Article Text

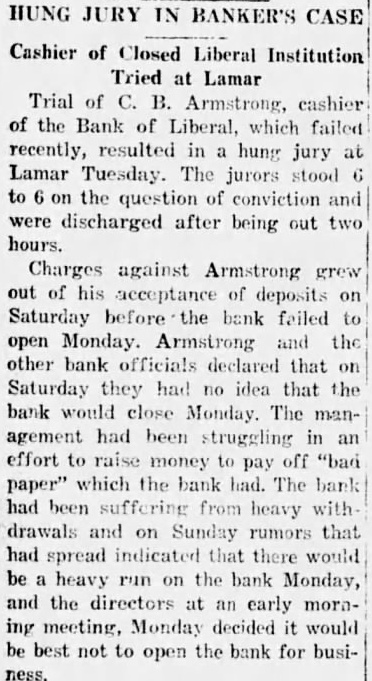

HUNG JURY IN BANKER'S CASE Cashier of Closed Liberal Institution Tried at Lamar Trial of C. B. Armstrong, cashier of the Bank of Liberal, which failed recently, resulted in a hung jury at Lamar Tuesday. The jurors stood 6 to 6 on the question of conviction and were discharged after being out two hours. Charges against Armstrong grew out of his acceptance of deposits on Saturday before the bank failed to open Monday. Armstrong and the other bank officials declared that on Saturday they had no idea that the bank would close Monday. The management had been struggling in an effort to raise money to pay off "bad paper" which the bank had. The bank had been suffering from heavy with drawals and on Sunday rumors that had spread indicated that there would be a heavy run on the bank Monday, and the directors at an early morning meeting, Monday decided it would be best not to open the bank for business.