1.

January 28, 1908

The Marion Daily Mirror

Marion, OH

Click image to open full size in new tab

Article Text

MINOR MENTION. The Citizens' Savings bank, of Long Beach, Cal., has announced its suspension. The plant of the American Car and Foundry Co. at Detroit, which had been shut down for some time, has reopened, giving employment to 3,000 men. Nearly 200 employes at the Herreshoff boat building plant at Bristol, R. I., are back to work on full time after working for several months on a 4½hour basis. One fireman was killed, more than 20 were injured and property valued at $500,000 was destroyed in a fire which devastated the Mayer building, a seven-story brick building, and the Hotel Florence at Chicago. Franklin B. Lord, of the law firm of Lord, Day & Lord, who brought an unsuccessful suit against the Equitable Life Assurance society to prevent its transformation into a mutual company, is dead at his home in New York City.

2.

January 28, 1908

Pine Bluff Daily Graphic

Pine Bluff, AR

Click image to open full size in new tab

Article Text

BANK SUSPENDS IN CALIFORNIA Hearst News Special to the Graphic. Long Branch, Cal., Jan. 27-The Citizens Savings Bank today announced suspension. The raising of the 90-day requirement of depositors caused withdrawals too heavy for the bank to stand.

3.

January 28, 1908

The Seattle Star

Seattle, WA

Click image to open full size in new tab

Article Text

Savings Bank Suspends. LONG BEACH, Cal., Jan. 28.The Citizens' Savings bank of this city has announced its suspension.

4.

January 28, 1908

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

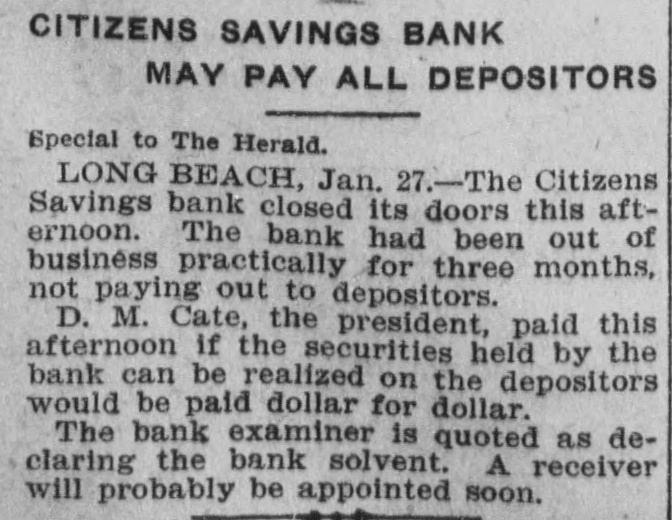

CITIZENS SAVINGS BANK MAY PAY ALL DEPOSITORS Special to The Herald. LONG BEACH, Jan. 27.-The Citizens Savings bank closed its doors this afternoon. The bank had been out of business practically for three months, not paying out to depositors. D. M. Cate, the president, paid this afternoon if the securities held by the bank can be realized on the depositors would be paid dollar for dollar. The bank examiner is quoted as declaring the bank solvent. A receiver will probably be appointed soon.

5.

January 30, 1908

Mexico Weekly Ledger

Mexico, MO

Click image to open full size in new tab

Article Text

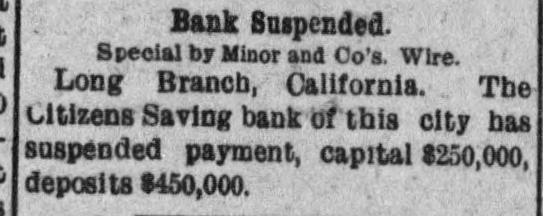

Bank Suspended. Special by Minor and Co's. Wire. Long Branch, California. The Citizens Saving bank of this city has suspended payment, capital $250,000, deposits $450,000.

6.

