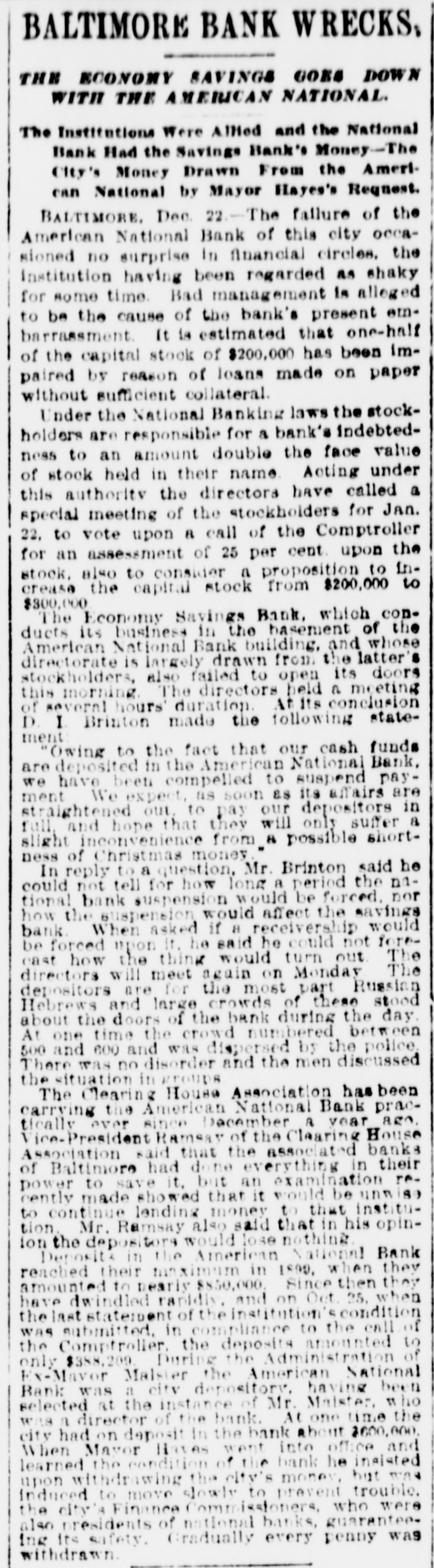

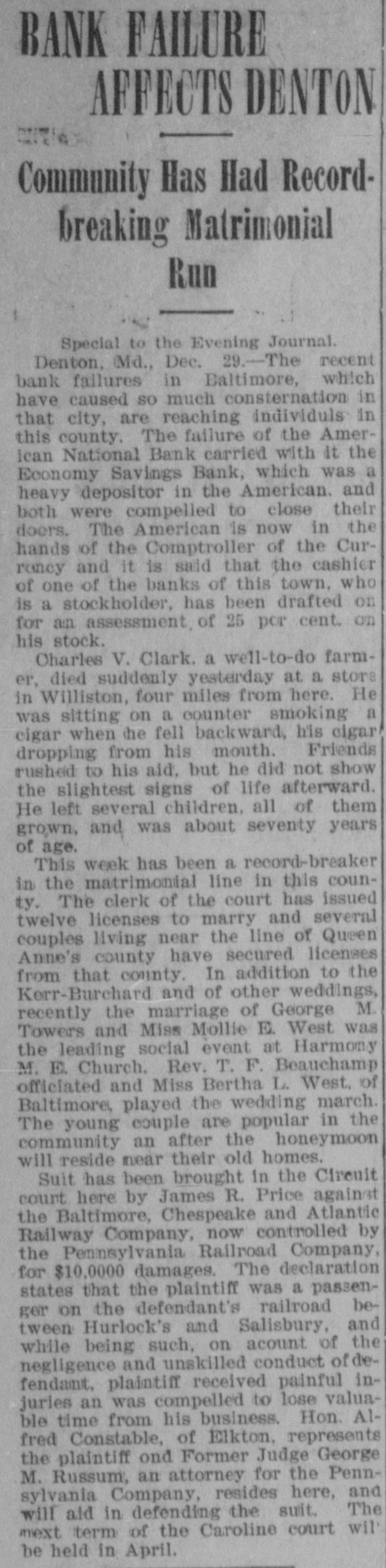

Article Text

THE BALTIMORE BANKS. Economy Savings Bank Also Closed Its Doors Yesterday. Baltimore, Dec. 22.-In financial circles little surprise was expressed to-day that the American National Bank of this city had suspended. It Is said that the Baltfmore Clearing House Association has pactically carried the institution since last December. Upon the report of a recent examination into its affairs, it was decided by the association yesterday to notify the Controller of Currency of its condition. The Associated Banks of Baltimore have advanced the embarrassed inscitution $30,000. which, It is said, is well secured. During the administration of ex-Mayor Malster, who was then a director of the bank. the American National was one of the city's depositories, the municipality at one time having $600,000 on deposit with 11. Upon assuming office In succession to Mr. Malster, Mayor Hughes withdrew the $200,000 due the city, The directors of the bank held a meeting to-day. but declined to make a statement for publication. This is the first failure of a national bank in Beltimore since the national banking law wgnt into effect. As a direct result of the embarrassment of the American National Bank the Economy Savings Bank, which occupies offices in the eame building. and whose directorate is largely drawn from the ialter's stockholders, also failed to open its doors this morning. The directors made the following statement: "Owing to the fact that our cash funds are deposited in the American National Bank, we have been compelled to suspend payment. We expect as soon as its offairs are straightened out, to pay our depositors in full, and hope that they will only suffer e slight inconvenience from a possible shortness of Christmas money." The depositors are for the most part Russian Hebrews, and a large crowd of these stood about the doors of the bank during the day. At one time the crowd numbered between 500 and 600, and necessitated a dispersing by the police.