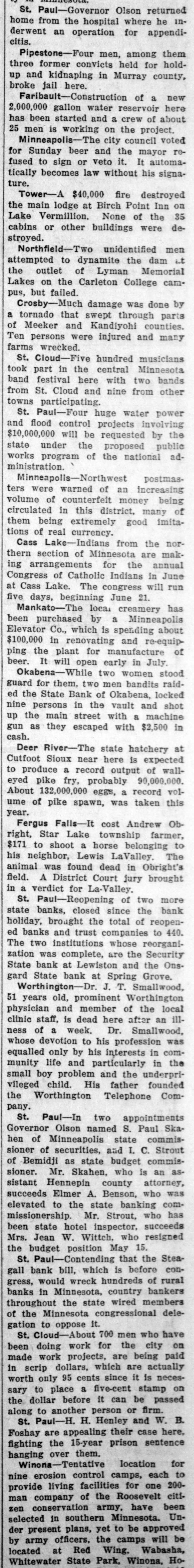

Article Text

St. Paul-Governor Olson returned home from the hospital where he inderwent an operation for appendicitis. Pipestone-Four men, among them three former convicts held for holdup and kidnaping in Murray county, broke jail here. Faribault-Construction of a new 2,000,000 gallon water reservoir here has been started and a crew of about 25 men is working on the project. Minneapolis-The city council voted for Sunday beer and the mayor refused to sign or veto it. It automatically becomes law without his signature. Tower-A $40,000 fire destroyed the main lodge at Birch Point Inn on Lake Vermillion. None of the 35 cabins or other buildings were destroyed. Northfield-Two unidentified men attempted to dynamite the dam at the outlet of Lyman Memorial Lakes on the Carleton College campus, but failed. Crosby-Much damage was done by a tornado that swept through parts of Meeker and Kandiyohi counties. Ten persons were injured and many farms wrecked. St. Cloud-Five hundred musicians took part in the central Minnesota band festival here with two bands from St. Cloud and nine from other towns participating. St. Paul-Four huge water power and flood control projects involving $10,000,000 will be requested by the state under the proposed public works program of the national administration. Minneapolis-Northwest postmasters were warned of an increasing volume of counterfeit money being circulated in this district, many of them being extremely good imitations of real currency. Cass Lake-Indians from the northern section of Minnesota are making arrangements for the annual Congress of Catholic Indians in June at Cass Lake. The congress will run five days, beginning June 21. Mankato-The local creamery has been purchased by a Minneapolis Elevator Co., which is spending about $100,000 in renovating and re-equipping the plant for manufacture of beer. It will open early in July. Okabena-While two women stood guard for them, two men bandits raided the State Bank of Okabena, locked nine persons in the vault and shot up the main street with a machine gun as they escaped with $2,500 in cash. Deer River-The state hatchery at Cutfoot Sioux near here is expected to produce a record output of walleyed pike fry, probably 90,000,000. About 132,000,000 eggs, a record volume of pike spawn, was taken this year. Fergus Falls-It cost Andrew Obright, Star Lake township farmer, $171 to shoot a horse belonging to his neighbor, Lewis LaValley. The animal was found dead in Obright's field. A District Court jury brought in a verdict for La-Valley. St. Paul-Reopening of two more state banks, closed since the bank holiday, brought the total of reopened banks and trust companies to 440. The two institutions whose reorganization was complete, are the Security State bank at Lewiston and the Onsgard State bank at Spring Grove. Worthington-Dr. J. T. Smallwood, 51 years old, prominent Worthington physician and member of the local clinic staff, is dead here after an illness of a week. Dr. Smallwood, whose devotion to his profession was equalled only by his interests in community life and particularly in the small boy problem and the underprivileged child. His father founded the Worthington Telephone Company. St. Paul-In two appointments Governor Olson named S. Paul Skahen of Minneapolis state commissioner of securities, and I. C. Strout of Bemidji as state budget commissioner. Mr. Skahen, who is an assistant Hennepin county attorney, succeeds Elmer A. Benson, who was elevated to the state banking commissionership. Mr. Strout, who has been state hotel inspector, succeeds Mrs. Jean W. Wittch, who resigned the budget position May 15. St. Paul-Contending that the Steagall bank bill, which is before congress, would wreck hundreds of rural banks in Minnesota, country bankers throughout the state wired members of the Minnesota congressional delegation to oppose it. St. Cloud-About 700 men who have been doing work for the city on made work projects, are being paid in scrip dollars, which are actually worth only 95 cents since it is necessary to place a five-cent stamp on the dollar before it can be passed along to another person or firm. St. Paul-H. H. Henley and W. B. Foshay are appealing their case here. fighting the 15-year prison sentence hanging over them. Winona-Tentative location for nine erosion control camps, each to provide living facilities for one 200man company of the Roosevelt citizen conservation army, have been selected in southern Minnesota. Under present plans, yet to be approved by army officers, the camps will be located at Red Wing, Wabasha, Whitewater State Park, Winona, Ho-