Click image to open full size in new tab

Article Text

Politicana

Annapolis, Nov. 1 (P)-Confidence for Governor Ritchie and the entire Democratic ticket. that Governor Ritchie would be re- elected by majority as great or larger than the 66,000 he received in 1930 was expressed tonight by Daniel S. Sullivan, who managed Dr. Charles Conley's primary campaign at an Anne Arundel county Democratic rally held at Crystal Beach. Approximately 3,000 persons, from every section of the county, gathered in and around the auditorium to hear local candidates speak. It was one of the largest rallies ever held in the county. Sullivan, who is chairman of the Democratic campaign speakers' committee, declared the attendance showed that Anne Arundel county was safe inefficient executive. Still nothing was done to remedy this situation or to take steps to protect the money of the many thousands of depositors. [Mr. Nice here read extracts from an address by Isaac Lobe Straus relating to the banking situation.]

Questions Raised "I ask you, am right when I say there must be searching, thorough and impartial investigation? Am right when say that believe that if the true facts can disclosed, there may result some additional relief to the many thousands of unfortunate depositors, through salvaging and distribution of additional sums? "Are the people of Maryland to be forever kept in ignorance of the true facts, or are we, the people of Maryland, going to find out what became of our money? Are we not entitled to know, so that at least we may be able to profit by our sad experiences and provide against such condition in the future? Much has been said and written about this matter by worthy and respectable members of the Governor's own party.

Criticism Is Cited "No denunciation I can make can be more severe than that of the Governor's opponent in the late primary and other prominent members of his own party. submit to you, the present Democratic dynasty to be continued in control, at sacrifice of the people's interest, and their right to know the conditions, so that, so far as it is humanly possible, these ditions may be rectified, or at least prevented in the future? "I propose searching, thorough and impartial investigation. propose that this shall be made by commission of three distinguished outstanding citizens to be appointed by me, regardless of their party affiliations, to whom shall delegate power equal to that of legislative inquisitorial investigators, and who shall report to me, so that may report to you. ask you, whose responsibility is it that at the close of business on April 29, 1933, there was total of State funds on deposit in various institutions to $7,112,759.42, of which more than two millions had been deposited by Mr Dennis, the State Treasurer, in the Union Trust Company, of which he was the president.

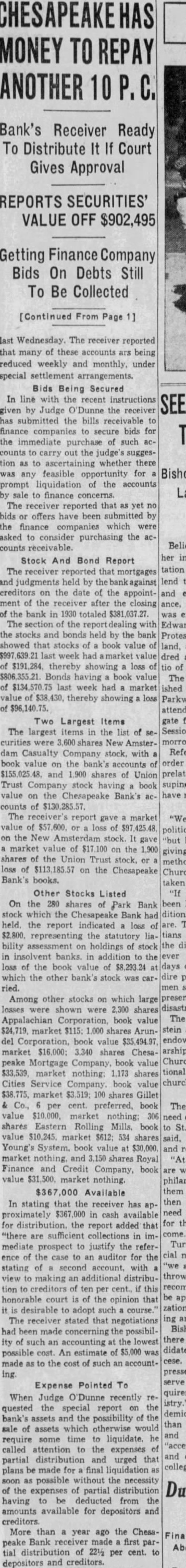

Points To Deposits "Over one-half million was on deposit in the Baltimore Trust Company, and approximately $200,000.00 in the Title Guarantee and Trust Company, aggregating over $3,000,000 of the State's in these three banks, practically half of the total amount of the deposits of the State. "Upon the other hand, in the five national banks-the First National Bank, the Canton National Bank, the National Marine Bank, the National Central Bank and the Western National Bank-all of unquestionable solvency, there was less than $250,000 of the State's money on deposit. "I charge that the Governor of the State of Maryland knew the condition of these failing institutions. He could not have helped knowing it. His own appointee was Bank Commissioner of the State of Maryland. It was the latter's duty to keep the Chief Magistrate of this State advised. If he failed in this duty, then the Governor was

Approximately For Nice thousand persons jammed into the Baltimore Talmud Torah Hall, 22 North Broadway last night to hear Harry W. Nice, Republican candidate for Governor and other members of the State-wide ticket. The rally was held under auspices of the East End Republican Club of which Samuel G. Lipman is president. Joseph Davis presided at the meeting.

