Article Text

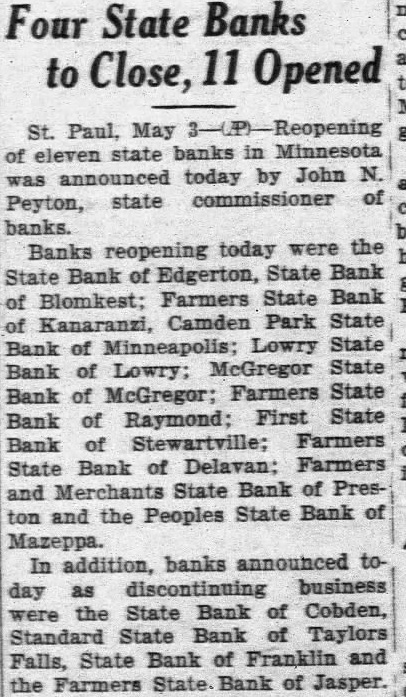

Four State Banks to Close, Opened St. Paul, May of eleven state banks in Minnesota announced today by John state commissioner Peyton, banks. today were the Banks reopening of State Bank State Bank Edgerton, Farmers State Bank of Camden Park State Kanaranzi, of Lowry State Bank of Lowry; McGregor State Bank Farmers State Bank of McGregor; Raymond; First State Bank of Bank of Stewartville; Farmers Bank of Delavan: Farmers State and State Bank of Presthe Peoples State Bank of ton and Mazeppa. In addition, banks announced todiscontinuing business day as were the State Bank of Cobden, Standard State Bank of Taylors Bank of Franklin and Falls, State the Farmers State Bank of Jasper.