Click image to open full size in new tab

Article Text

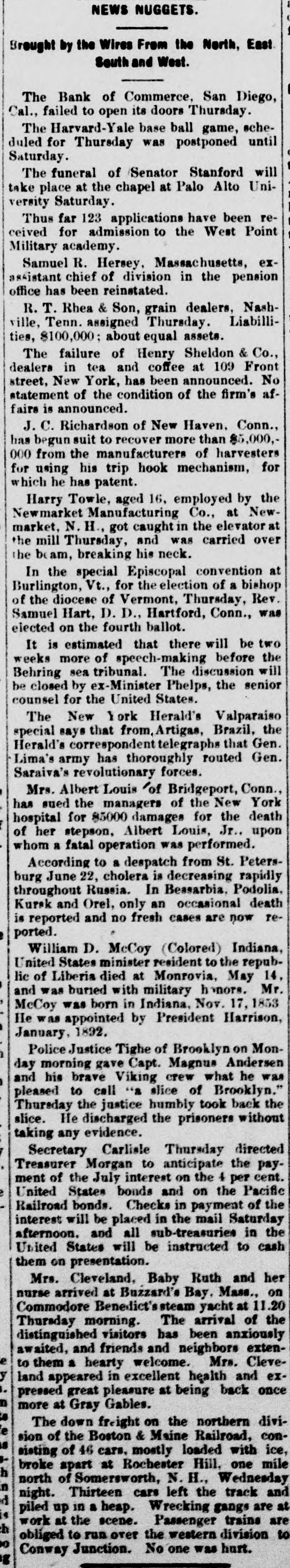

NEWS NUGGETS. Brought by the Wires From the North, East South and West. The Bank of Commerce. San Diego, Cal., failed to open its doors Thursday. The Harvard-Yale base ball game, scheduled for Thursday was postponed until Saturday. The funeral of Senator Stanford will take place at the chapel at Palo Alto University Saturday. Thus far 123 applications have been received for admission to the West Point Military academy. Samuel R. Hersey, Massachusetts, exassistant chief of division in the pension office has been reinstated. R. T. Rhea & Son, grain dealers. Nashville, Tenn. assigned Thursday. Liabillities, $100,000; about equal assets. The failure of Henry Sheldon & Co., dealers in tea and coffee at 109 Front street, New York, has been announced. No statement of the condition of the firm's affairs is announced. J.C Richardson of New Haven, Conn., has begun suit to recover more than 85,000,000 from the manufacturers of harvesters for using his trip hook mechanism, for which he has patent. Harry Towle, aged 16, employed by the Newmarket Manufacturing Co., at Newmarket, N. H., got caught in the elevator at the mill Thursday, and was carried over the beam, breaking his neck. In the special Episcopal convention at Burlington, Vt., for the election of a bishop of the diocese of Vermont, Thursday, Rev. Samuel Hart, D., Hartford, Conn., was elected on the fourth ballot. It is estimated that there will be two weeks more of speech-making before the Behring sea tribunal. The discussion will be closed by ex-Minister Phelps, the senior counsel for the United States. The New York Herald's Valparaiso special says that from, Artigas, Brazil, the Herald's correspondent telegraphs that Gen. Lima's army has thoroughly routed Gen. Saraiva's revolutionary forces. Mrs. Albert Louis of Bridgeport, Conn., has sued the managers of the New York hospital for 85000 damages for the death of her stepson, Albert Louis, Jr. upon whom a fatal operation was performed. According to a despatch from St. Petersburg June 22, cholera is decreasing rapidly throughout Russia. In Bessarbia. Podolia. Kursk and Orel, only an occasional death is reported and no fresh cases are now reported. William D. McCoy (Colored) Indiana, United States minister resident to the republic of Liberia died at Monrovia, May 14. and was buried with military honors. Mr. McCoy was born in Indiana, Nov. 17, 1853 He was appointed by President Harrison, January, 1892. Police Justice Tighe of Brooklyn on Monday morning gave Capt. Magnus Andersen and his brave Viking crew what he was pleased to call "a slice of Brooklyn." Thursday the justice humbly took back the slice. He discharged the prisoners without taking any evidence. Secretary Carlisle Thursday directed Treasurer Morgan to anticipate the payment of the July interest on the 4 per cent. United States bonds and on the Pacific Railroad bonds. Checks in payment of the interest will be placed in the mail Saturday afternoon. and all sub-treasuries in the United States will be instructed to cash them on presentation. Mrs. Cleveland, Baby Ruth and her nurse arrived at Buzzard's Bay. Mass., on Commodore Benedict's team yacht at 11.20 Thursday morning. The arrival of the distinguished visitors has been anxiously awaited, and friends and neighbors extene to them a hearty welcome. Mrs. Clevey land appeared in excellent health and ex. pressed great pleasure at being back once n more at Gray Gables. a The down freight on the northern divie sion of the Boston & Maine Railroad, conis sisting of 46 cars. mostly loaded with ice, broke apart at Rochester Hill. one mile h north of Somersworth, N. H., Wednesday in night. Thirteen cars left the track and d piled up in a heap. Wrecking gangs are at is work at the scene. Passenger traine are h obliged to run over the western division to o Conway Junction. No one was hurt. g