Article Text

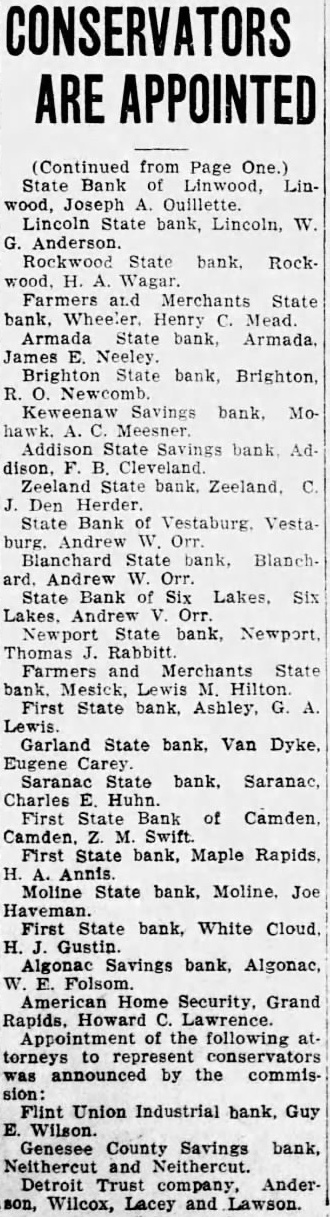

CONSERVATORS ARE APPOINTED (Continued from Page One.) State Bank of Linwood, Linwood, Joseph A. Ouillette Lincoln State bank, Lincoln, W. G. Anderson. Rockwood State bank. RockWagar. and Merchants State bank, Wheeler. Henry Mead. Armada State bank, Armada. James Neeley. State bank, Brighton, Savings bank. MoAddison State Savings bank AdB. Zeeland State bank. Zeeland. Den Herder. State Bank of Vestaburg. Vesta burg. Andrew W. Orr Blanchard State bank, BlanchAndrew Orr. State Bank of Six Lakes. Six Lakes. Andrew Orr. Newport State bank, Newport. Thomas Rabbitt Farmers Merchants State bank. Mesick, Lewis M. Hilton First State bank. Ashley, Garland State bank, Van Dyke, Eugene Carey Saranac State bank. Saranac Charles Huhn. First State Bank of Swift First State bank, Maple Rapids, H. Annis Moline State bank, Moline. Joe Haveman. First State bank, White H. Gustin. Algonac Savings bank, Algonac, W. Folsom. American Home Security, Grand Rapids, Howard Lawrence. Appointment of the following torneys to represent conservators was announced by the commission: Flint Union Industrial bank, Guy Wilson. Genesee County Savings Neithercut and Neithercut. Detroit Trust company, Anderson, Wilcox, Lacey and Lawson.