Click image to open full size in new tab

Article Text

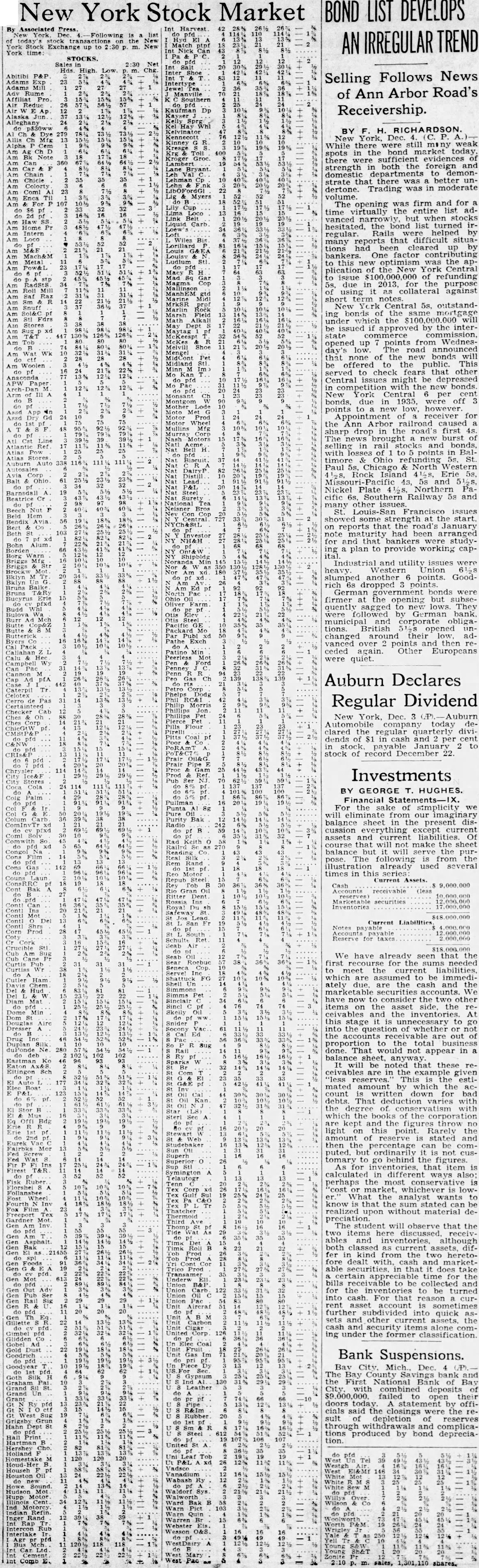

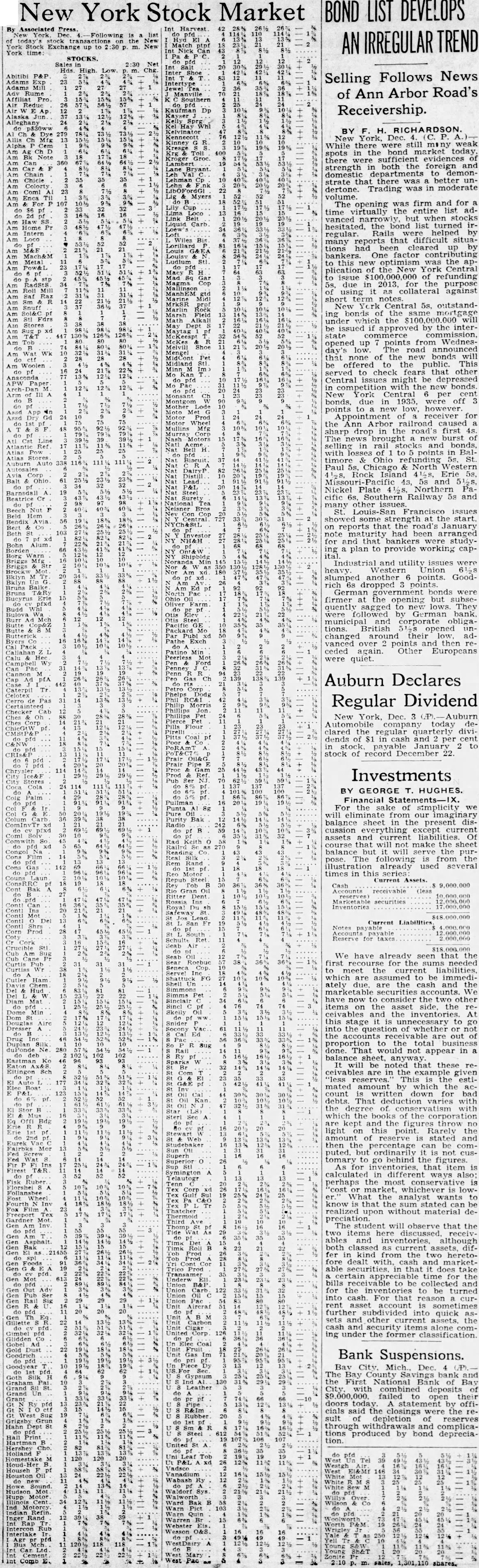

New York Stock Market

Associated Following stock York Exchange to York time:

AN IRREGULAR TREND Sales Abitibi P&P Selling Follows News of Ann Arbor Road's Affiliat Receivership. Alaska Alleghany BY F. H. RICHARDSON. New York, Dec. C. P. While there were still m' ny weak spots in the bond market today, there were sufficient evidences of strength in both the foreign and domestic departments to demonChicle strate that there was a better undertone. Trading was in moderate Coml Enca volume The opening was firm and for a time virtually the entire list advanced but when stocks hesitated, the bond list turned irregular. Rails were helped by many reports that difficult situa tions had been cleared up Mach&M bankers. One factor contributing Metal to this new optimism was the application of the New York Central to issue 000 of refunding 5s, due in 2013, for the purpose of using it as collateral against short term New Central 5s, outstanding bonds of the same mortgage under which the $100,000.000 will be issued if approved by the interstate commerce commission. opened up 7 points from Wednesday's low The road announced that none of the new bonds will Woolen be offered to the public. This served to check fears that other Central issues might be depressed Paper in competition with the new bonds. New York Central per cent bonds, due in 1935, were off 3 points to new low, however. Appointment of receiver for the Ann Arbor railroad caused a sharp drop in the road's first 4s The news brought a new burst of selling in rail stocks and bonds, with of to points in Baltimore Ohio refunding 5s Auburn Paul 5s, Chicago & North Western Rock Island 41/28, Erie 5s. Balt Ohio Missouri- Pacific 43, 5s and pf Nickel Plate 41/28, Northern Pa Barnsdal cific 6s, Southern Railway 5s and many other issues St. Louis- issues Beld some sti reng at the start. on reports that the road' January note maturity had been arranged for and that bankers were study ing a plan to provide working capIndustrial and utility issues were heavy. Western Union 61/28 slumped another 6 points. Goodrich 6s dropped 3 points German government bonds were firmer at the opening but subsequently sagged to new lows. They Wa were followed by German bank. municipal and corporate obligations. British opened unchanged around their low advanced over 2 points and then receded again. Other Europeans were quiet. Auburn Declares Regular Dividend New York, Dec. 3 (AP) Auburn Automobile company today declared the regular quarterly dividends of $1 in cash and 2 per cent in stock, payable January 2 to stock of record December 22. Investments BY GEORGE T. HUGHES. the of stmplicity we will eliminate from our imaginary Colum balance sheet in the present discussion everything except current assets and current liabilities. Of course that will not make the sheet balance but will serve the purpose. The following is from the illustration already used several times in this series Current Assets. Cash Accounts receivable (less securities Inventories Current Liabilities Notes Reserve for taxes We have already seen that the first recourse for the sums needed Curtis to meet the current liabilities. which are assumed to be immediately due, are the cash and the securities accounts. We have now to consider the two other items on the asset side, the ceivables and the inventories. At this stage it is unnecessary to go into the question of whether or not the accounts receivable are out of proportion to the total done. That would not appear in a balance sheet anyway It will be noted that these receivables are in the example given "less reserves. This is the estimated amount by which the account written down for bad debts That deduction varies with the of vatism with which the books of the corporation are kept and the figures throw no light on this point. Rarely the amount of reserve is stated and then the percentage can be computed. but ordinarily it is not customary to go behind the figures. As for inventories, that item is Firest T&R calculated in different ways also: Ruber perhaps the most conservati is "cost market, whichever is lower. What the analyst wants to know is that the sum stated can be realized upon without material deThe student will observe that the two items here discussed. receivables and inventories, although both classed as current assets, dif fer in kind from the two heretofore dealt with, cash and marketable securities. in that it does take certain appreciable time for the bills ivable to be and for the inventories to be turned into cash. For that a current asset account is sometimes further subdivided into quick sets and other current assets, the cash and security items alone coming under the former classification. Gold Bank Suspensions. Bav City Mich Dec. 4 The Bay County bank and the First National Bank of Bay with combined deposits of $9,000,000. failed to open their doors today. A statement by officials said the closings were the result of depletion of reserves through withdrawals and complications produced by bond depreciation. Hartman do Comb