Article Text

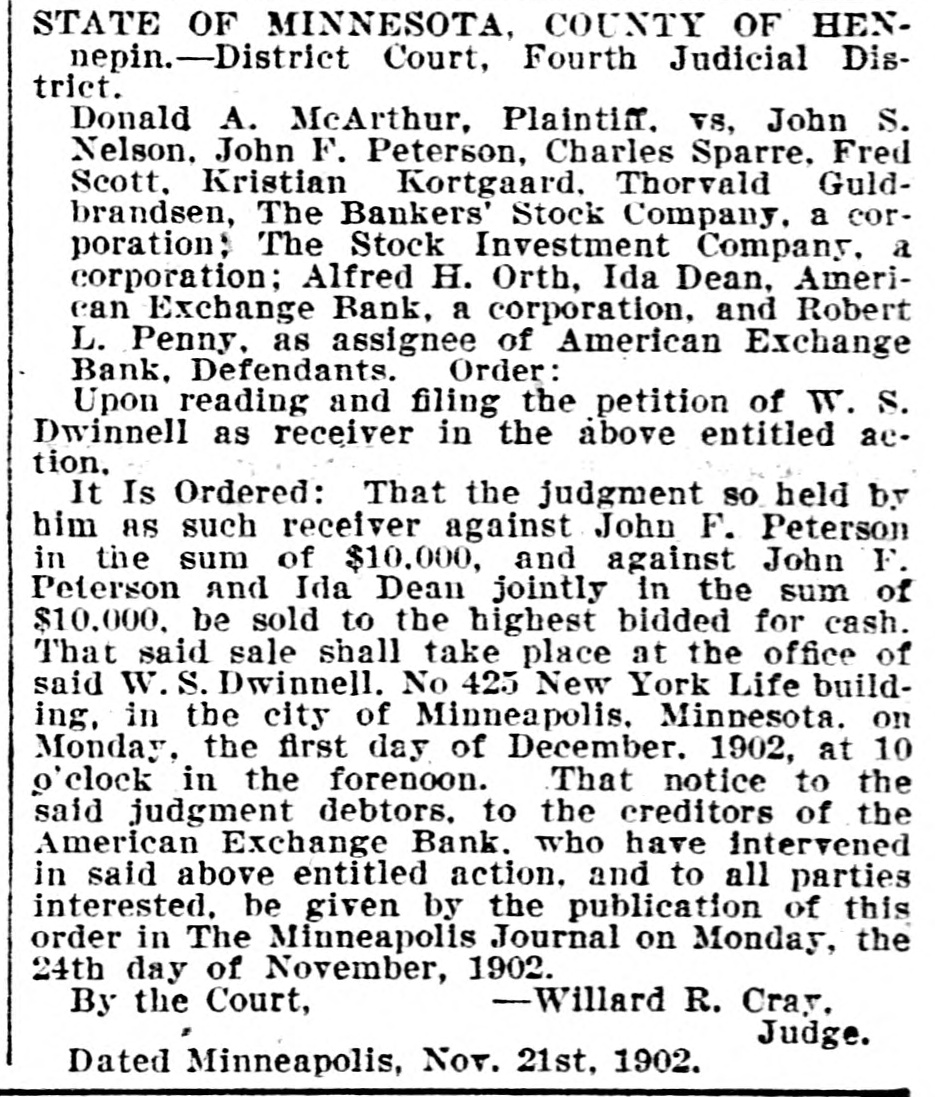

STATE OF MINNESOTA, COUNTY OF HENnepin.-District Court, Fourth Judicial District. Donald A. McArthur, Plaintiff. vs, John S. Nelson. John F. Peterson, Charles Sparre, Fred Scott. Kristian Kortgaard. Thorvald Guldbrandsen, The Bankers' Stock Company. a corporation; The Stock Investment Company. a corporation; Alfred H. Orth, Ida Dean. American Exchange Bank, a corporation, and Robert L. Penny. as assignee of American Exchange Bank, Defendants. Order: Upon reading and filing the petition of W. S. Dwinnell as receiver in the above entitled action. It Is Ordered: That the judgment so held by him as such receiver against John F. Peterson in the sum of $10,000, and against John F. Peterson and Ida Dean jointly in the sum of $10.000, be sold to the highest bidded for cash. That said sale shall take place at the office of said W. S. Dwinnell. No 425 New York Life building, in the city of Minneapolis. Minnesota. on Monday. the first day of December. 1902, at 10 o'clock in the forenoon. That notice to the said judgment debtors. to the creditors of the American Exchange Bank. who have intervened in said above entitled action. and to all parties interested, be given by the publication of this order in The Minneapolis Journal on Monday, the 24th day of November, 1902. -Willard R. Cray. By the Court, Judge. Dated Minneapolis, Nov. 21st, 1902.