Click image to open full size in new tab

Article Text

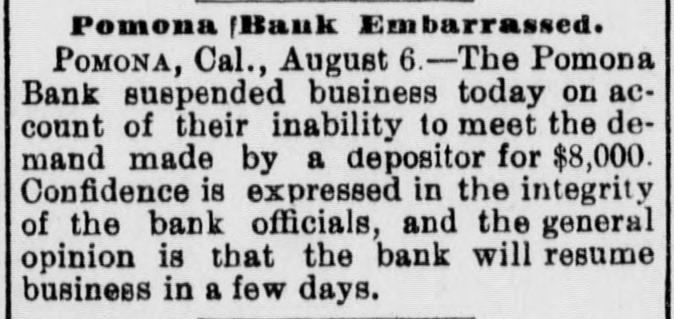

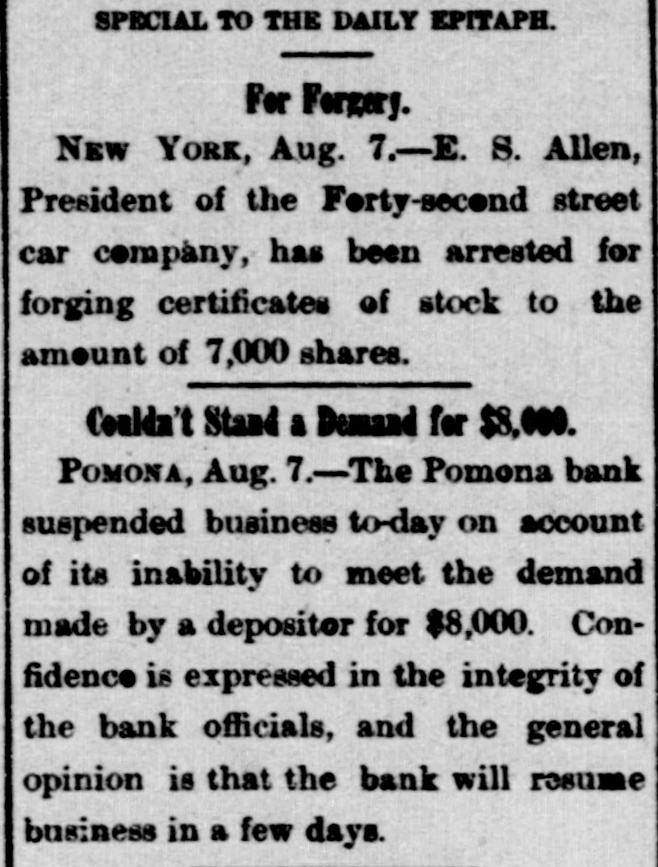

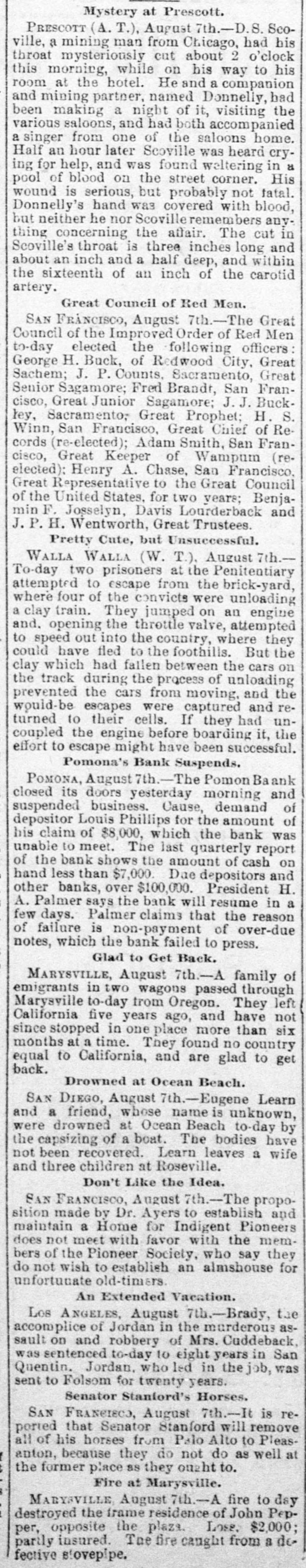

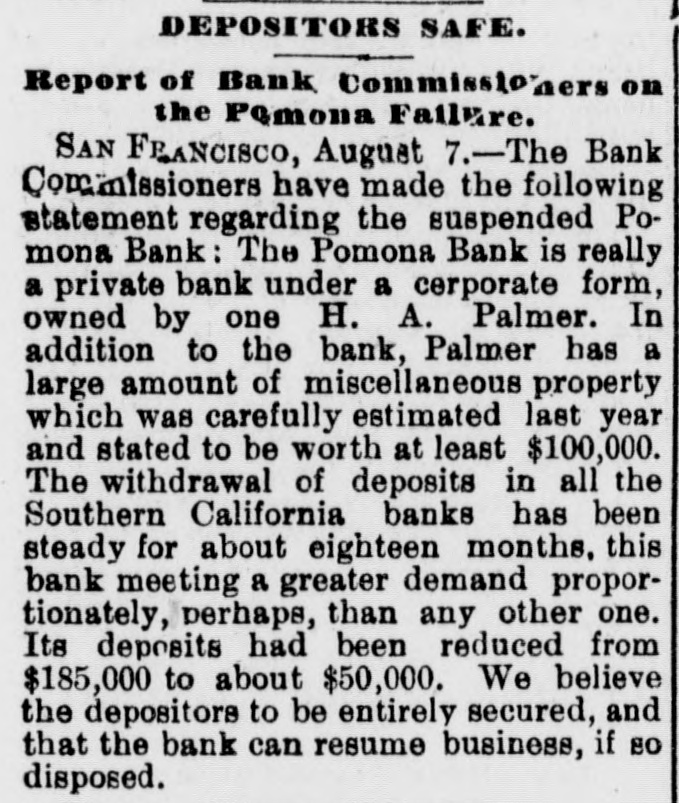

Mystery at Prescott. PRESCOTT (A. T.), August 7th.-D.S. Scoville, a mining man from Chicago, had his throat mysteriously cut about 2 o'clock this morning, while on his way to his room at the hotel. He and a companion and mining partner, named Donnelly, had been making a night of it, visiting the various saloons, and had both accompanied a singer from one of the saloons home. Half an hour later Scoville was heard crying for help, and was found weltering in a pool of blood on the street corner. His wound is serious, but probably not fatal. Donnelly's hand was covered with blood, but neither he nor Scoville remembers anything concerning the affair. The cut in Scoville's throat is three inches long and about an inch and a half deep, and within the sixteenth of an inch of the carotid artery. Great Council of Red Men. SAN FRANCISCO, August 7th.-The Great Council of the Improved Order of Red Men to-day elected the following officers: George H. Buck, of Redwood City, Great Sachem; J. P. Counts, Sacramento, Great Senior Sagamore; Fred Brandt, San Francisco, Great Junior Sagamore; J. J. Buckley, Sacramento, Great Prophet; H. S. Winn, San Francisco, Great Chief of Records (re-elected); Adam Smith, San Francisco, Great Keeper of Wampum (reelected): Henry A. Chase, San Francisco, Great Representative to the Great Council of the United States, for two years; Benjamin F. Josselyn, Davis Lourderback and J. P. H. Wentworth, Great Trustees. Pretty Cute, but Unsuccessful. WALLA Walla (W. T.), August 7th.To-day two prisoners at the Penitentiary attempted to escape from the brick-yard, where four of the convicts were unloading a clay train. They jumped on an engine and. opening the throttle valve, attempted to speed out into the country, where they could have fled to the foothills. But the clay which had fallen between the cars on the track during the process of unloading prevented the cars from moving, and the would-be escapes were captured and returned to their cells. If they had uncoupled the engine before boarding it, the effort to escape might have been successful. Pomona's Bank Suspends. POMONA, August 7th.