Article Text

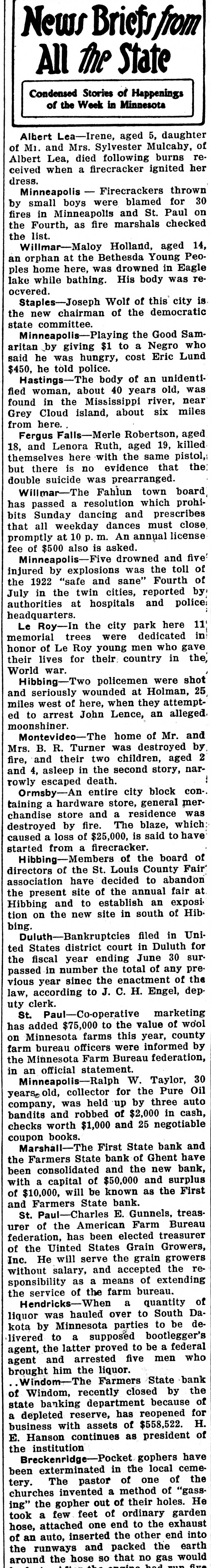

News Briefs from All the State Condensed Stories of Happenings of the Week in Minnesota Albert Lea-Irene, aged 5, daughter of Mr. and Mrs. Sylvester Mulcahy, of Albert Lea, died following burns received when a firecracker ignited her dress. Minneapolis - Firecrackers thrown by small boys were blamed for 30 fires in Minneapolis and St. Paul on the Fourth, as fire marshals checked the list. Willmar-Maloy Holland, aged 14, an orphan at the Bethesda Young Peoples home here, was drowned in Eagle lake while bathing. His body was reocvered. Staples-Joseph Wolf of this city is the new chairman of the democratic state committee. Minneapolis-Playing the Good Samaritan by giving $1 to a Negro who said he was hungry, cost Eric Lund $450, he told police. Hastings-The body of an unidentified woman, about 40 years old, was found in the Mississippi river, near Grey Cloud island, about six miles from here. Fergus Falls-Merle Robertson, aged 18, and Lenora Ruth, aged 19, killed themselves here with the same pistol, but there is no evidence that the double suicide was prearranged. Willmar-The Fahlun town board has passed a resolution which prohibits Sunday dancing and prescribes that all weekday dances must close, promptly at 10 p. m. An annual license fee of $500 also is asked. Minneapolis-Five drowned and five' injured by explosions was the toll of the 1922 "safe and sane" Fourth of July in the twin cities, reported by: authorities at hospitals and police: headquarters. Le Roy-In the city park here 11' memorial trees were dedicated in honor of Le Roy young men who gave their lives for their country in the, World war. Hibbing-Two policemen were shot and seriously wounded at Holman, 25 miles west of here, when they attempted to arrest John Lence, an alleged. moonshiner. Montevideo-The home of Mr. and Mrs. B. R. Turner was destroyed by fire, and their two children, aged 2 and 4, asleep in the second story, narrowly escaped death. Ormsby-An entire city block con-. taining a hardware store, general merchandise store and a residence was destroyed by fire. The blaze, which: caused a loss of $25,000, is said to have started from a firecracker. Hibbing-Members of the board of directors of the St. Louis County Fair association have decided to abandon the present site of the annual fair at Hibbing and to establish an exposition on the new site in south of Hib. bing. Duluth-Bankruptcies filed in United States district court in Duluth for the fiscal year ending June 30 surpassed in number the total of any previous year sinec the enactment of the law, according to J. C. H. Engel, deputy clerk. St. Paul-Co-operative marketing has added $75,000 to the value of wool on Minnesota farms this year, county farm bureau officers were informed by the Minnesota Farm Bureau federation, in an official statement. Minneapolis-Ralph W. Taylor, 30 years old, collector for the Pure Oil company, was held up by three auto bandits and robbed of $2,000 in cash, checks worth $1,000 and 25 negotiable coupon books. Marshall-The First State bank and the Farmers State bank of Ghent have been consolidated and the new bank, with a capital of $50,000 and surplus of $10,000, will be known as the First and Farmers State bank. St. Paul-Charles E. Gunnels, treasurer of the American Farm Bureau federation, has been elected treasurer of the Uinted States Grain Growers, Inc. He will serve the grain growers without salary, and accepted the responsibility as a means of extending the service of the farm bureau. Hendricks-When a quantity of liquor was hauled over to South Dakota by Minnesota parties to be delivered to a supposed bootlegger's agent, the latter proved to be a federal agent and arrested five men who brought him the liquor. .Windom-The Farmers State bank of Windom, recently closed by the state banking department because of a depleted reserve, has reopened for business with assets of $558,522. H. E. Hanson continues as president of the institution Breckenridge-Pocket gophers have been exterminated in the local cemetery. The pastor of one of the churches invented a method of "gassing" the gopher out of their holes. He took a few feet of ordinary garden hose, attached one end to the exhaust of an auto, inserted packed the other the end earth into