Article Text

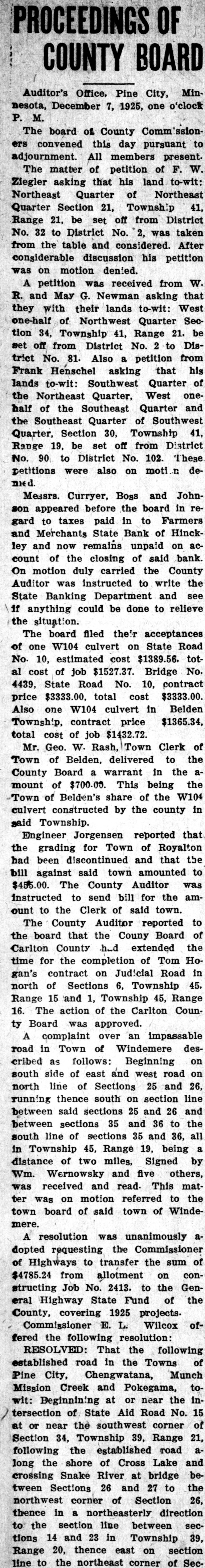

PROCEEDINGS OF COUNTY BOARD Auditor's Office, Pine City, Minnesota, December 7, 1925, one o'clock P. M. The board of County Commissioners convened this day pursuant to adjournment. All members present. The matter of petition of F. W. Ziegler asking that his land to-wit: Northeast Quarter of Northeast Quarter Section 21, Township 41, Range 21, be set off from District No. 32 to District No. 2, was taken from the table and considered. After considerable discussion his petition was on motion denied. A petition was received from W. R. and May G. Newman asking that they with their lands to-wit: West one-half of Northwest Quarter Section 34, Township 41, Range 21. be set off from District No. 2 to District No. 81. Also a petition from Frank Henschel asking that his lands to-wit: Southwest Quarter of the Northeast Quarter, West onehalf of the Southeast Quarter and the Southeast Quarter of Southwest Quarter, Section 30, Township 41, Range 19, be set off from District No. 90 to District No. 102. These petitions were also on motion demed. Messrs. Curryer, Boss and Johnson appeared before the board in regard to taxes paid in to Farmers and Merchants State Bank of Hinckley and now remains unpaid on account of the closing of said bank. On motion duly carried the County Auditor was instructed to write the State Banking Department and see if anything could be done to relieve the situation. The board filed their acceptances of one W104 culvert on State Road No. 10, estimated cost $1389.56. total cost of job $1527.37. Bridge No. 4439, State Road No. 10, contract price $3333.00, total cost $3333.00. Also one W104 culvert in Belden Township, contract price $1365.34, total cost of job $1432.72. Mr. Geo. W. Rash, Town Clerk of Town of Belden, delivered to the County Board a warrant in the amount of $700.00. This being the Town of Belden's share of the W104 culvert constructed by the county in said Township. Engineer Jorgensen reported that the grading for Town of Royalton had been discontinued and that the bill against said town amounted to $455.00. The County Auditor was instructed to send bill for the amount to the Clerk of said town. The County Auditor reported to the board that the Couny Board of Carlton County had extended the time for the completion of Tom Hogan's contract on Judicial Road in north of Sections 6, Township 45. Range 15 and 1, Township 45, Range 16. The action of the Carlton County Board was approved. A complaint over an impassable road in Town of Windemere described as follows: Beginning on south side of east and west road on north line of Sections 25 and 26, running thence south on section line between said sections 25 and 26 and between sections 35 and 36 to the south line of sections 35 and 36, all in Township 45, Range 19, being a distance of two miles, Signed by Wm. Wernowsky and five others, was received and read. This matter was on motion referred to the town board of said town of Windemere. A resolution was unanimously adopted requesting the Commissioner of Highways to transfer the sum of $4785.24 from allotment on constructing Job No. 2413. to the General Highway State Fund of the County, covering 1925 projects. Commissioner E. L. Wilcox offered the following resolution: RESOLVED: That the following established road in the Towns of Pine City, Chengwatana, Munch Mission Creek and Pokegama, towit: Beginnining at or near the intersection of State Aid Road No. 15 at or near the southwest corner of Section 34, Township 39, Range 21, following the established road along the shore of Cross Lake and crossing Snake River at bridge between Sections 26 and 27 to the northwest corner of Section 26, thence in a northeasterly direction to the section line between sections 14 and 23 in Township 39,