Article Text

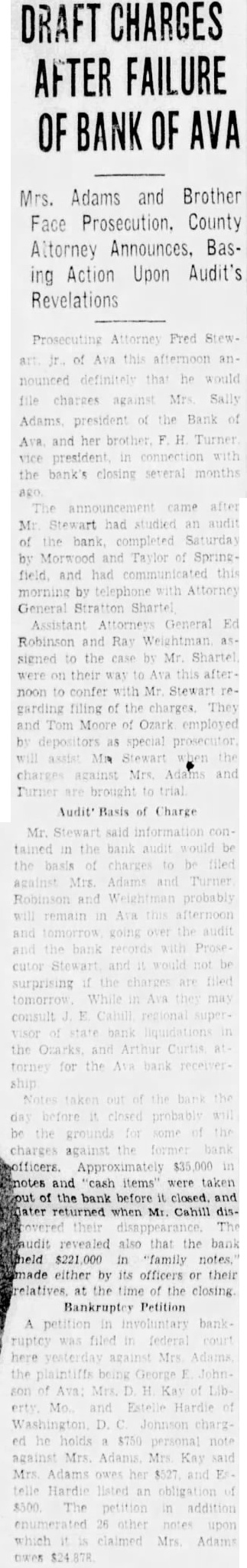

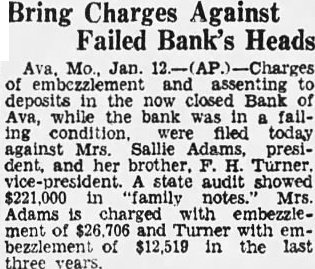

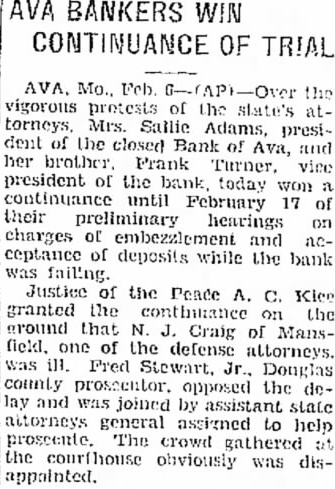

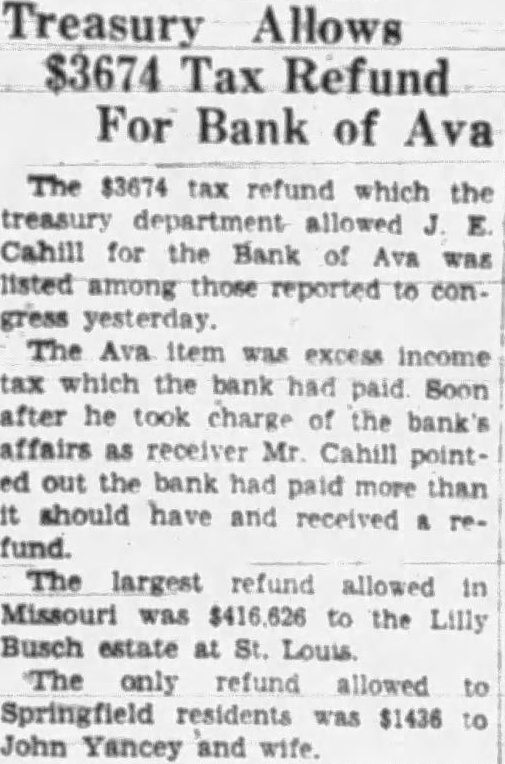

DRAFT CHARGES AFTER FAILURE OF BANK OF AVA Mrs. Adams and Brother Face Prosecution. County Attorney Announces. BasAction Upon Audit's ing Revelations Prosecuting Attorney Fred Stewof Ava this afternoon nounced definitely that he file charges against Mrs Sally Adams president of the Bank vice president in with the bank's closing several months ago announcement came Mr Stewart had studied audit of the bank, completed Saturday and Taylor of Springfield and had communicated this morning by with Attorney General Stratton Shartel Assistant General Ed Robinson and Ray Weightman signed to the case by Mr. Shartel were their Ava this afternoon to confer with Mr. Stewart garding filing of the They and Tom of employed by depositors as special assist Stewart the charges against Mrs and Turner brought to trial Audit' Basis of Charge Mr. Stewart said information tained in the bank audit would be basis of charges filed against Mrs. Adams and Turner Robinson and probably remain afternoon the with surprising charges tomorrow Arthur Curtis for the ship before closed probably charges against the Approximately $35,000 and "cash items' were taken of the bank before closed. and later returned when Mr. Cahill discovered revealed also that the bank $221,000 in "family notes, either by its officers or their relatives. at the time of the closing Bankruptcy Petition A petition involuntary ruptcy was federal Mrs Ava: Mo Hardie Washington D. Johnson ed he $750 personal against Mrs. Adams Mrs. Mrs Adams her $527 and an obligation The addition enumerated 26 upon which claimed Adams