Article Text

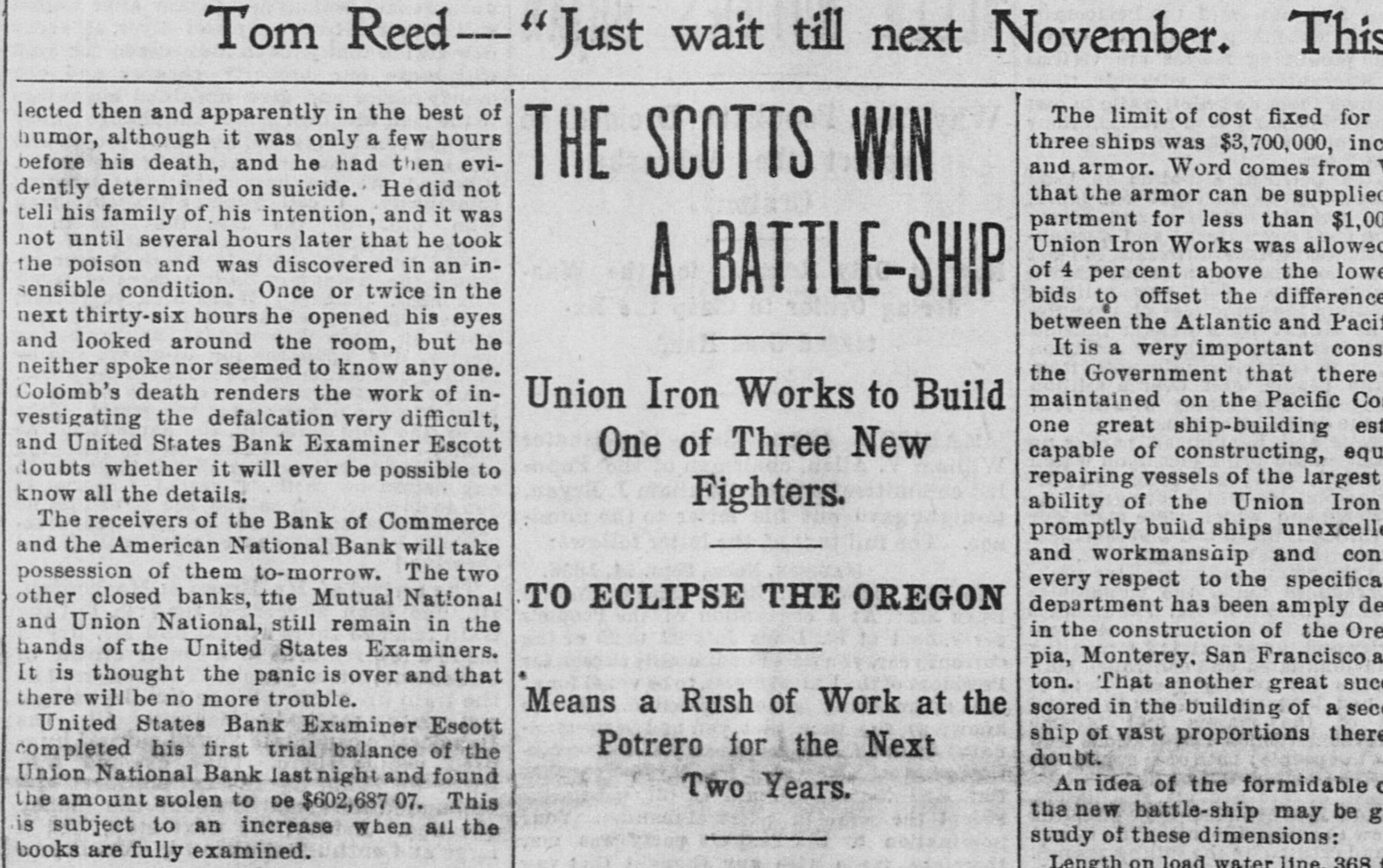

This Tom Reed. "Just wait till next November. The limit of cost fixed for lected then and apparently in the best of humor, although it was only a few hours three ships was $3,700,000, inc before his death, and he had then eviand armor. Word comes from 1 THE SCOTTS WIN dently determined on suicide. Hedid not that the armor can be supplied tell his family of his intention, and it was partment for less than $1,00 not until several hours later that he took Union Iron Works was allowed the poison and was discovered in an inof 4 per cent above the low A BATTLE-SHIP sensible condition. Once or twice in the bids to offset the difference next thirty-six hours he opened his eyes between the Atlantic and Paci and looked around the room, but he It is a very important cons neither spoke nor seemed to know any one. the Government that there Colomb's death renders the work of inmaintained on the Pacific Co Union Iron Works to Build vestigating the defalcation very difficult, one great ship-building est and United States Bank Examiner Escott One of Three New capable of constructing, equ doubts whether it will ever be possible to repairing vessels of the largest know all the details. ability of the Union Iron Fighters. The receivers of the Bank of Commerce promptly build ships unexcell and the American National Bank will take and workmanship and con possession of them to-morrow. The two every respect to the specifica other closed banks, the Mutual National TO ECLIPSE THE OREGON department has been amply de and Union National, still remain in the in the construction of the Ore hands of the United States Examiners. pia, Monterey, San Francisco a It is thought the panic is over and that ton. That another great suc there will be no more trouble. Means a Rush of Work at the scored in the building of a sec United States Bank Examiner Escott ship of vast proportions there Potrero for the Next completed his first trial balance of the doubt. Union National Bank last night and found An idea of the formidable o Two Years. the amount stolen to be $602,687 07. This the new battle-ship may be g is subject to an increase when all the study of these dimensions: books are fully examined. Length on load water line 368 f