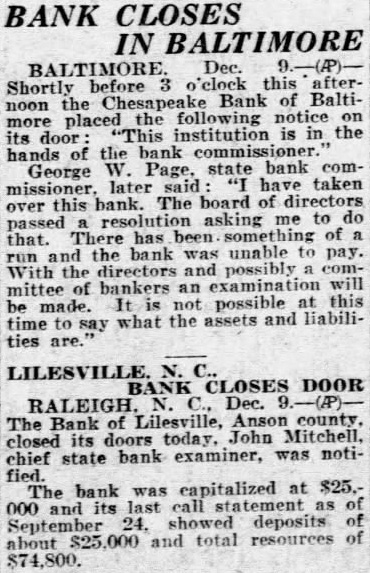

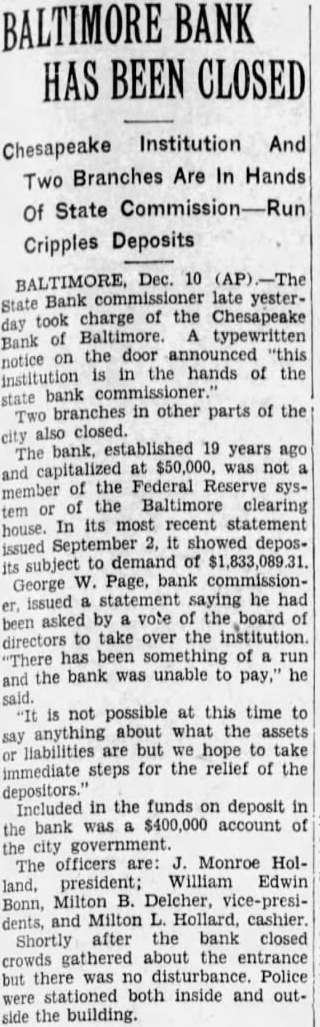

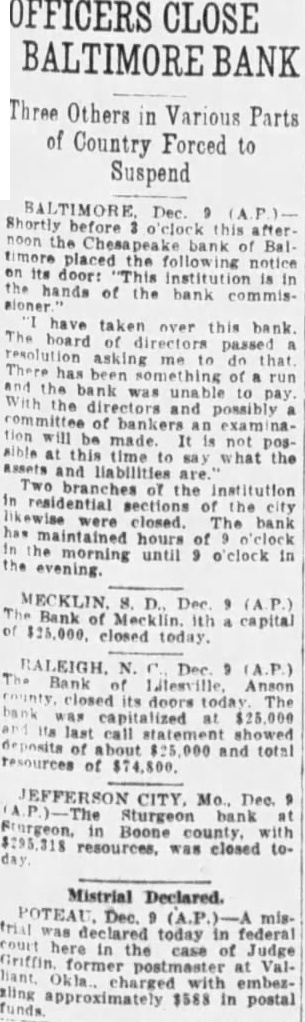

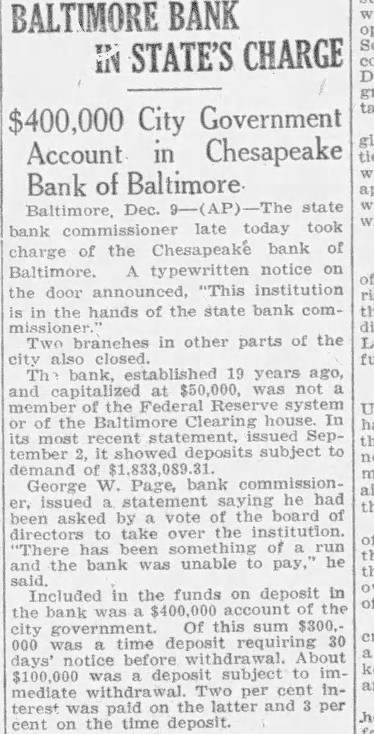

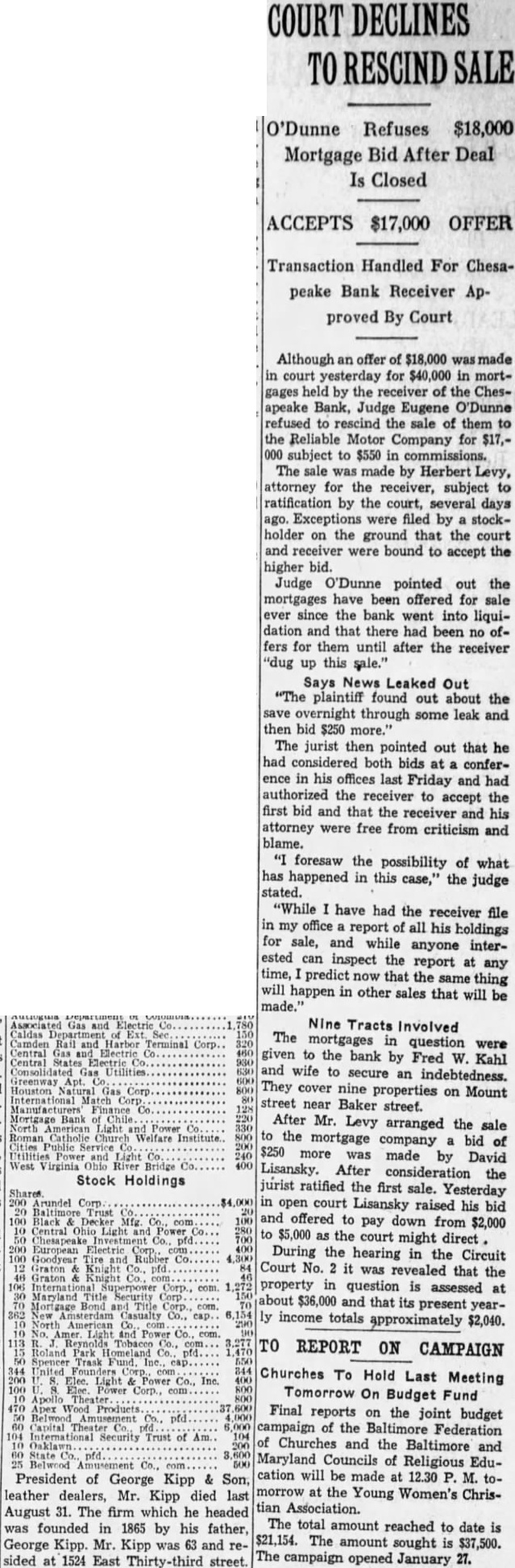

Harry F. Klinefelter, For Phelps vice-president of the Twenty-seventh Ward Republican Organization, went on record last night as indorsing John Phelps, independent candidate for judge of the Supreme Bench. derelict in his duty in not compelling him to keep him advised. "For months and months, however, running into years, it was common knowledge there was something wrong. Runs were being made upon these banks. Emergency meetings were being held, calls for aid were being sent to the Reconstruction Finance Corporation and large sums were secured from this source. "Why, under such circumstances. was this condition in the banking system of Maryland permitted to go on? There is only one answer. The political connections of the officers of these banks with the Democratic administration and the Chief Executive of the State were too close. The responsibility is on him and him alone. But this was not all. Long before the red flag of danger was waving over the Union Trust Company and the Baltimore Trust Company there had been two other failures in Baltimore city, to which have already referred. Way back in 1930 the Chesapeake Bank; then the Park Bank, with 80,000 or more depositors, working people, whose savings represented their all to them. "Nor were the depositors the only sufferers.

Stockholders Hit, Claim

"There were innocent, unsuspecting stockholders who had been led to believe that their investments in the stock of these institutions were safe. Stockholders who were induced to purchase stock of the Baltimore Trust Company within the last few weeks before its collapse, all of whose investments in this stock were wiped out completely. [At this point Mr. Nice referred at length to a description of the banking situation by Dr. Charles H. Conley an address at Hagerstown on June 19, 1934.]

"Under the law of this State no stockholder be sued for double liability, save and except through receiver. It is pertinent, therefore, to inquire why the caused to be passed at the recent special session of the Legislature law preventing the appointment of receivers for these political banks, thus prohibiting the State Bank Examiner, under penalty of the law, from giving out information in connection with these political banks, safeguarding the large stockholders of such banks from being subject to double liability, and thus preventing the depositor from profiting from such action, while the stockholders of the smaller banks throughout the State were compelled to meet this obligation. This law has been extended for another year by executive proclamation.

