Article Text

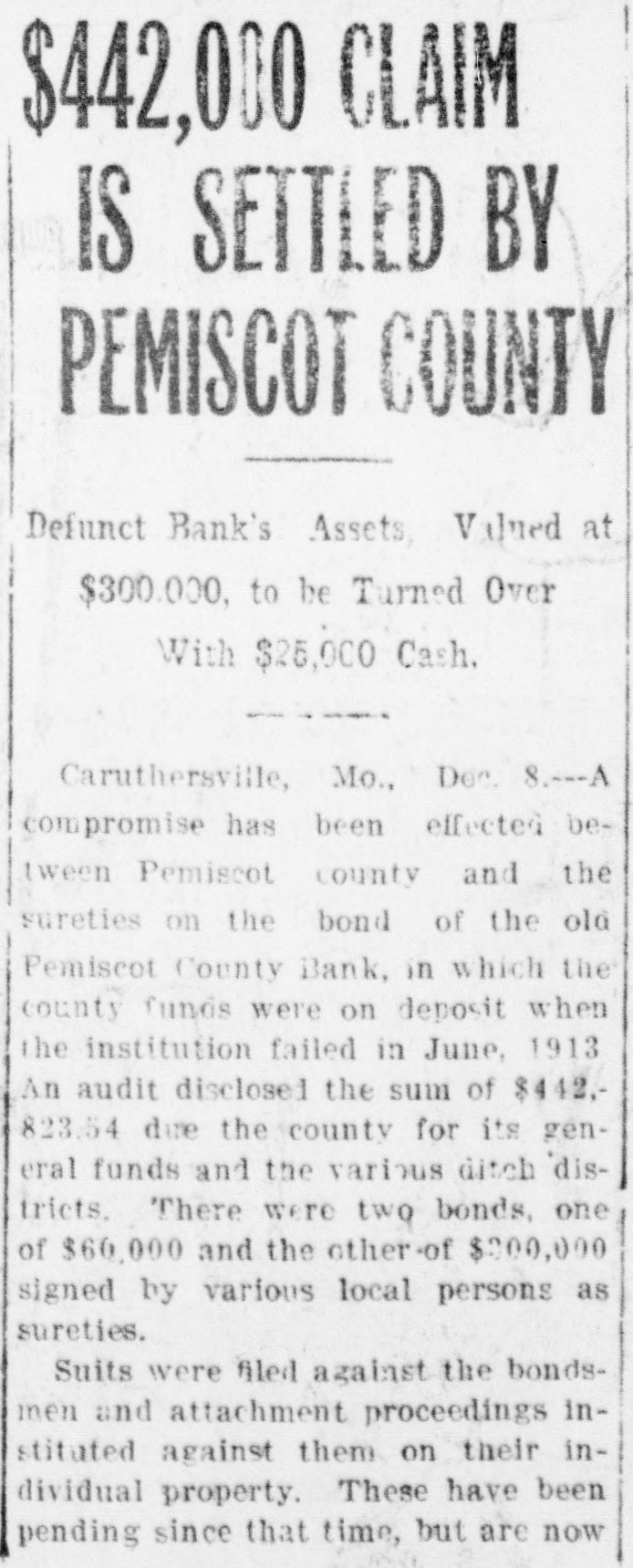

$442,000 CLAIM IS SETTLED BY PEMISCOT COUNTY Defunct Bank's Assets, Valued at $300.000, to be Turned Over With $25,000 Cash. Caruthersville, Mo., Dec. 8.---A compromise has been effected between Pemiscot county and the sureties on the bond of the old Pemiscot County Bank, in which the county funds were on deposit when the institution failed in June, 1913 An audit disclosed the sum of $442.823.54 due the county for its general funds and the various ditch districts. There were two bonds, one of $60,000 and the other of $000,000 signed by various local persons as sureties. Suits were filed against the bondsmen and attachment proceedings instituted against them on their individual property. These have been pending since that time, but are now