Article Text

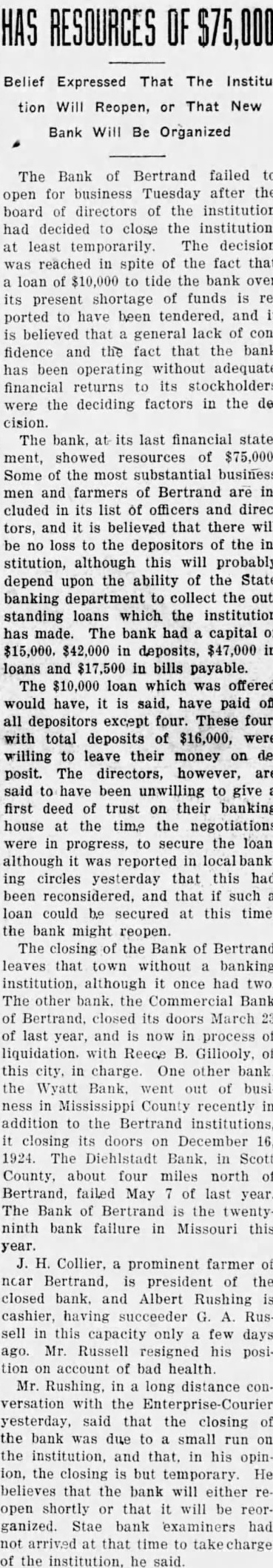

Belief Expressed That The Institution Will Reopen, or That New Bank Will Be Organized The Bank of Bertrand failed open for business Tuesday after the board directors of the institution had decided to close the institution. least temporarily. The decision reached in spite of the fact that loan $10,000 tide the bank over its present shortage funds ported to have been tendered. and believed that general lack of fidence and the fact that the bank has been operating without adequate financial returns its stockholders the deciding factors in the decision. The bank, its last financial statement, showed resources of Some of the most substantial business men and farmers of Bertrand are cluded its list officers and directors, and believed that there will loss to the depositors of the institution, although this will probably depend upon the ability of the State banking department to collect the outstanding loans which the institution has made. The bank had capital $15,000. $42,000 in deposits, in loans and in bills payable. The $10,000 loan which was offered would have, it said, have paid off all depositors except four. These four, with total deposits of $16,000, were willing to leave their money on deposit. The directors, however, are said to have been unwilling to give first deed of trust on their banking house at the time the negotiations progress, to secure the loan, although reported in ing circles yesterday that this had reconsidered, and that such loan could be secured at this time, the bank might reopen. The closing of the Bank of Bertrand that town without banking institution, although once had The other bank. the Commercial Bank of Bertrand. closed its doors March of last year, and now in process of liquidation. with Reece Gillooly, of this city, charge. One other bank. the Wyatt Bank, went of busiin Mississippi County recently in addition to the Bertrand institutions, closing its doors on December 16, 1924. The Diehlstadt Bank. in Scott County, about four miles north of Bertrand. failed May of last year. The Bank of Bertrand the twentyninth bank failure in Missouri this year. Collier. prominent farmer of Bertrand, president of the closed bank. and Albert Rushing cashier, succeeder Russell in this capacity only few days ago. Mr. Russell resigned his position account of bad health. Mr. Rushing, in long distance versation with the yesterday, said that the closing of the bank due to small run on the institution, and that, in his opinion, the closing is but temporary. He believes that the bank will either open shortly that will ganized. Stae bank examiners had not arrived that time to of the institution, said.