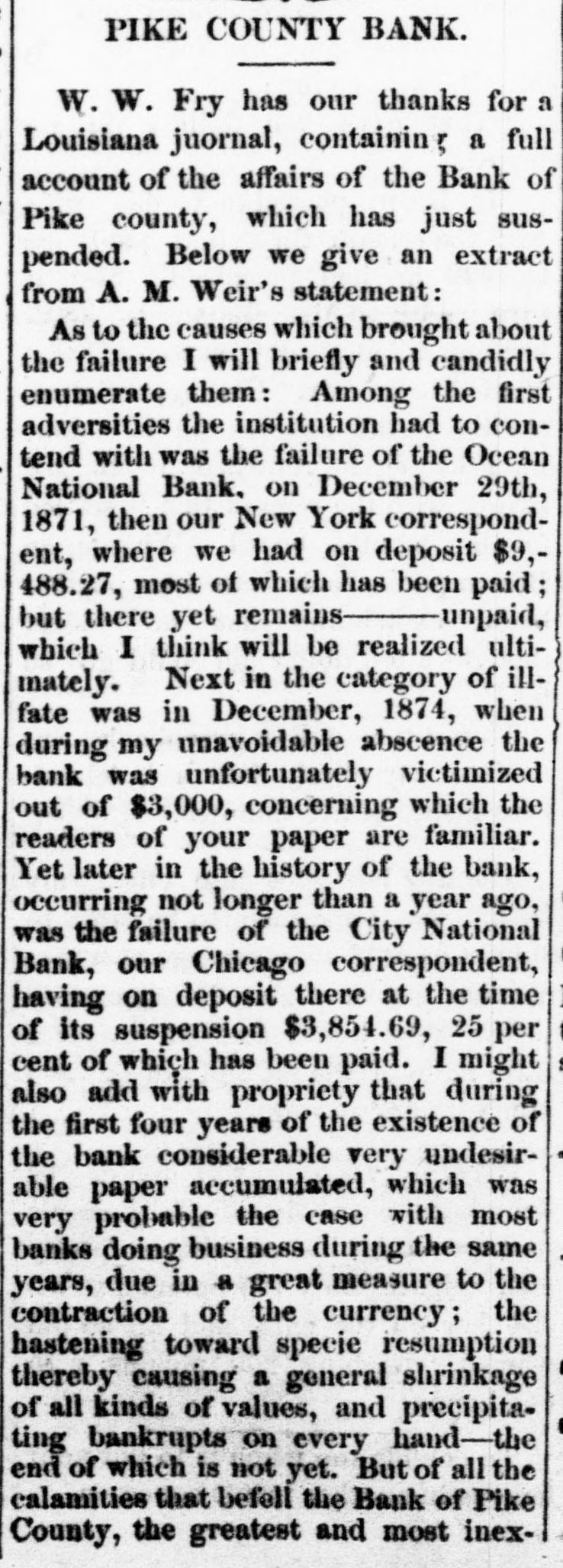

# PIKE COUNTY BANK. W. W. Fry has our thanks for a Louisiana juornal, containing a full account of the affairs of the Bank of Pike county, which has just suspended. Below we give an extract from A. M. Weir's statement: As to the causes which brought about the failure I will briefly and candidly enumerate them: Among the first adversities the institution had to contend with was the failure of the Ocean National Bank, on December 29th, 1871, then our New York correspondent, where we had on deposit $9,488.27, most of which has been paid; but there yet remains—unpaid, which I think will be realized ultimately. Next in the category of ill-fate was in December, 1874, when during my unavoidable abscence the bank was unfortunately victimized out of $3,000, concerning which the readers of your paper are familiar. Yet later in the history of the bank, occurring not longer than a year ago, was the failure of the City National Bank, our Chicago correspondent, having on deposit there at the time of its suspension $3,854.69, 25 per cent of which has been paid. I might also add with propriety that during the first four years of the existence of the bank considerable very undesirable paper accumulated, which was very probable the case with most banks doing business during the same years, due in a great measure to the contraction of the currency; the hastening toward specie resumption thereby causing a general shrinkage of all kinds of values, and precipitating bankrupts on every hand—the end of which is not yet. But of all the calamities that befell the Bank of Pike County, the greatest and most inex-