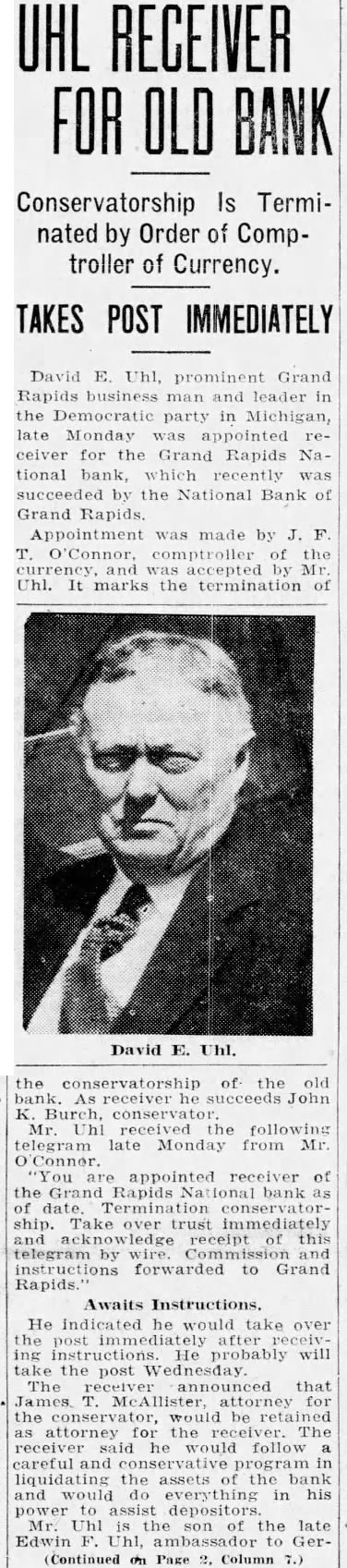

Article Text

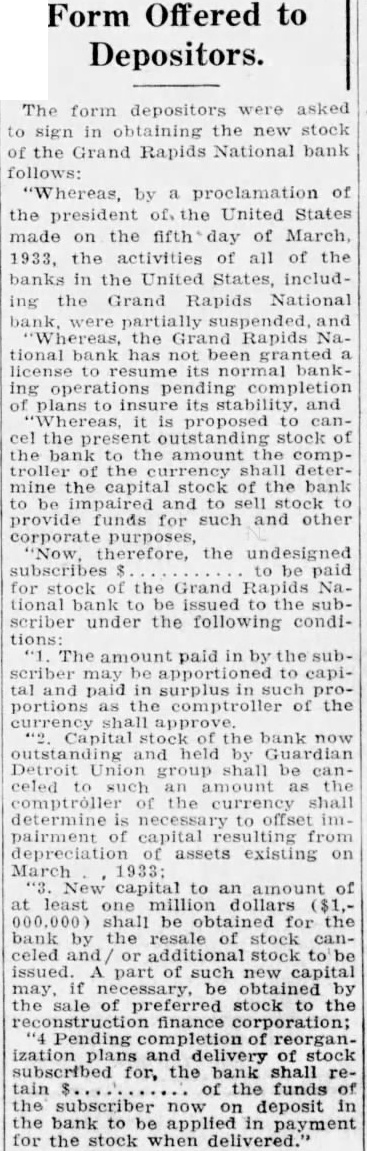

Form Offered to Depositors. The form depositors asked in obtaining the new stock the Grand Rapids National bank follows: "Whereas, by a proclamation of the president of, the United States made on the fifth day of March, 1933, the activities of all of the banks in the United States, including the Grand Rapids National were suspended and the Rapids Na. tional ing pending completion plans to insure its and "Whereas, proposed to cancel the outstanding stock the to the amount compdetermine the capital stock of the bank impaired and sell stock provide funds for such and other corporate purposes, "Now, therefore, the undesigned for stock the Grand Rapids Na. tional bank be the scriber under the following conditions: The amount paid in by the subscriber may be to paid surplus proportions the of the shall Capital stock the bank now outstanding and held by Guardian Detroit shall be celed such amount the currency shall determine necessary offset pairment of capital resulting from depreciation of assets existing on March capital to an of at least shall be obtained for the bank the resale of stock celed additional stock to be issued. part of such new capital obtained the preferred stock the finance Pending completion reorganization delivery of stock subscribed for, the bank shall retain the funds the subscriber now on deposit the bank be applied in payment for the stock when delivered.