Article Text

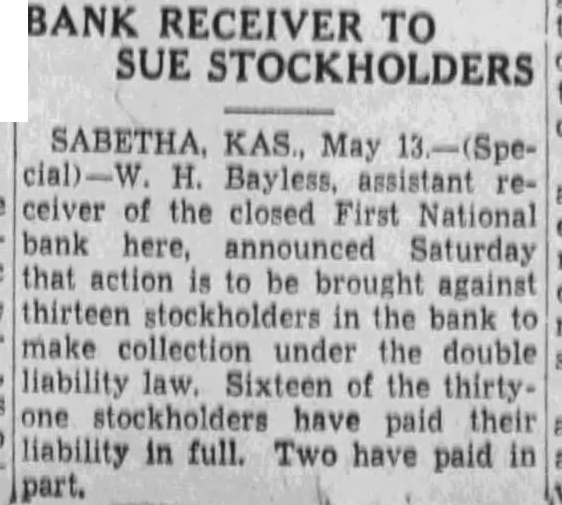

BANK RECEIVER TO SUE KAS., May H. assistant ceiver of the closed First National bank here, announced Saturday that action to be brought against thirteen stockholders in the bank make under the double liability law. Sixteen of the thirtystockholders have paid their liability in full. have paid