Article Text

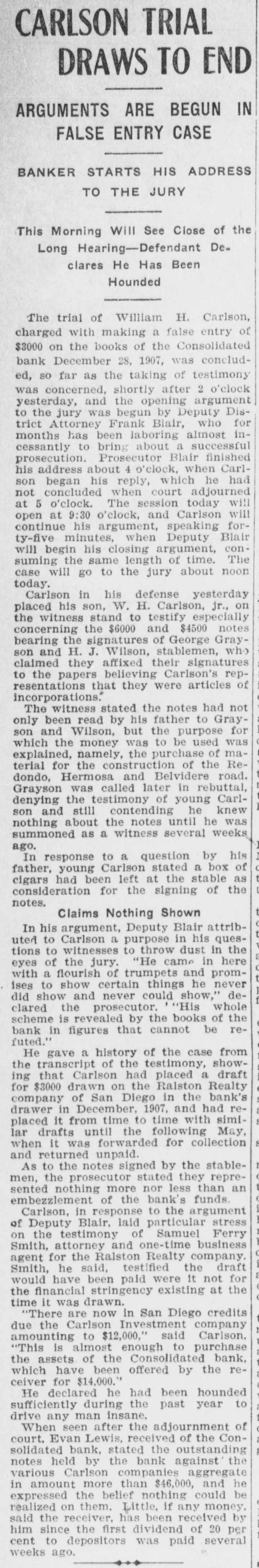

CARLSON TRIAL DRAWS TO END ARGUMENTS ARE BEGUN IN FALSE ENTRY CASE BANKER STARTS HIS ADDRESS TO THE JURY This Morning Will See Close of the Long Hearing-Defendant Declares He Has Been Hounded The trial of William H. Carlson, charged with making a false entry of $3000 on the books of the Consolidated bank December 28, 1907, was concluded, so far as the taking of testimony was concerned, shortly after 2 o'clock and the to was yesterday, the jury begun opening by Deputy argument District Frank for been a months cessantly Attorney has to bring laboring about Blair, almost successful who inProsecutor finished about 4 son his his prosecution. address began reply, o'clock, which Blair when he Carl- had not concluded when court adjourned at 5 o'clock. The session today will 9:30 o'clock, and Carlson will his continue open ty-five at minutes, argument, closing when argument, Deputy speaking Blair forwill begin his consuming the same length of time. The case will go to the jury about noon today. Carlson in his defense yesterday placed his son, W. H. Carlson, jr., on the stand to the the concerning bearing witness signatures $6000 and testify of George $4500 especially Gray- notes son J. claimed to repthe and papers H. they affixed believing Wilson, their stablemen, Carlson's signatures who resentations that they were articles of incorporations. The witness stated the notes had not only been read by his father to Grayson and Wilson, but the purpose for which the money was to be used was explained, namely, the purchase of mathe construction of the Rewas called the young denying dondo, Grayson terial for Hermosa testimony and later Belvidere of in rebuttal, Carl- road. about the notes was nothing son and still contending until he he knew summoned as a witness several weeks ago. In response to a question by his Carlson of been at as father, cigars had young left stated the stable a box consideration for the signing of the notes. Claims Nothing Shown In his argument, Deputy Blair attributed to Carlson a purpose in his questions to witnesses to throw dust in the eyes of the jury. "He came in here with a flourish of trumpets and promises to show certain things he never did show and never could show," declared the prosecutor. "His whole scheme is revealed by the books of the bank in figures that cannot be refuted.' He gave a history of the case from the transcript of the testimony, showing that Carlson had placed a draft on of San Diego December, redrawer company for $3000 in drawn the 1907, Ralston in and the had Realty bank's it from time to until the lar placed drafts forwarded following time for with collection simi- May, when it was and returned unpaid. As to the notes signed by the stablemen, the prosecutor stated they represented nothing more nor less than an embezzlement of the bank's funds. Carlson, in response to the argument of Deputy Blair, laid particular stress on the testimony of Samuel Ferry Smith, attorney and one-time business agent for the Ralston Realty company. Smith, he said, testified the draft would have been paid were it not for the financial stringency existing at the time it was drawn. 'There are now in San Diego credits due the Carlson Investment company amounting to $12,000," said Carlson. "This is almost enough to purchase the assets. of the Consolidated bank, which have been offered by the receiver for $14,000. He declared he had been hounded sufficiently during the past year to drive any man insane. When seen after the adjournment of court, Evan Lewis, received of the Consolidated bank, stated the outstanding notes held by the bank against the various Carlson companies aggregate in amount more than $46,000, and he expressed the belief nothing could be realized on them. Little, if any money, said the receiver, has been received by him since the first dividend of 20 per cent to depositors was paid several weeks ago. w