Article Text

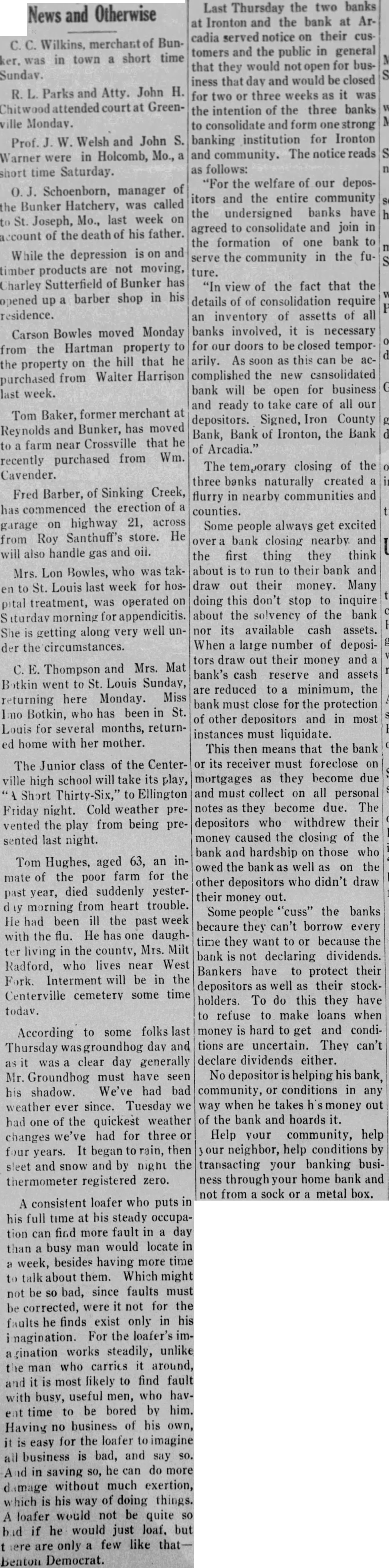

News and Otherwise C. C. Wilkins, merchant of Bunker, was in town a short time Sundav. R. L. Parks and Atty. John H. Chitwood attended court Greenville Monday. Prof. J. W. Welsh and John S. Warner were in Holcomb, Mo., a short time Saturday. O. J. Schoenborn, manager of the Bunker Hatchery, was called to St. Joseph, Mo., last week on account of the death of his father. While the depression is on and timber products are not moving, Charley Sutterfield of Bunker has opened up a barber shop in his residence. Carson Bowles moved Monday from the Hartman property to the property on the hill that he purchased from Walter Harrison last week. Tom Baker, former merchant at Reynolds and Bunker, has moved to a farm near Crossville that he recently purchased from Wm. Cavender. Fred Barber, of Sinking Creek, has commenced the erection of a garage on highway 21, across from Roy Santhuff's store. He will also handle gas and oil. Mrs. Lon Bowles, who was taken to St. Louis last week for hospital treatment, was operated on turdav morning for appendicitis. She is getting along very well under the circumstances. C. E. Thompson and Mrs. Mat tkin went to St. Louis Sunday, returning here Monday. Miss Imo Botkin, who has been in St. Louis for several months, returned home with her mother. The Junior class of the Centerville high school will take its play, Short Thirty-Six," to Ellington Friday night. Cold weather prevented the play from being presented last night. Tom Hughes, aged 63, an inmate of the poor farm for the past year, died suddenly yesterday morning from heart trouble. He had been ill the past week with the flu. He has one daughter living in the county, Mrs. Milt Radford, who lives near West Fork. Interment will be in the Centerville cemeterv some time todav. According to some folks last Thursday wasgroundhog day and as it was a clear day generally Mr. Groundhog must have seen his shadow. We've had bad weather ever since. Tuesday we had one of the quickest weather changes we've had for three or four years. It began to rain, then sleet and snow and by night the thermometer registered zero. Last Thursday the two banks at Ironton and the bank at Arcadia served notice on their customers and the public in general that they would not open for business that day and would be closed for two or three weeks as it was the intention of the three banks to consolidate and form one strong banking institution for Ironton and community. The notice reads as follows: "For the welfare of our depositors and the entire community the undersigned banks have agreed to consolidate and join in the formation of one bank to serve the community in the future. "In view of the fact that the details of of consolidation require an inventory of assetts of all banks involved, it is necessary for our doors to be closed temporarily. As soon as this can be accomplished the new csnsolidated bank will be open for business and ready to take care of all our depositors. Signed, Iron County Bank, Bank of Ironton, the Bank of Arcadia." The temporary closing of the three banks naturally created a flurry in nearby communities and counties. Some people always get excited over a bank closing nearby. and the first thing they think about is to run to their bank and draw out their money. Many doing this don't stop to inquire about the solvency of the bank nor its available cash assets. When a large number of depositors draw out their money and a bank's cash reserve and assets are reduced to a minimum, the bank must close for the protection of other depositors and in most instances must liquidate. This then means that the bank or its receiver must foreclose on mortgages as they become due and must collect on all personal notes as they become due. The depositors who withdrew their money caused the closing of the bank and hardship on those who owed the bank as well as on the other depositors who didn't draw their money out. Some people "cuss" the banks becaure they can't borrow every time they want to or because the bank is not declaring dividends. Bankers have to protect their depositors as well as their stockholders. To do this they have to refuse to make loans when money is hard to get and conditions are uncertain. They can't declare dividends either. No depositor is helping his bank, community, or conditions in any way when he takes money out of the bank and hoards it. Help your community, help our neighbor, help conditions by transacting your banking business through your home bank and not from a sock or a metal box. A consistent loafer who puts in his full time at bis steady occupation can find more fault in a day than a busy man would locate in a week, besides having more time to talk about them. Which might not be so bad, since faults must be corrected, were it not for the faults he finds exist only in his magination. For the loafer's ima gination works steadily, unlike the man who carries it around, and it is most likely to find fault with busy, useful men, who havent time to be bored by him. Having no business of his own, it is easy for the loafer to imagine all business is bad, and say so. in saving so, he can do more damage without much exertion, which is his way of doing things. A loafer would not be quite so bad if he would just loaf, but t ere are only a few like thatBenton Democrat.