-The Pomon Baank closed its doors yesterday morning and suspended business. Cause, demand of depositor Louis Phillips for the amount of his claim of $8,000, which the bank was unable to meet. The last quarterly report of the bank shows the amount of cash on hand less than $7,000. Due depositors and other banks, over $100,000. President H. A. Palmer says the bank will resume in a few days. Palmer claims that the reason of failure is non-payment of over-due notes, which the bank failed to press. Glad to Get Back. MARYSVILLE, August 7th.-A family of emigrants in two wagons passed through Marysville to-day from Oregon. They left California five years ago, and have not since stopped in one place more than six months at a time. They found no country equal to California, and are glad to get back. Drowned at Ocean Beach. SAN DIEGO, August 7th.-Eugene Learn and a friend, whose name is unknown, were drowned at Ocean Beach to-day by the capsizing of a boat. The bodies have not been recovered. Learn leaves a wife and three children at Roseville. Don't Like the Idea. SAN FRANCISCO, August 7th.-The proposition made by Dr. Ayers to establish and maintain a Home for Indigent Pioneers does not meet with favor with the members of the Pioneer Society, who say they do not wish to establish an almshouse for unfortunate old-timers. An Extended Vacation. Los ANGELES, August 7th.-Brady, the accomplice of Jordan in the murderous assault on and robbery of Mrs. Cuddeback, was sentenced to-day to eight years in San Quentin. Jordan, who led in the job, was sent to Folsom for twenty years. Senator Stanford's Horses. SAN FRANCISCO, August 7th.-It is reported that Senator Stanford will remove all of his horses from Palo Alto to Pleasanton, because they do not do as well at the former place as they ought to. Fire at Marysville. MARYSVILLE August 7th.-A fire to day destroyed the frame residence of John Pepper, opposite the plaza. Lose, $2,000; partly insured. The fire caught from a de fective slovepipe.