Calls Hold Too Strong "This political machine, however, built up with the people's money, was too powerful to overcome, and today the Democratic party, regard- shall not be selected for office merely less of the views of those thoughtful as reward for political favors. citizens who realized that the best "I have assured the people of this interests of their State and party State that the office of Insurance Comwould have been best served by missioner shall be filled by man of change of administration, finds itself in experience in insurance, competent and capable of fulfilling the duties the strangle hold of this Democratic which the office imposes upon him, machine. "Do those gentlemen who officered who will give his entire time to the discharge of his responsibilities. these banks and who are now straining every nerve and sinew to hold "I solemnly promise that when am elected Governor there shall be control of the State government. desire such an investigation? No. They no one appointed to fill public office have no love for the present Chief merely because of his political activiExecutive of this State, but to them ties. Appointees shall and must be he is safe. They are interested in men and women of high character and themselves, not in him. Their interest ability. is in maintaining the status quo, Refers To Auto Commissioner keeping the lid on, so that you and "What justification or excuse can the people of the State will never there be for the present automobile know the truth about these banks. who recently was ediWill Seek Advice torially called upon by The Evening

"I have been questioned concerning appointments which I may make when am elected Governor. have stated, not once. but many times, that when am elected Governor, shall. in making my appointments, expect the assistance and advice of all associations which may be interested in the particular subject matter of the board or commission to be appointed. "I have laid down, as a primary principle, that there shall be minority representation on all boards and commissions. have criticized, and still criticize, the Public Service Commission as now composed. This Commission is of semi-judicial character. and, as such, its members should be and remain free from all political activities which might affect or tend to influence the exercise of their free will and judgement. "I am opposed to the practice of State Executive appointing. during the terms for which they are elected, members of the Legislature to public office or employment.

Not Based On Favors

"I have pledged myself that the police magistrates shall be men of high character and principle, and that they

Sun to resign? For the present conservation commissioner, who has permitted an industry which, in 1919 was worth over $7,000,000 to the people of this State, to fall to such low level that today it is worth, according to the Governor's own statement, $2,000,000, and requires an expenditure of half million dollars to save it? "How can the Governor justify the appointment of an insurance sioner who lacked experience in insurance matters and who has failed to enforce the law providing for reserves to be put up by foreign insurance and casualty companies doing business in Maryland. which has caused great loss and suffering to those who have been so unfortunate as to have carried in such panies, relying upon the State insurance department to afford them