Article Text

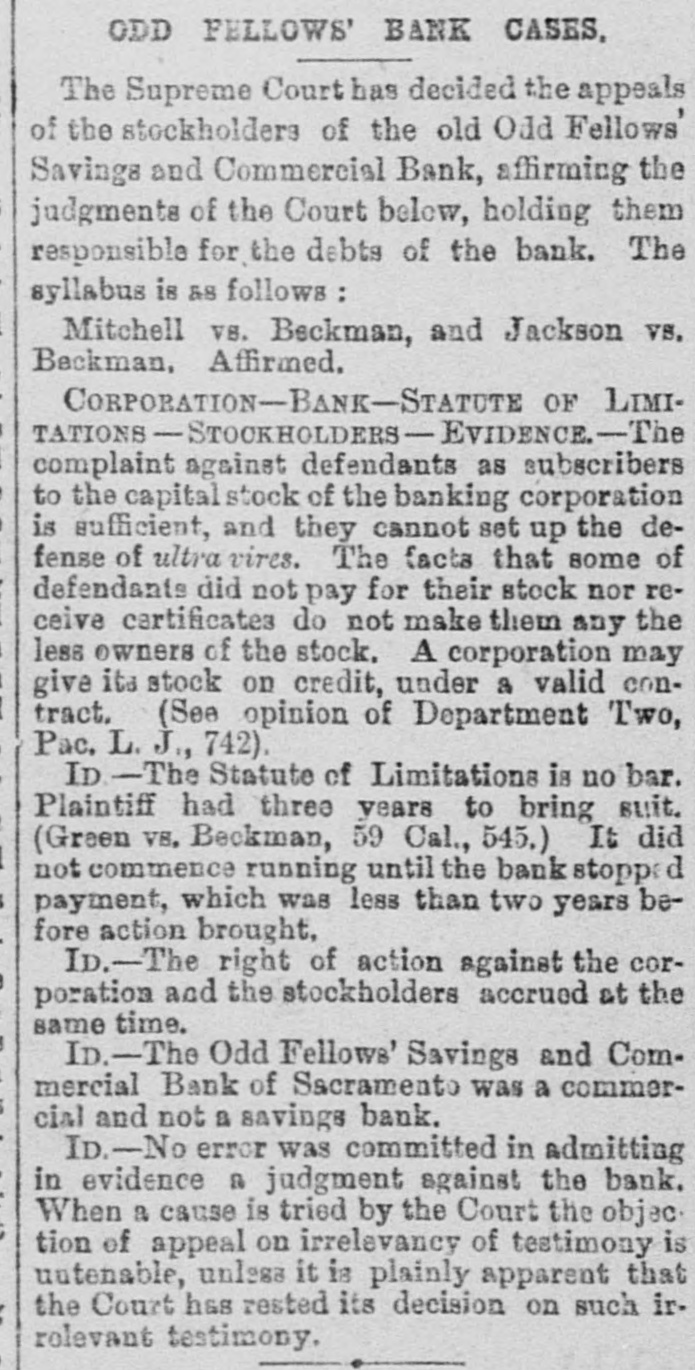

# ODD FELLOWS' BANK CASES, The Supreme Court has decided the appeals of the stockholders of the old Odd Fellows' Savings and Commercial Bank, affirming the judgments of the Court below, holding them responsible for the debts of the bank. The syllabus is as follows: Mitchell vs. Beckman, and Jackson vs. Beckman, Affirmed. CORPORATION-BANK-STATUTE OF LIMI-TATIONS-STOCKHOLDERS-EVIDENCE.-The complaint against defendants as subscribers to the capital stock of the banking corporation is sufficient, and they cannot set up the defense of ultra vires. The facts that some of defendants did not pay for their stock nor receive certificates do not make them any the less owners of the stock. A corporation may give its stock on credit, under a valid contract. (See opinion of Department Two, Pac. L. J., 742). ID.-The Statute of Limitations is no bar. Plaintiff had three years to bring suit. (Green vs. Beckman, 59 Cal., 545.) It did not commence running until the bank stopped payment, which was less than two years before action brought. ID.-The right of action against the corporation and the stockholders accrued at the same time. ID.-The Odd Fellows' Savings and Commercial Bank of Sacramento was a commercial and not a savings bank. ID.-No error was committed in admitting in evidence a judgment against the bank. When a cause is tried by the Court the objection of appeal on irrelevancy of testimony is untenable, unless it is plainly apparent that the Court has rested its decision on such irrelevant testimony.