January 31, 1908

Twice-A-Week Plain Dealer

Cresco, IA

Click image to open full size in new tab

Article Text

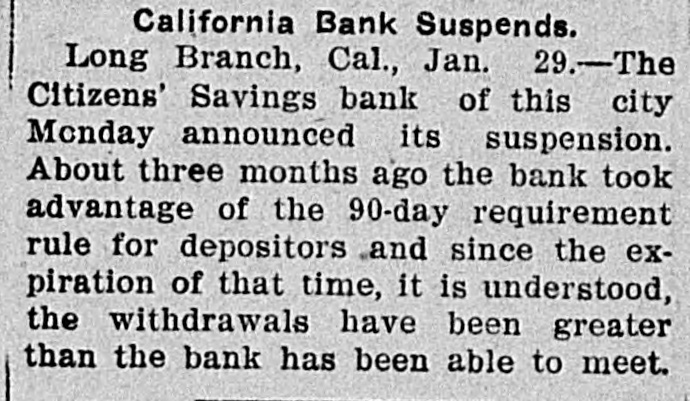

California Bank Suspends. Long Branch, Cal., Jan. 29.-The Citizens' Savings bank of this city Monday announced its suspension. About three months ago the bank took advantage of the 90-day requirement rule for depositors and since the expiration of that time, it is understood, the withdrawals have been greater than the bank has been able to meet.

7.

February 2, 1908

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

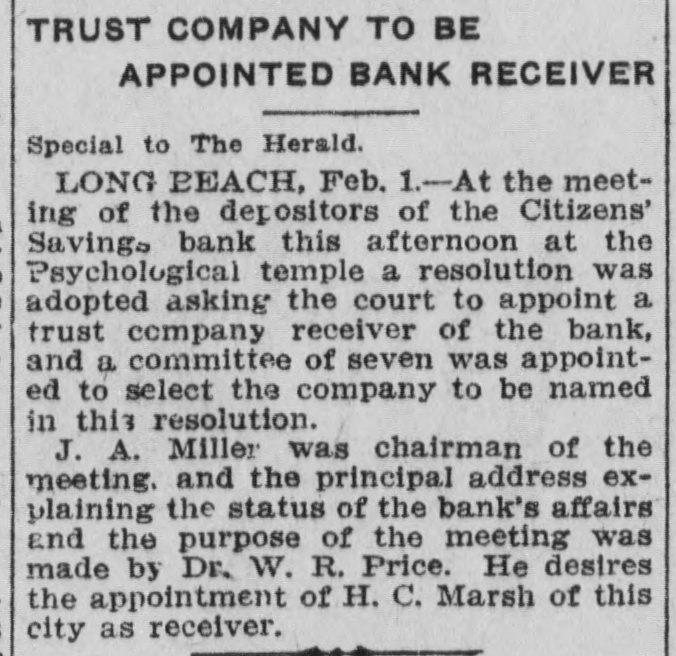

TRUST COMPANY TO BE APPOINTED BANK RECEIVER Special to The Herald. LONG PEACH, Feb. 1.-At the meeting of the depositors of the Citizens' Savings bank this afternoon at the Psychological temple a resolution was adopted asking the court to appoint a trust company receiver of the bank, and a committee of seven was appointed to select the company to be named in this resolution. J. A. Miller was chairman of the meeting. and the principal address explaining the status of the bank's affairs and the purpose of the meeting was made by Dr. W. R. Price. He desires the appointment of H. C. Marsh of this city as receiver.

8.

February 6, 1908

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

BANK'S FORMER PRESIDENT MAY BECOME ITS RECEIVER Special to The Herald. LONG BEACH, Feb. 5.-The rumor was prevalent here today that Charles L. Heartwell, formerly president of the Citizens Savings bank, is to be appointed receiver for that institution. The rumor is to the effect that the governor and Walter Parker will work with him to secure the appointment. Mr. Heartwell is a member of the governor's staff. The depositors of the bank at a meeting held a few days ago voted in favor of asking the court to appoint a trust company, and the committee which was appointed to select a trust company has agreed upon the Los Angeles Trust company. The appointment of a man connected with the bank will, it is said, be displeasing to a large number of the depositors.

9.

