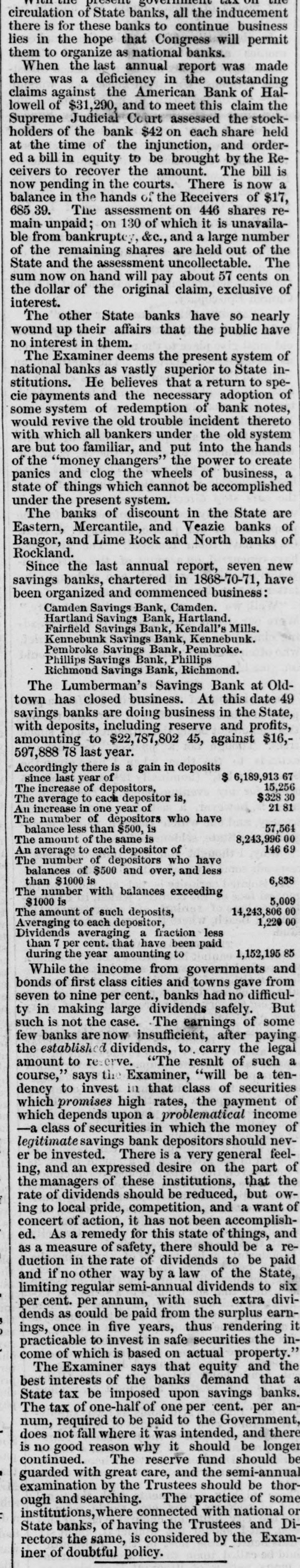

Article Text

DAILY PRESS. PORTLAND. Tuesday Morning, January 4 1870. Banking and Insurance in Maine. REPORT OF THE STATE EXAMINER. The second annual report of Mr. Paine embraces many interesting statements. It appears that only the Eastern, Mercantile and Veazie banks of Bangor and the Lime Rock and North of Rockland, whose charters expire on the 1st of October next, are now doing business under authority of the State. The circulation of State banks now outstanding is $102,262, The receivers of the American Bank, Hallowell, are "getting on," and report that the amount of claims proved is $43,714,26, while the cash assets on hand amount to only $13,457,38. Mr. Paine argues vigorously for the repeal of the existing State banking law. Profoundly impressed with the advantages arising from the National Banking system, he would have State banks deprived of the privilege of issuing currency. The other functions of a bank can be performed by associations of capitalists without much legislative control, a free banking system, having all the powers of banks except that of issuing money, being suggested as a means of their doing so. On this point the report says: The system proposed will serve to supply a want found very generally to exist in different parts of the State from a lack of National Bank facilities for discounts, exchange and to meet resort to imis temporary properly, has been of deposits, had Savings the and Bank procuring charters. which, very It hoped that for this reason, if no other, some such provision will be made as is now suggested. The Examiner finds in the recent decision of the Supreme Court upholding the validity of a national tax on the State bank circulation an additional reason for abandoning the State banks. There is nothing that the people of modern times look upon with more complacency than their savings banks. It was in 1778 that the first one was established in Hamburg, but it was not till 1816 that the institution was naturalized in America. Through the influence of Hon. Wm. Willis the third savings bank on this side of the Atlantic was established in this city. Now there are thirty-seven banks in the State, charters having been granted to those at Brewer, Bridgton, Eastport, Machias, Bangor, Skowhegan, Solon, Waterville and West Waterville during the year. These banks have nearly forty thousand depositors, while the gross deposits amount to nearly eleven million dollars, being an increase of $2,807,000 during the past year and of $5,241,000 during the last two years-very nearly 100 per cent. for the last period. These deposits amount to over a million and a quarter more than the entire banking capital of Maine, State and National. This exhibit will surprise persons who strenuously contend that "the rich are growing richer and the poor poorer," especially if they examine another part of the report, where Mr. Paine, speaking of the impolicy of taxing savings banks and deposits, shows that, from actual examination of deposits of over $1000, it appears that there is "almost an entire exclusion of men of wealth from the list of depositors." The provision of the new Savings Bank law forbidding loans on the security of names alone has met with considerable opposition in some quarters, but its wisdom is generally commended. The report says that there were at the beginning of the year 42 insurance companies doing business under the laws of the State. During the year three small companies have discontinued their business, a course which the Examiner commends to "all small companies having the good of their patrons in view." The following is a statement of the business of foreign companies: The whole number of Foreign Fire and and Fire Mariue Companies Going business in Maine is. 67 in underwritten Number of policies Maine in 1868 27.974 Amount $52,613,758 00 Number of policies outstancing January 1. 1869. 20,501 Amount. $39,452,746 00 $649,002 51 Premiums received during the year Losses paid duriog the year $339,906 72 Racio of losses to premiums, 52 S per et Ratio of losses to risks, 646 per cent. 39 Life Companies doing business in Me.. 10,756 Number of policies January 1, 1869