Click image to open full size in new tab

Article Text

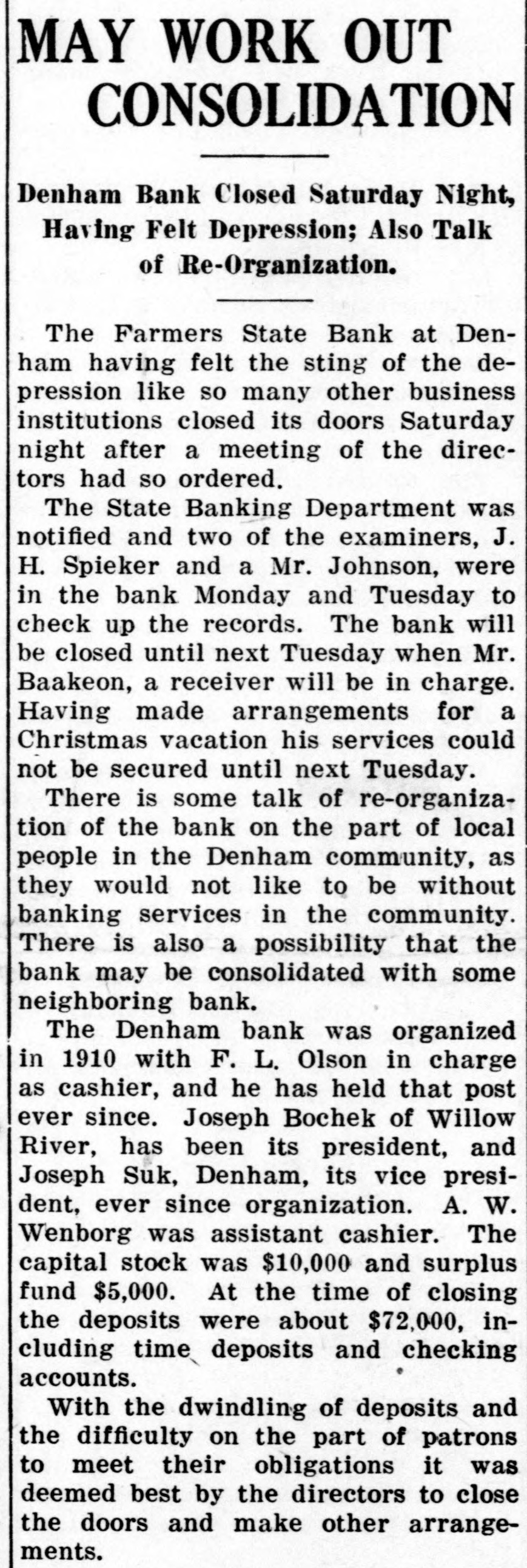

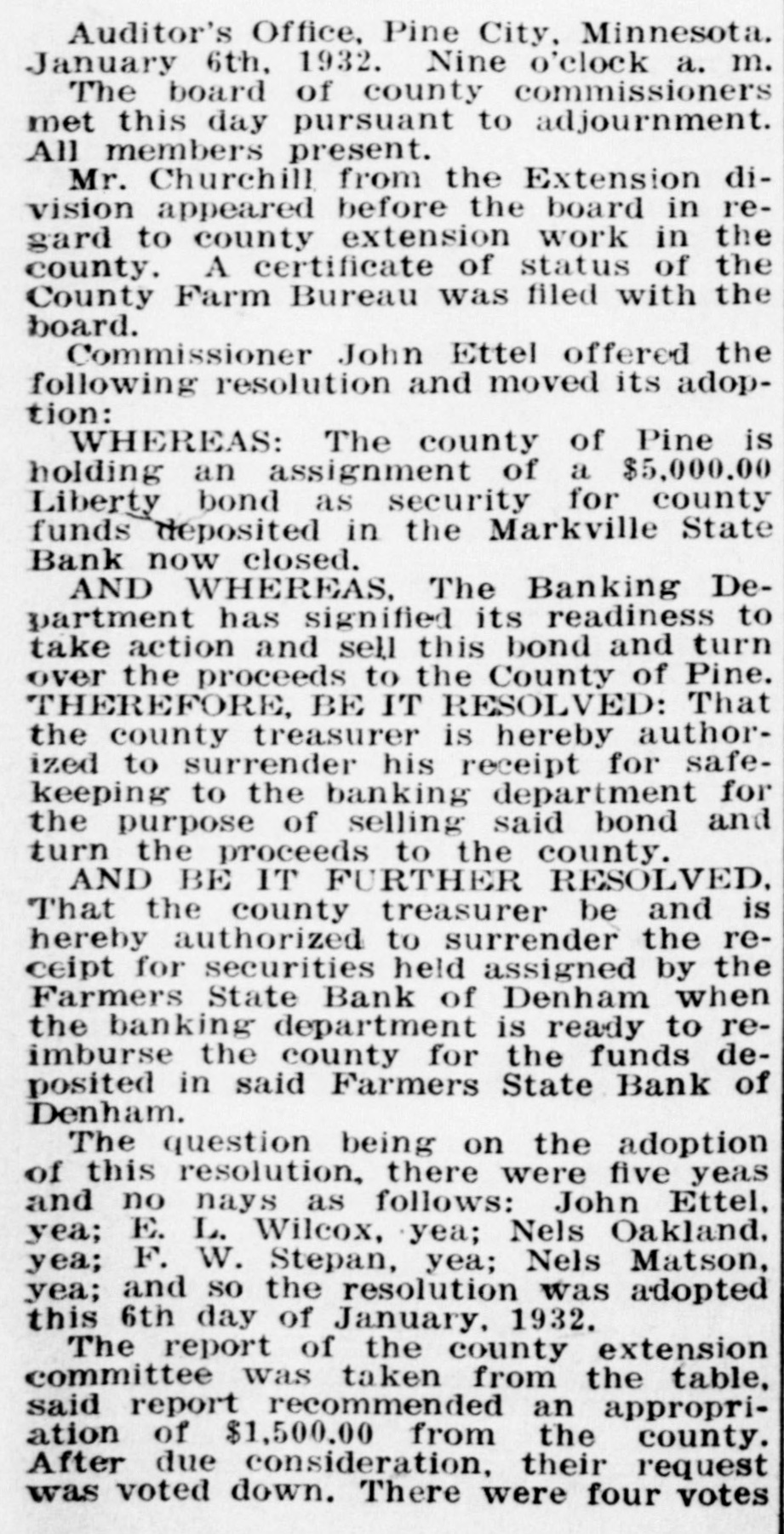

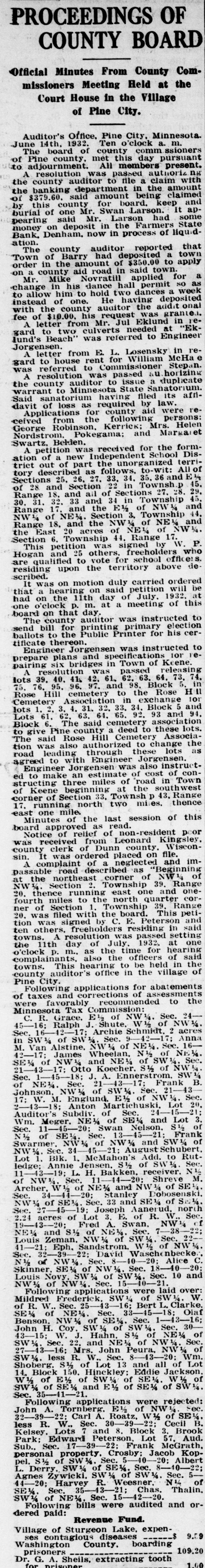

PROCEEDINGS OF COUNTY BOARD Official Minutes From County Commissioners Meeting Held at the Court House in the Village of Pine City. Auditor's Office, Pine City, Minnesota. June 14th, 1932. Ten 'clock a. m. The board of county comm ssioners of Pine county, met this day pursuant to adjournment. All members present. A resolution was passed authoriz ng the county auditor to file a claim with the banking department in the amount of $379.60. said amount being claimed by this county for board. keep and burial of one Mr. Swan Larson. It appearing said Mr. Larson had some money on deposit in the Farmers State Bank, Denham. now in process of liquidation. The county auditor reported that Town of Barry had deposited a town order in the amount of $350.00 to apply on a county aid road in said town. Mr. Mike Novratill applied for a change in his dance hall permit so as to allow him to hold two dances a week instead of one. He having deposited with the county auditor the addit onal fee of $10.00, his request was grante.i. A letter from Mr. Jul Eklund in regard to two culverts needed at "Eklund's Beach" was referred to Engineer Jorgensen. A letter from E. L. Losensky in regard to house rent for William McHa e was referred to Commissioner Stepan. A resolution was passed au horizing the county auditor to issue a duplicate warrant to Minnesota State Sanatorium. Said sanatorium having filed its affidavit of loss as required by law. Applications for county aid were rereived from the following persons: George Robinson, Kerrick; Mrs. Helen Nordstrom. Pokegama; and Margaret Swartz. Belden. A petition was received for the formation of a new Independent School District out of part the unorganized territory described as follows. to-wit: All of Sections 25. 26, 27. 33, 34. 35. 36 and E1/4 of 28 and Section 22 in Townsh D 45. Range 18, and all of Sections 27. 28. 29. 30. 31. 32. 