February 15, 1908

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

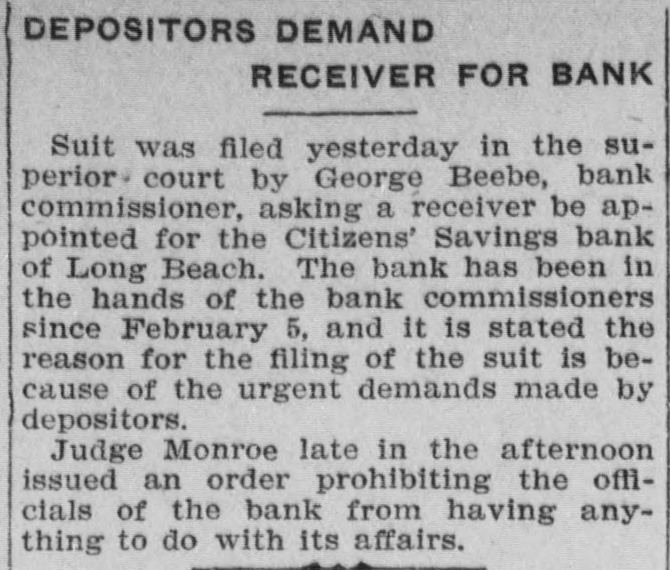

DEPOSITORS DEMAND RECEIVER FOR BANK Suit was filed yesterday in the superior court by George Beebe, bank commissioner, asking a receiver be appointed for the Citizens' Savings bank of Long Beach. The bank has been in the hands of the bank commissioners since February 5, and it is stated the reason for the filing of the suit is because of the urgent demands made by depositors. Judge Monroe late in the afternoon issued an order prohibiting the officials of the bank from having anything to do with its affairs.

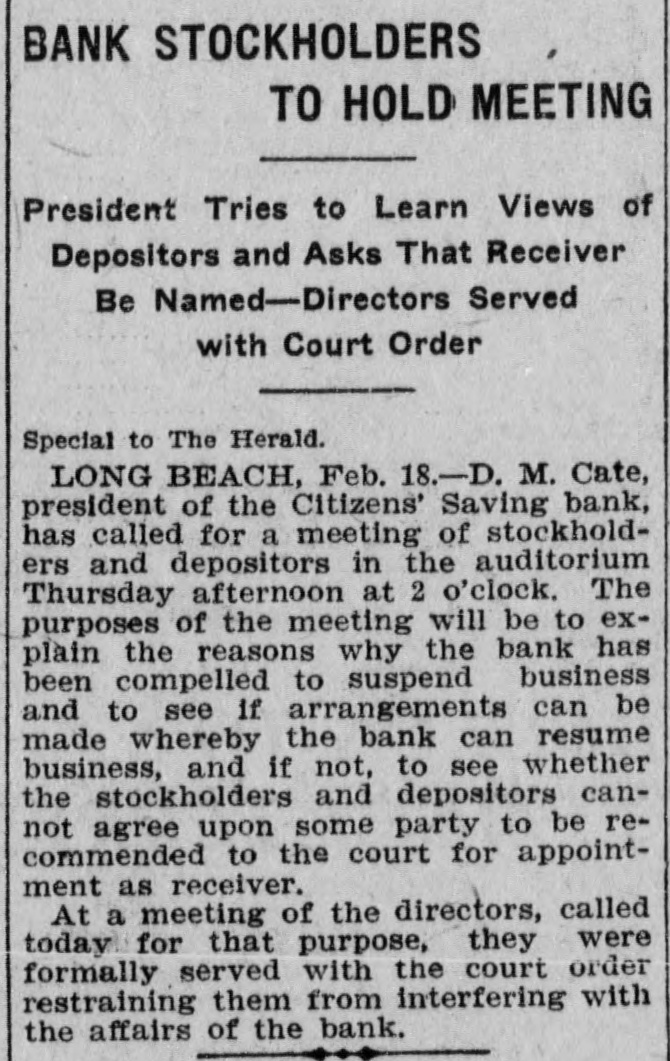

10.

February 19, 1908

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

BANK STOCKHOLDERS TO HOLD MEETING President Tries to Learn Views of Depositors and Asks That Receiver Be Named-Directors Served with Court Order Special to The Herald. LONG BEACH, Feb. 18.-D. M. Cate, president of the Citizens' Saving bank, has called for a meeting of stockholders and depositors in the auditorium Thursday afternoon at 2 o'clock. The purposes of the meeting will be to explain the reasons why the bank has been compelled to suspend business and to see if arrangements can be made whereby the bank can resume business, and if not, to see whether the stockholders and depositors cannot agree upon some party to be recommended to the court for appointment as receiver. At a meeting of the directors, called today for that purpose, they were formally served with the court order restraining them from interfering with the affairs of the bank.

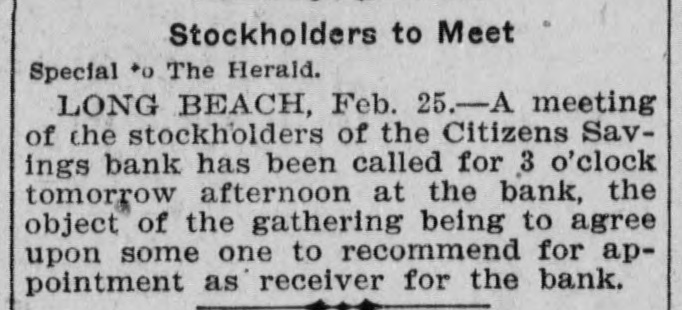

11.

