Article Text

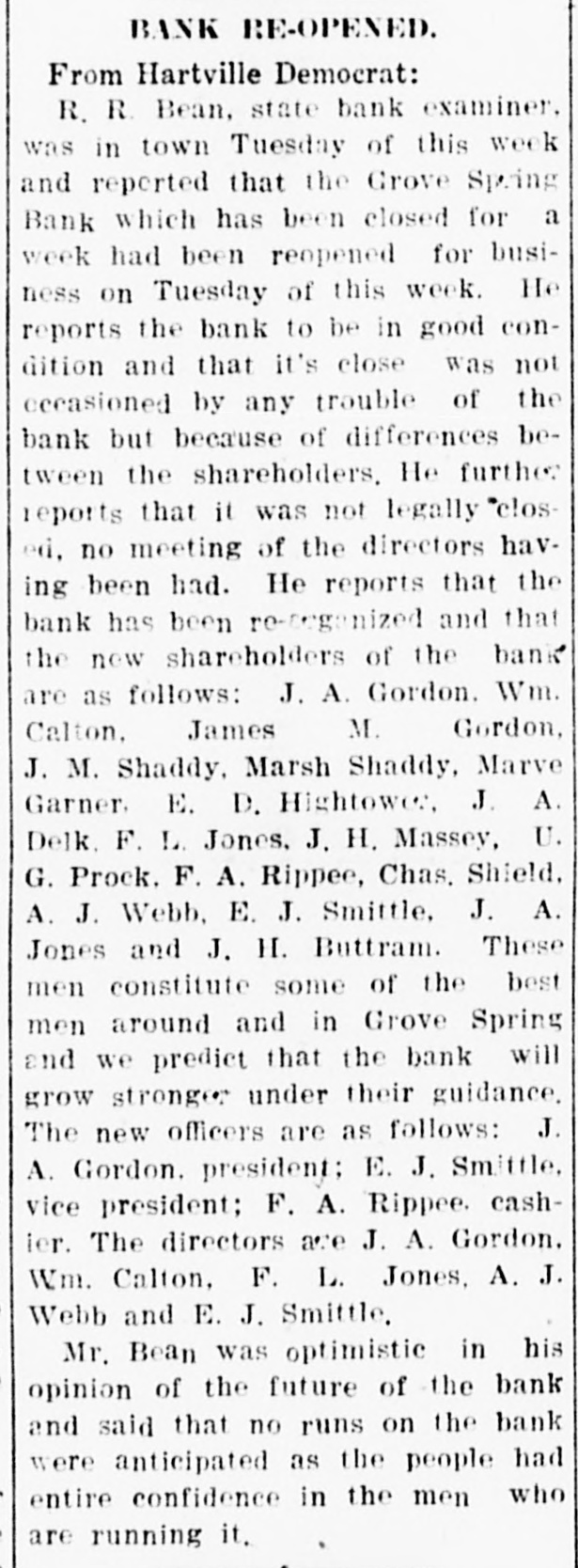

BANK RE-OPENED. From Hartville Democrat: R. R. Bean, state bank examiner. was in town Tuesday of this week and reported that the Grove Spring Bank which has been closed for a week had been reopened for business on Tuesday of this week. He reports the bank to be in good condition and that it's close was not occasioned by any trouble of the bank but because of differences between the shareholders. He further reports that it was not legally "closed, no meeting of the directors having been had. He reports that the bank has been re-teganized and that the new shareholders of the bank are as follows: J. A. Gordon. Wm. Calton. James M. Gordon, J. M. Shaddy. Marsh Shaddy, Marve Garner. E. D. Hightower, J. A. Delk. F. L. Jones, J. H, Massey, U. G. Prock. F. A. Rippee, Chas. Shield. A. J. Webb, E. J. Smittle, J. A. Jones and J. H. Buttram. These men constitute some of the best men around and in Grove Spring and we predict that the bank will grow stronger under their guidance. The new officers are as follows: J. A. Gordon. president; E. J. Smittle, vice president; F. A. Rippee. cashier. The directors are J. A. Gordon. Wm. Calton, F. L. Jones, A. J. Webb and E. J. Smittle, Mr. Bean was optimistic in his opinion of the future of the bank and said that no runs on the bank were anticipated as the people had entire confidence in the men who are running it,