33 and 34 in Township 45. Range 17, and the E½ of NW1 and NW14 of NE%. Section 3, Township 44. Range 18, and the NW of NE% and the East 20 acres of NE14 of NW 4. Section 6. Township 44. Range 17. P This petition was signed by W. Hogan and 25 others. freeholders who are qualified to vote for school officer residing upon the territory above de scribed. It was on motion duly carried ordered that a hearing on said petition will be had on the 11th day of July. 1932, at one o'clock p. m. at a meeting of this board on that day. The county auditor was instructed to send bill for printing primary election ballots to the Public Printer for his certificate thereon. Engineer Jorgensen was instructed to prepare plans and specifications for repairing six bridges in Town of Keene. A resolution was passed releasing lots 39, 40. 41. 42. 61, 62. 63, 64. 73. 74. 75 76. 95. 96. 97. and 98, Block 5, in Rose Hill cemetery to the Rose H 11 Cemetery Association in exchange 101 lots 1, 2, 3, 4. 31. 32, 33, 34, Block 5 and Lots 61, 62, 63. 64, 65. 92. 93 and 94, Block 6. The said cemetery association to give Pine county a deed to these lots. The said Rose Hill Cemetery Association was also authorized to change the road leading through these lots as agreed to with Engineer Jorgensen. Engineer Jorgensen was also instructed to make an estimate of cost of constructing three miles of road in Town of Keene beginning at the southwest corner of Section 33, Townsh P 43, Range 17. running north two miles. thence east one mile. Minutes of the last session of this board approved as read. Notice of relief of non-resident poor was received from Leonard Kingsley, county clerk of Dunn county Wiscon sin. It was ordered placed on file. A complaint of a neglected and impassable road described as 'Beginning at the northeast corner of NW14 of NW 1/4 Section 2. Township 39. Range 20. thence running east one and onefourth miles to the north quarter corner of Section 1. Township 39. Range 20. was filed with the board. This petition was signed by C. E. Peterson and ten others, freeholders residing in said towns. A resolution was passed setting the 11th day of July 1932, at one o'clock p. m., as the time for hearing complainants also the officers of said