February 26, 1908

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

Stockholders to Meet Special *o The Herald. LONG BEACH, Feb. 25.-A meeting of the stockholders of the Citizens Savings bank has been called for 3 o'clock tomorrow afternoon at the bank, the object of the gathering being to agree upon some one to recommend for appointment as receiver for the bank.

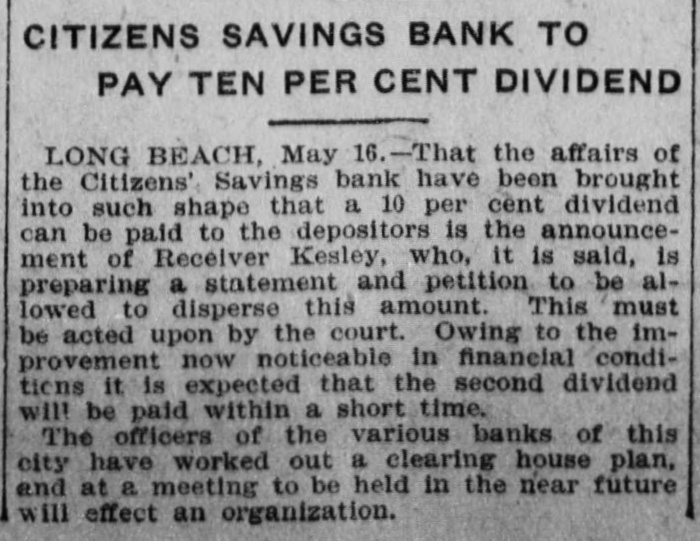

12.

May 17, 1908

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

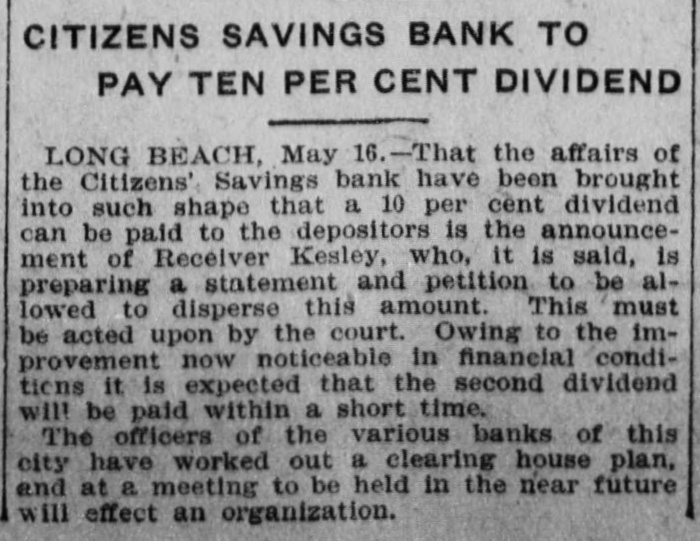

CITIZENS SAVINGS BANK TO PAY TEN PER CENT DIVIDEND LONG BEACH, May 16.-That the affairs of the Citizens' Savings bank have been brought into such shape that a 10 per cent dividend can be paid to the depositors is the announcement of Receiver Kesley, who, it is said, is preparing a statement and petition to be allowed to disperse this amount. This must be acted upon by the court. Owing to the improvement now noticeable in financial conditions it is expected that the second dividend will be paid within a short time. The officers of the various banks of this city have worked out a clearing house plan, and at a meeting to be held in the near future will effect an organization.

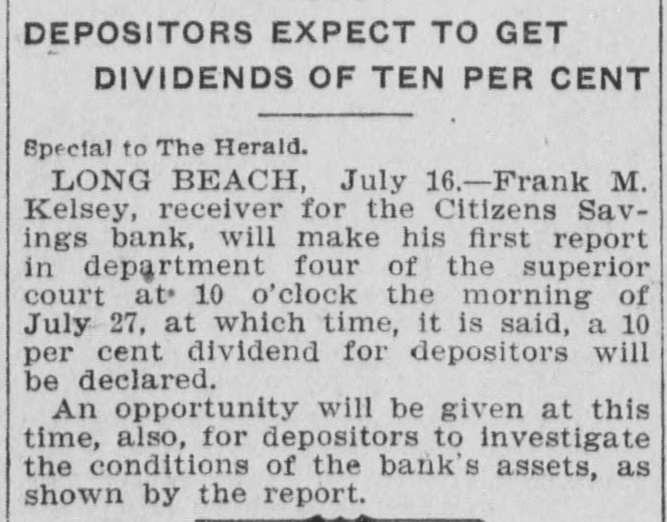

13.

