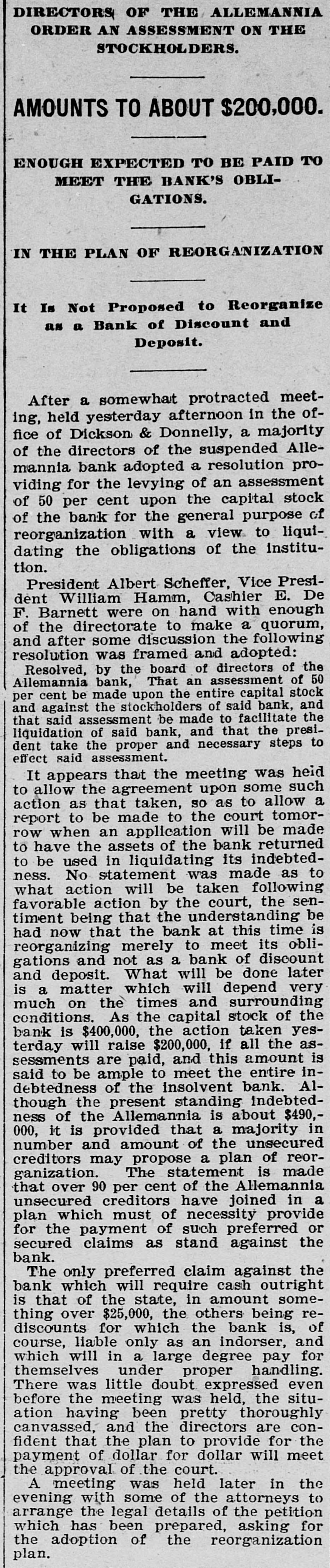

Article Text

sion or for fear of the instability of the banks. In many, if not most instances, the depositors were out of employment and needed their savings. Of course there were some who closed their accounts and put their money in safety deposit vaults and other places for safe keeping. The usual effort to withdraw in gold was resisted by the banks and most of the money is now coming back to us in rolls of bills that the depositors have had hoarded in secret places since its withdrawal. Less than $60,000 was withdrawn in this way during the past four months. Most of It has returned, the balance will sooner or later, and we are opening new accounts with new depositors hourly. There are many who are holding back until they are quite certain that the election of McKinley means a stable money market, and then they will come in again, also. The future is bright with the prospect of a business revival." "Eastern capital is already seeking investment in Minnesota," said C. W. Eberlein, secretary of the St. Paul Trust company, "and the election of Gov. Clough means as much to the people of Minnesota as the election of McKinley to the nation. The money lenders of the East have had experience with the Populist states of the West and they are shy of placing their money in such states. If Minnesota had been so unfortunate as to be under the reign of a Populist governor, I doubt if the Eastern men could have been persuaded to send their money here. As it is, they are offering it freely. There will be plenty of money offered now to move the crops and that is the basis of our business in this country. The good effects of the election will be felt in every channel of trade within a short time. I have had little opportunity to judge whether there was much hoarding or withdrawals from the banks, but I do know. that while there was plenty of money, none could be borrowed while the uncertainty concerning the financial policy of the nation existed. Now there is no more money, but there is a freedom of movement and willingness to invest. There is already noticeable in the business of this company a more prompt payment of interest, and rents and other accounts that have been neglected during the past four months. There is no question but that the tide has already turned and that good times will follow on the heels of the general feeling of confidence." One banker cited as an instance of the general feeling that the election of McKinley would have a beneficial effect on the money market, the fact that a customer of the bank, who had $20,000 in gold on deposit, loaned half the amount the day after election, before even the official figures had been hinted at. "McKinley's elected, and that's all I want to know," said the man with the $20,000 and he was given the sum he wanted to loan, which went at once into the grain business of the Northwest. This man was but a single instance of the many whom the bankers cite as evidence that only confidence in the stability of the money system was needed to restore that measure of confidence that insures success in business circles. Some men, large holders of ready capital, too, were anxious to secure their deposits from the banks in gold. This was denied them, as the bankers knew that the men had no place to lend money, but sought to withdraw It simply for the purpose of placing it in safety deposit vaults. Frustrated in their designs some of the depositors bought drafts and in this way secured their gold from the subtreasuries. But all that money is finding its way back into the banks and will soon be oiling the wheels of commerce. President Albert Scheffer, of the Allemannia bank, said that as the result of the financial agitation, business had been practically at a standstill during