Article Text

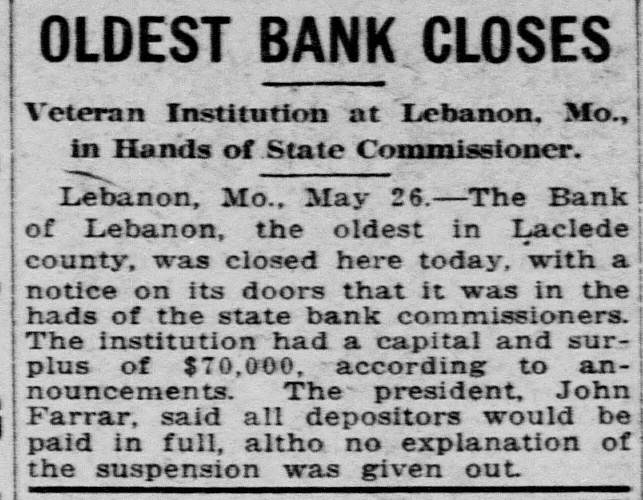

OLDEST BANK CLOSES Veteran Institution at Lebanon. Mo., in Hands of State Commissioner. Lebanon, Mo., May 26.-The Bank of Lebanon, the oldest in Laclede county, was closed here today, with a notice on its doors that it was in the hads of the state bank commissioners. The institution had a capital and surplus of $70,000, according to announcements. The president, John Farrar, said all depositors would be paid in full, altho no explanation of the suspension was given out.