Article Text

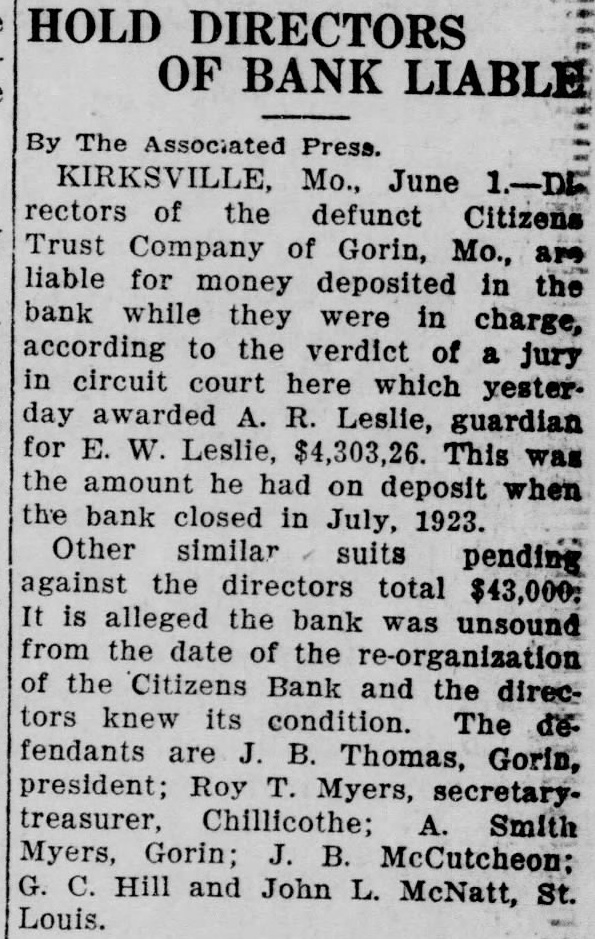

HOLD DIRECTORS OF BANK Mo., June rectors the defunct Citizens Trust Company Gorin, Mo., liable for money deposited the bank while they were in charge, according to the verdict of circuit court here which awarded R. Leslie, guardian for This the amount he had deposit when the bank closed July, 1923. Other similar pending the directors total alleged the bank was date the the Citizens Bank the tors knew its The fendants Thomas, Gorin, president; Roy Myers, Chillicothe; Smith Myers, Gorin; McCutcheon: Hill and John McNatt, Louis.