Click image to open full size in new tab

Article Text

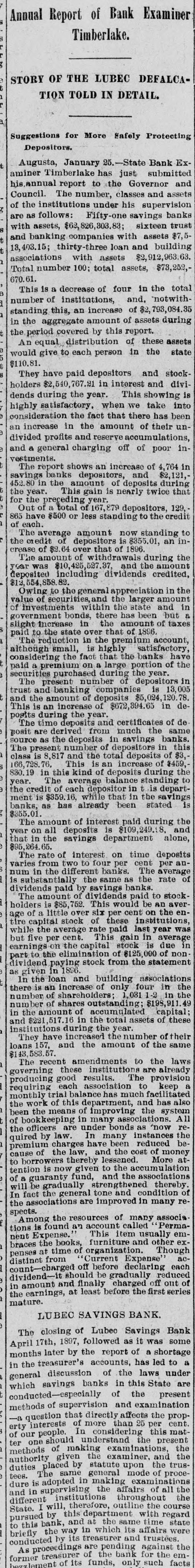

Annual Report of Bank Examiner Timberlake. STORY OF THE LUBEC DEFALCA TION TOLD IN DETAIL. Suggestions for More gafely Protecting Depositors Augusta, January 25 State Bank Ex aminer Timberlake has just submitted his.annual report to the Governor assets and Council. The number, classes and of the institutions under his supervision bank as follows: Fifty-one savings trust are with assets, $62, 826,303.83; sixteen and banking companies with assets $7,5 building 13,403.15; thirty -three loan and $2,912,963.63 associations with assets $73,252, Total number 100; total assets, 670.61. This is a decrease of four in the "notwith- total number of institutions, and, $2,793,084.35 standing this, an increase of during the aggregate amount of assets the in period covered by this report. equal distribution of these assets state would An give to each person in the $110.81. They have paid depositors and stock divi holders $2,540,767.21 in interest and during the year. This showing is dends highly satisfactory. when we take been into consideration the fact that there has un increase in the amount of their divided an profits and reserve accumulations, in and general charging off of poor vestments. report shows an increase of 4,764 in $2,121, The banks deposito and during the savings the amount of deposits that year. 452.80 in This gain is nearly twice for the preceding total of year. 167,879 depositors, 129, 865 Out have of $500 or less standing to the credit of each. amount now standing an in- to the The average credit of depositors is 1896 $355.01, of $2.64 over that of crease amount of withdrawals during amount the The 425, 527.37, and the $1,454,858.82 deposited year was $10 including dividends credited, Owing to the general the appreciation larger amount in the of value investments of securities,and within the has state been and but in & government bonds in there the amount of taxes slight increase state over that of 1896. is paid The to reduction in the highly premium satisfactory, account considering although small, the fact that the portion banks have of the premium on a large the year. paid purchased during depositors securities present number of is 13,005 in trust The and banking companie $5. 1,024,120.78 This is an increase and the amount of deposits of $672,394.65 in deposits time during deposits the year and certificates the of same de as source in positors posit The are derived the deposits from in much savings banks. this The present number and the of total deposits of $459, $3, class is 8,817 This is an increase of the 830.19 166,728 in 76. this kind of balance deposits standing during to year. The average depositor in t is departthe credit of each while that in the savings is banks, ment is as $359. has 16, already been stated $355.01 The amount of interest is $109,249.18 paid during and the year that on in the all savings deposits department alone, $95,264.65. of interest on time deposits The rate from two to four per cent The per an- average varies in the different banks. the rate of num is substantially the savings same as banks The amount be This would dividends paid of by dividends paid to AD stock avera of age of these holders is little $85, 752 over six per cent institutions, on the en tire capital stock rate paid last year was while the average This gain in average but five per cent. the capital stock 000 is due of non in earnings elimination of $125, dividend part to the paying stock from the statement as given in 1896 and building associations in the In the loan an increase of only 1.031 1-2 four in the there is of shareholders $199,911.49 number number of shares outstanding accumulated capital; in the amount of in the total assets of these and $221,517.10 institutions during the the year. number of their loans 157, They have and increase the amount of the same laws $143,583.57 amendments to the The recent these institution The are provision already governing good results. producing requiring each association has much to facilitated keep a monthly trial this balance department, and has system also the work means of of improving lations the All been bookkeepi the in many bonds asso as 'now relaw. of the officers are under In many instances be- the reduced quired premium by charges law, have and been the cost of money at cause of the thereby lessened. accumulation More to borrowe given to the associations tention guaranty is now fund, and the thereby of will be gradually strengthened tone and indition re- of the In fact associations the general are improved in many associaan is found item spects. Among the resources account of called many Perma- emThis usually tions nent Expense. books, furniture and other Though ex braces the organization. penses at time of Current declaring Expense each ac. count - it should count-chargeround distinction from off before be gradually charged off reduced out of mature. the earnings, dividend- in amount and at finally least before the first series LUBEC SAVINGS BANK. closing of Lubec Savings was Bank some The 1897, followed as it shortage months accounts, April 17th, later by the report of has a led to a in the treasurer's discussion of the laws under are general savings banks in this State present which especially of the examination conducted of supervision and the propmethods that directly than affects 25 per cent people. understand erty -& question interests of In more considering the this present matthe of ter our one should of making examiner. examinations, and the the general authority methods placed given by statute upon mode of the proce- trusduties tees. The adopted same in making affairs examinations of all the dure is supervising the throughout the and in institutions therefore outline the course at different State. will, by this depar the ment same with time regard state pursued to this bank way and in which its affairs trustees. were briefly the its treasurer and the conducted by dings are pending for against the emof the bank former As treasurer of its funds, only such facts hezzlement