July 17, 1908

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

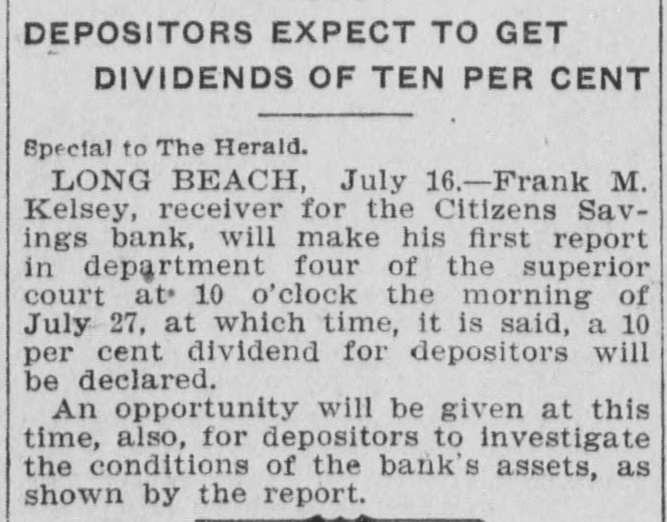

DEPOSITORS EXPECT TO GET DIVIDENDS OF TEN PER CENT Special to The Herald. LONG BEACH, July 16.-Frank M. Kelsey, receiver for the Citizens Savings bank, will make his first report in department four of the superior court at* 10 o'clock the morning of July 27, at which time, it is said, a 10 per cent dividend for depositors will be declared. An opportunity will be given at this time, also, for depositors to investigate the conditions of the bank's assets, as shown by the report.

14.