towns. This hearing to be held in the county auditor's office in the village of Pine City. Following applications for abatements of taxes and corrections of assessments were favorably recommended to the Minnesota Tax Commission: C. R. Grace, E½ of NW Sec. 2445-16; Ralph J. Shute, W½ of NW 1/4 Sec. 42-17; Archie Schmidt. 2 acres in SW½ of SW Sec. 9-42-17; Anna M. Van Alstine, NW14 of NE1/4 Sec. 1642-17; James Wheelan, N½ of NE1/4 1/4 SE% of NW and NE½ of SW1 Sec. Otto Koecher. S½ of NW14 1/4 Sec. 18; J. A. Ennerstrom. SW 1/4 of NE1/4 Sec. 21 Frank B. Johnson, NW1/4 of SW½ Sec 21-43 17: W. M. Englund. E½ of NW14 Sec. 2-43-18; Anton Martichuski, Lot 20, Auditor's Subdiv. of Sec. 15-21 Wm. Meger. NE1/4 of SE1/4 and Lot 3. Sec. 11-45-20; Swan Nelson. S½ of N½ of SE%. Sec. 45-21; Frank Swarmer NW½ of NW 1/4 and SW of NW1/4 Sec. 34 45-21; August Schubert, Lot Blk. 1. McMahon's Add. to Rutledge; Annie Jensen, S½ of SW½ Sec. 11-43-19; L. H. Bakken. receiver. N½ of NW1/4 Sec. 11 -44-20; Shreve M. Archer W½ of NE1/4 and NW 1/4 of SE Sec. 34-44-20; Stanley Dobosenski. NW½ of SE14 Sec. 33 and SE½ of SE%. Sec. Joseph Aanerud, north 2.24 acres of Lot 3. E. of R. W. Sec 19-43-20; Fred A. Swan. NW14 NE1/4 and S½ of NE% Sec. 38 Louis Zeman, NW½ of SW 1/4 Sec. 22-41-21; Eph. Sandstrom. W½ of NW1/4 Sec. 32-39- 22; David Waschenbecke N½ of NW1/4 Sec. 40 Alice C. Skinner, SE1/4 of NW Sec. 18-40 Louis Novy SW 1/4 of SW 1/4. Sec. 10 and NW½ of NW Sec. 15-40-21. Following applications were laid over: Mildred Frederick. SW 1/4 of SW 1/4 W of R. W. Sec. 25 43 Bert L. Clarke. SE 1/4 of NE1/4 Sec. 33 18; Olaf Benson, NW 1/4 of SE14 Sec. 1-43-16; John H. Coy. SW 1/4 of SW 1/4, Sec. 3043-15; W. J. Hahn, S½ of NE½ of SW Sec. 22, and NE 1/4 of NW½ Sec. Mrs. John Peura, NW 1/4 of SW 1/4 less R. W., Sec. 8-43- Wm. Shoberg. S½ of Lot 13 and all of Lot 14. Block 150. Hinckley: Eddie Jackson. W½ of E½ of SW 1/4 of SE 1/4 W½ of SW 1/4 of SE 1/4 and E½ of SE 1/4 of SW14. Sec. 35-41-21. Following applications were rejected: John A. Tornberg. E½ of NW Fec. 32-39-22; Carl A. Roatz, W½ of SE%. less R. W., Sec. 39 Cecil B. Kelsey, Lots 7 and 8. Block 3. Brook