Article Text

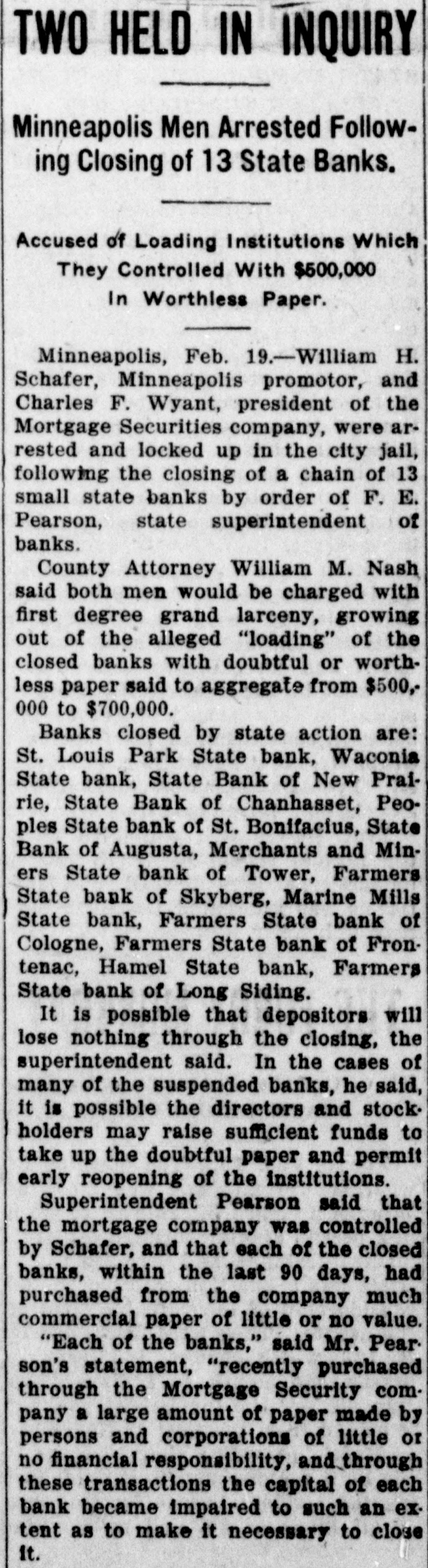

TWO HELD IN INQUIRY Minneapolis Men Arrested Following Closing of 13 State Banks. Accused of Loading Institutions Which They Controlled With $500,000 In Worthless Paper. Minneapolis, Feb. 19.-William H. Schafer, Minneapolis promotor, and Charles F. Wyant, president of the Mortgage Securities company, were arrested and locked up in the city jail, following the closing of a chain of 13 small state banks by order of F. E. Pearson, state superintendent of banks. County Attorney William M. Nash said both men would be charged with first degree grand larceny, growing out of the alleged "loading" of the closed banks with doubtful or worthless paper said to aggregate from $500,000 to $700,000. Banks closed by state action are: St. Louis Park State bank, Waconia State bank, State Bank of New Prairie, State Bank of Chanhasset, Peoples State bank of St. Bonifacius, State Bank of Augusta, Merchants and Miners State bank of Tower, Farmers State bank of Skyberg, Marine Mills State bank, Farmers State bank of Cologne, Farmers State bank of Frontenac, Hamel State bank, Farmers State bank of Long Siding. It is possible that depositors will lose nothing through the closing, the superintendent said. In the cases of many of the suspended banks, he said, it is possible the directors and stock. holders may raise sufficient funds to take up the doubtful paper and permit early reopening of the institutions. Superintendent Pearson said that the mortgage company was controlled by Schafer, and that each of the closed banks, within the last 90 days, had purchased from the company much commercial paper of little or no value. "Each of the banks," said Mr. Pear son's statement, "recently purchased through the Mortgage Security company a large amount of paper made by persons and corporations of little or no financial responsibility, and through these transactions the capital of each bank became impaired to such an extent as to make it necessary to close it.