August 1, 1908

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

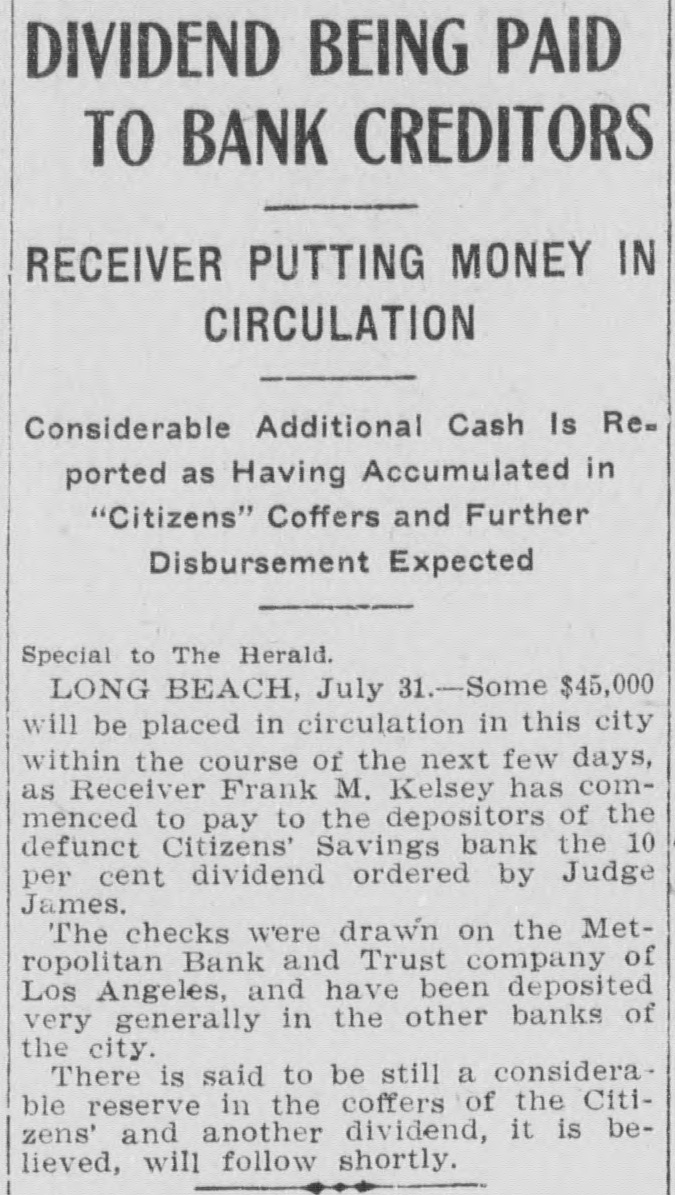

DIVIDEND BEING PAID TO BANK CREDITORS RECEIVER PUTTING MONEY IN CIRCULATION Considerable Additional Cash Is Reported as Having Accumulated in "Citizens" Coffers and Further Disbursement Expected Special to The Herald. LONG BEACH, July 31.-Some $45,000 will be placed in circulation in this city within the course of the next few days, as Receiver Frank M. Kelsey has commenced to pay to the depositors of the defunct Citizens' Savings bank the 10 per cent dividend ordered by Judge James. The checks were drawn on the Metropolitan Bank and Trust company of Los Angeles, and have been deposited very generally in the other banks of the city. There is said to be still a considerable reserve in the coffers of the Citizens' and another dividend, it is believed, will follow shortly.

15.

