Article Text

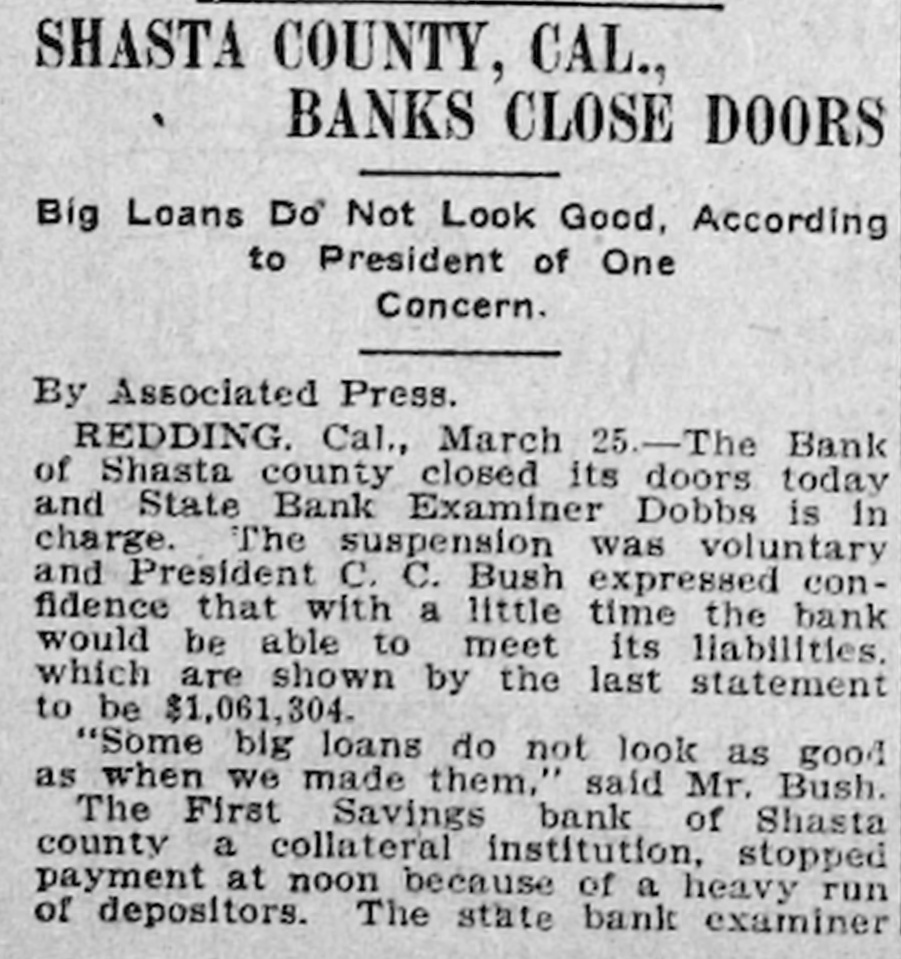

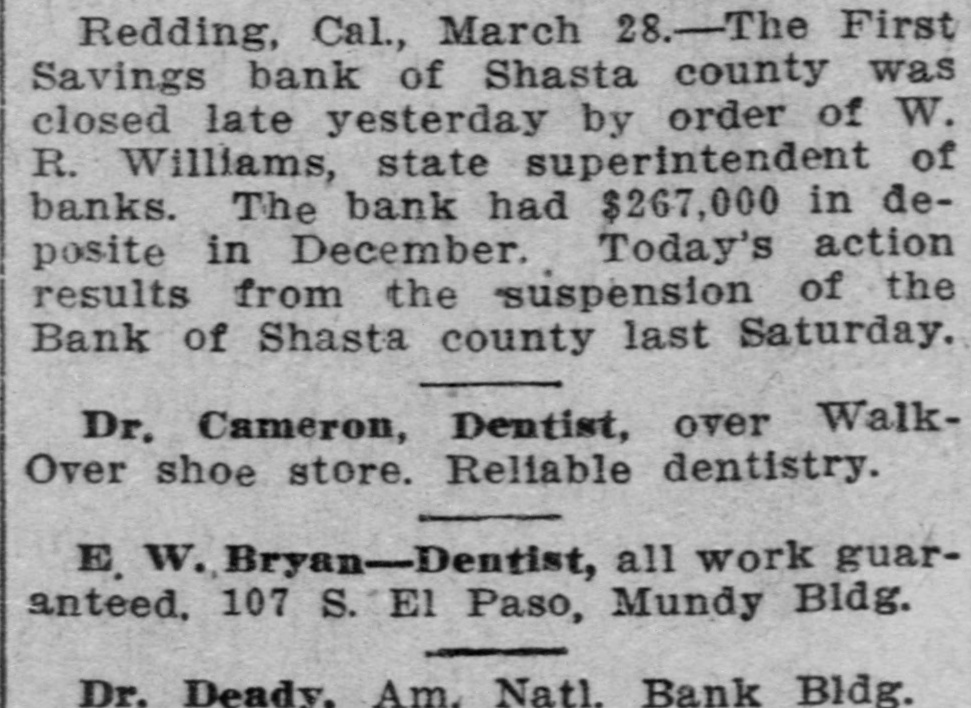

SHASTA COUNTY, CAL., BANKS CLOSE DOORS Big Loans Do Not Look Good, According to President of One Concern. By Associated Press. REDDING. Cal., March 25.-The Bank of Shasta county closed its doors today and State Bank Examiner Dobbs is in charge. The suspension was voluntary and President C. C. Bush expressed confidence that with a little time the bank would be able to meet its liabilities. which are shown by the last statement to be $1,061,304. "Some big loans do not look as good as when we made them." said Mr. Bush. The First Savings bank of Shasta county a collateral institution, stopped payment at noon because of a heavy run of depositors. The state bank examiner