Article Text

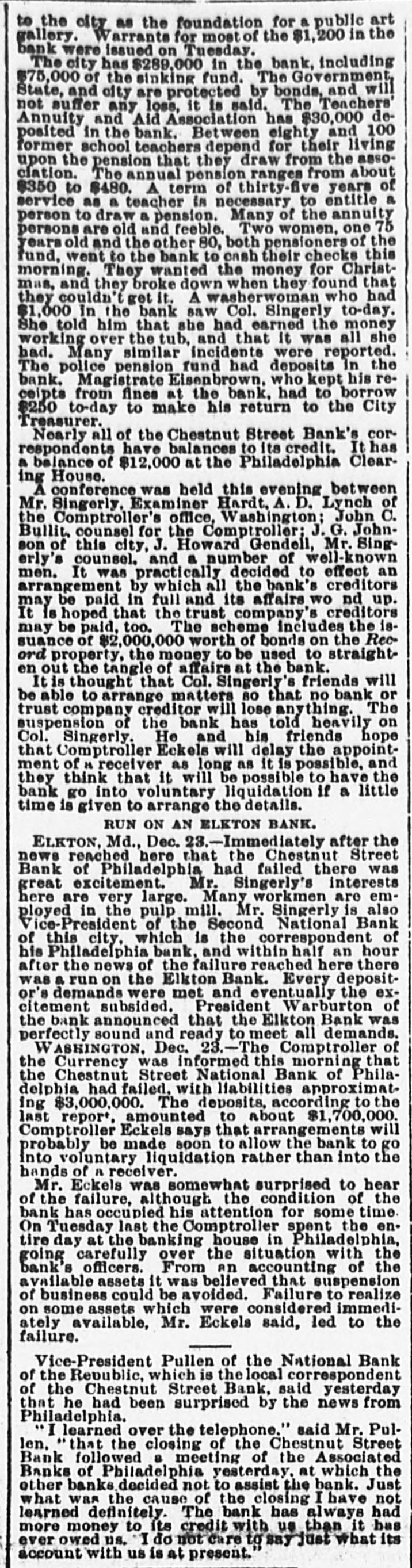

to the city as the foundation for a public art gallery. Warrants for most of the $1,200 in the bank were issued on Tuesday. The city has $289,000 in the bank, including $75,000 of the sinking fund. The Government, State, and city are protected by bonds, and will not suffer any loss, it is said. The Teachers' Annuity and Aid Association has $30,000 deposited in the bank. Between eighty and 100 former school teachers depend for their living upon the pension that they draw from the assoclation. The annual pension ranges from about 8350 to $480. A term of thirty-five years of service as a teacher in necessary to entitle a person to draw a pension. Many of the annuity persons are old and feeble. Two women. one 75 years old and the other 80, both pensioners of the fund, went to the bank to cash their checks this morning. They wanted the money for Christmas, and they broke down when they found that they couldn't get it. A washerwoman who had $1,000 In the bank saw Col. Singerly to-day. She told him that she had earned the money working over the tub, and that it was all she had. Many similar incidents were reported. The police pension fund had deposits In the bank. Magistrate Eisenbrown, who kept his receipts from fines at the bank, had to borrow $250 to-day to make his return to the City Treasurer. Nearly all of the Chestnut Street Bank's correspondents have balances to its credit. It has a balance of $12,000 at the Philadelphia Clearing House. A conference was held this evening between Mr. Singerly. Examiner Hardt. A. D. Lynch of the Comptroller's office, Washington; John C. Bullit, counsel for the Comptroller; J. G. Johnson of this city, J. Howard Gendell, Mr. Singerly's counsel. and a number of well-known men. It was practically decided to effect an arrangement by which all the bank's creditors may be paid in full and its affairs wo nd up. It is hoped that the trust company's creditors may be paid, too. The scheme includes the issuance of $2,000,000 worth of bonds on the Record property, the money to be used to straighten out the tangle of affairs at the bank. It is thought that Col. Singerly's friends will be able to arrange matters 80 that no bank or trust company creditor will lose anything. The suspension of the bank has told heavily on Col. Singerly. He and his friends hope that Comptroller Eckels will delay the appointment of is receiver as long as it is possible, and they think that it will be possible to have the bank go into voluntary liquidation if a little time is given to arrange the details. RUN ON AN ELETON BANK. ELKTON, Md., Dec. 23.-Immediately after the news reached here that the Chestnut Street Bank of Philadelphia had failed there was great excitement. Mr. Singerly's interests here are very large. Many workmen are employed in the pulp mill. Mr. Singerly is also Vice-President of the Second National Bank of this city, which is the correspondent of his Philadelphia bank, and within half an hour after the news of the failure reached here there was a run on the Elkton Bank. Every depositor's demands were met and eventually the excitement subsided. President Warburton of the bank announced that the Elkton Bank was perfectly sound and ready to meet all demands. VASHINGTON, Dec. 23.-The Comptroller of the Currency was informed this morning that the Chestnut Street National Bank of Philadelphia had failed. with liabilities approximating $3,000,000. The deposits, according to the last report, amounted to about $1,700,000. Comptroller Eckels says that arrangements will probably be made soon to allow the bank to go into voluntary liquidation rather than into the hands of a receiver. Mr. Eckels was somewhat surprised to hear of the failure, although the condition of the bank has occupied his attention for some time. On Tuesday last the Comptroller spent the entire day at the banking house in Philadelphia, going carefully over the situation with the bank's officers. From an accounting of the available assets it was believed that suspension of business could be avoided. Failure to realize on some assets which were considered immediately available, Mr. Eckels said, led to the failure. Vice-President Pullen of the National Bank of the Republic, which is the local correspondent of the Chestnut Street Bank, said yesterday that he had been surprised by the news from Philadelphia. "I learned over the telephone." said Mr. Pullen. that the closing of the Chestnut Street Bank followed a meeting of the Associated Banks of Philadelphia yesterday. at which the other banks decided not to assist the bank. Just what was the cause of the closing I have not learned definitely. The bank has always had more money to its credit with us than it has ever owed us. I do not care to say just what its account with us is at present.