January 1, 1909

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

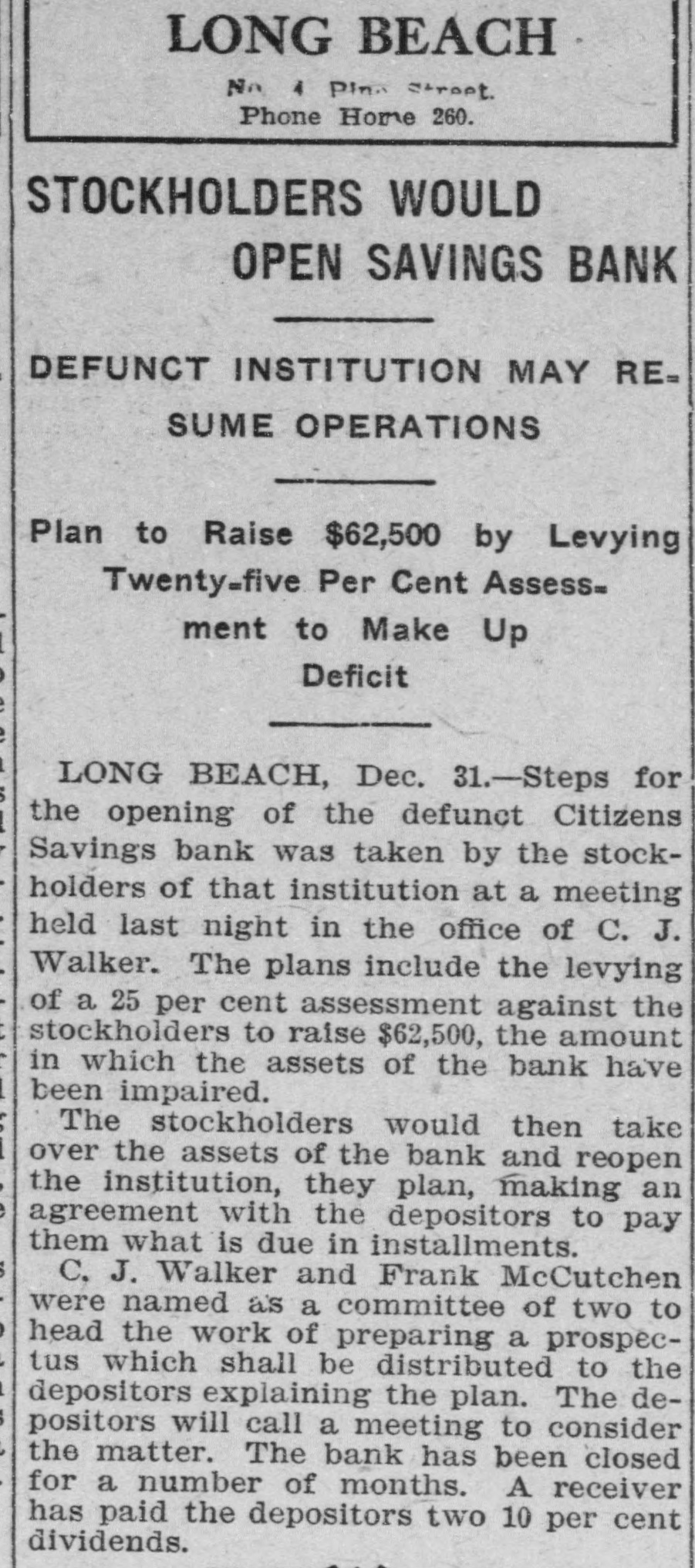

LONG BEACH No 4 Pino street Phone Home 260. STOCKHOLDERS WOULD OPEN SAVINGS BANK DEFUNCT INSTITUTION MAY RESUME OPERATIONS Plan to Raise $62,500 by Levying Twenty-five Per Cent Assess= ment to Make Up Deficit LONG BEACH, Dec. 31.-Steps for the opening of the defunct Citizens Savings bank was taken by the stockholders of that institution at a meeting held last night in the office of C. J. Walker. The plans include the levying of a 25 per cent assessment against the stockholders to raise $62,500, the amount in which the assets of the bank have been impaired. The stockholders would then take over the assets of the bank and reopen the institution, they plan, making an agreement with the depositors to pay them what is due in installments. C, J. Walker and Frank McCutchen were named as a committee of two to head the work of preparing a prospectus which shall be distributed to the depositors explaining the plan. The depositors will call a meeting to consider the matter. The bank has been closed for a number of months. A receiver has paid the depositors two 10 per cent dividends.

16.

March 31, 1909

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

Citizens Bank to Reopen LONG BEACH, March 30.-Depositors representing more than $275,000 having signed an agreement with the stockholders of the recently defunct Citizens Savings bank, that institution will be reopened shortly. The stockholders will make good the depletion in the assets of the bank, amounting to about $65,000, and the depositors will accept their money in installments. If signatures representing $300,000 can be secured the stockholders will give out a 10 per cent dividend at once. Two dividends of 10 per cent each have been paid by the receiver.

17.

June 24, 1909

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

CITIZENS BANK MAY BE REOPENED SOON TO TRY TO GET INJUNCTION MODIFIED Directors of Savings Institution Decide to Employ Senator Hahn to Secure Change in Court Order [Special to The Herald.] LONG BEACH, June 23.-The directors of the Citizens Savings bank voted last night to employ Senator Hahn of Pasadena to petition the court to modify the injunction against the Citizens Savings bank, now in the hands of a receiver, so that the directors can reopen it, an assessment of 25 per cent to be made against the stock in order to make good the deficiencies in the assets. The bank is now in the hands of a receiver, the directors having been enjoined from managing the institution. All but a few of the stockholders have signed an agreement to pay the assessment, and it is believed the others can be forced to assent to its being levied.

18.

August 4, 1909

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

That the new banking laws which went into effect are proving no hardship to the better class of sound financial institutions is the opinion of State Superintendent of Banking Alden Anderson, who says that most of the bankers have shown an earnest disposition to comply with the requirements of the recently passed acts, and all the good bankers seem to feel that it really adds to their status and prestige to have the closest supervision and examination. "However, those which do not wish to comply with the laws will have to do so, anyway," tersely remarked Mr. Anderson, as he shifted his cigar. "I shall endeavor to work with the controller of currency at Washington, and will call on the state banks for their reports at about the same time calls are made on the national banks." To Be Bank Examiner When questioned as to whom he would appoint as bank examiner for the district of Los Angeles, Mr. Anderson stated that John W. Wilson had been suggested by the Clearing House association, and was an admirable man for the position. "Mr. Wilson is a very capable man, and the only question is whether his duties in his present position would not interfere with his efficiency in the work of bank examiner. If I find that his duties do not interfere I will indeed be glad to have such a capable man," remarked the state superintendent. When questioned as to what involved his attention at the present time, the superintendent of state banking smiled sardonically, as if to intimate that he was not exactly having a picnic, and admitted that a few things kept him busy. "Some things on which I have been working while in this part of the country are as follows," he said. "I have been investigating the affairs of the Kimmon-Ginko-which means in our language "Golden State" bank, and have its affairs now in process of liquidation. Long Beach Bank May Reopen "I have also looked into the affairs of the Citizens' Savings bank of Long Beach, the affairs of which are now in the hands of a receiver. At present 94 per cent of its stockholders and 80 per cent of its depositors are petitioning the superior court to levy an assessment on the stock in order to allow the bank to reopen. After careful consideration I have admitted the petition and will give permission to reopen if they will adhere strictly to the terms of their petition to the court. First, levying an assessment; second, opening the bank under different management than that which put in into the hands of a receiver, and third, that they will make their required weekly report. "The new banking laws passed in this state follow the national banking laws with respect to commercial banks, and they are similar to the New York state banking laws with respect to savings banks and trust companies, The laws themselves are complete and effective if properly administered. "I look to see bank conditions in this state on a very high plane when the provisions of these laws are fully complied with and its obligations are thoroughly understood and followed."

19.

