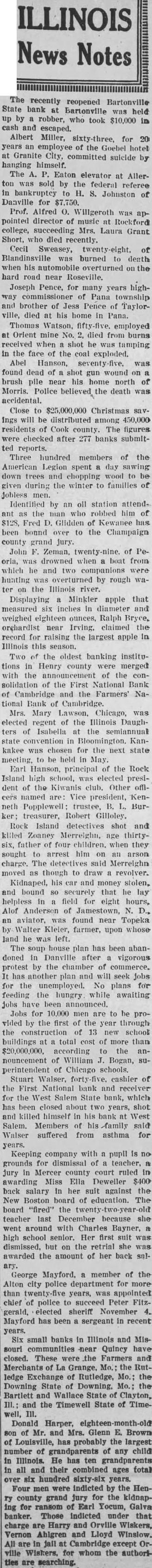

Article Text

THIRTY BANKS CLOSE IN ARK Continued from Page financial difficulties of Caldwell Company, bankers Tenn." also said affairs Caldwell & remote Arkansas nothing but an from excited public could have forced closing of this strong Nov. the closing the National Bank of Kentucky. today started run depositors every the city practically Similar existed in other parts the Most institutions issued of statements they no connection with the bank of Kentucky. The bank was closed following meeting of the board with repreof Louisville finanhouse. The meeting was in cial session from p.m. Saturday until 10 p.m. Sunday, when agreed that no immediate solution could be attained. SPRINGFIELD, Ill., Nov. Illinois banks were closed today, the number of failures in the state since Friday The Bartlett and Wallace State bank, Clayton. and Timewell State bank, Timewell, were closed today, auditor Oscar Nelson announced. All the closings in connection with the failure of the State Savings Loan and Trust company of Qunicy, which Timewell and Clayton institutions were correspondents. Timewell bank had deposits of $150,000 and the Clayton bank $50,000. NASHVILLE, Tenn., Nov. 17. Federal Judge John Gore today sustained for creditors' bill against Caldwell Company, investment banking house and dered to their claims before next July JEFFERSON CITY, Mo., Nov. Exchange bank, Rutledge, in with total of $43,790, and the Downing State bank, at Downing, in Schuyler county, were clostoday placed the hands the state finance department. The Downing bank had total resources of $193,929. Both banks were closed as sult the failure recently of the State Savings Loan Trust company Quincy, III., where they transacted business. LOUISVILLE, Ky., Nov. 17. Security bank, affiliated the bank Louisville Trust company through inclusion in the company, temporary suspension here today. LOUISVILLE Ky., Nov. 17.Kentucky, the oldest bank Kentucky, was closed by resolution of its board of placed the hands National bank examiner. The Trust company, an was closed by action of its board James B. Brown, president of the National of Kentucky, issued the to withdrawals in the past week and ruon the streets was advisable majority of the board of directors to close the bank, least temporarily, for the best interests of depositors and all concerned." Presidents of other Louisville banks issued statements that their institutions were solvent.