August 5, 1909

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

CITIZENS BANK TO BE REOPENED SOON DEPOSITORS PLEASED WITH REPORT Judge James Modifies Injunction Which Restrains Stockholders from Handling Affairs of the Institution [Special to The Herald.] LONG BEACH, Aug. 4.-General rejoicing here followed the receipt of the news that Judge James had granted the order for the reopening of the Citizens Savings bank, which has been in the hands of a receiver since April last year. During that time the depositors have received two 10 per cent dividends. The collection of the assements which must be levied by the stockholders to make good the $62,500 deficit in the assets will require about three weeks, after which the receiver will turn the affairs of the bank over to the stockholders. Judge James' order modified the injunction which restrained the stockholders from handling the bank's affairs.

20.

August 10, 1909

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

STOCKHOLDERS WILL BE CALLED TOGETHER CITIZENS BANK DIRECTORS HOLD MEETING Judge James Signs Order Permitting Defunct Institution to Be Opened Under Certain Con. ditions [Special to The Herald.] LONG BEACH. Aug. 9.-A meeting was held tonight by the old board of directors of the Citizens Savings bank to consider the calling of a meeting of the stockholders. In accordance with the order signed today by Judge James, which wlil allow the reopening of the bank under certain conditions, the stockholders must elect a new directorate, as the same officials will not be allowed to govern the bank. The final report filed today by Receiver Kelsey, who has been in charge of the affairs of the bank since April, 1908, contained thirty-three typewritten pages, giving every detail of the history of the institution's affairs since they passed into his hands. According to the report, the total assets of the bank are $695,275.95. of which $76,246.45 is in money. To this will be added $62,500 which will be raised by assessing the stockholders. According to the reopening order, those depositors who did not sign the agreement under wheih the order was secured may step in and ask for all their money at once, instead of waiting to get it in installments. as the others have agreed to do. But Attorney John E. Daly, who represents the interests of the bank, said today that many of these depositors would not insist on immediate payment. Those who refused to sign the agreement have deposits of between $70,000 and $75,000 in the bank.

21.

November 13, 1909

The San Francisco Call

San Francisco, CA

Click image to open full size in new tab

Article Text

HOLLAND GOING TO CAPITAL CITY Vice President of Western Na= tional to Manage Sacramento Valley Trust Company New Institution Will Be Con= nected With the Fort Sut= ter National Bank F. L. Holland, vice president of the Western national bank, and at present acting cashier of the Metropolis trust and savings bank, was elected yesterday vice president and manager of the Sacramento valley trust company, a new $1,000,000 institution that will be opened in the capital city about the first of the new year. The new bank will be of national ala though the Fort separate Sutter institution. a connection bank, The Fort Sutter national bank is one of the largest banks in Sacramento, its business branching out to such an extent that a trust company seemed to be a its are H. W. L. George necessity. J. Bryte, Among Conger, officers E. Southworth and A. L. Darrow. These officers will be prominently affiliated with the new trust company. F. L. Holland, who leaves the Metropolis trust and savings bank to become vice president and manager of the new institution, nas been in the banking business in this city only since the fire of 1906. He was made a vice president, of the Western national bank at the time of the reorganization and pulled that bank through the financial panic of 1907. Superintendent of Banks Alden Anderson gave permission to the Citizens' savings bank of Long Beach to reopen yesterday, the institution having made good the impairment of its capital. John E. Fitzpatrick, for 20 years with the Donohoe-Kelly banking company, was appointed cashier of the bank at a meeting of the directors last Wednesday. The appointment was made to fill the vacancy caused by the death of Edward Donohoe, son of the founder of the institution. John Y. Dispaux was appointed assistant cashier to fill the vacancy caused by Fitzpatrick's promotion.

22.

November 16, 1909

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

LONG BEACH Circulation Dept. No. 4 Plue street, Home phone 260. Correspondent Sunset phone Main 006. BIG BUSINESS DONE BY REOPENED BANK CITIZENS SAVING OFFICIALS ARE SWAMPED More Money Deposited Than Drawn Out of Institution Which Re= sumed Operations After Two Years' Lapse LONG BEACH, Nov. 15.-There was such a steady stream of business at the Citizens Savings bank today, when it re-opened, that the officers of the bank did not find time to stop for lunch, and President McCutchen said at 6 o'clock tonight the books would not be balanced, showing the results of the day's business, until late tonight. The deposits, he said, exceeded the payments, From opening time this morning until closing time this afternoon the corridor was full of persons. Many redeposited the checks given them by the receiver and many who were offered 20 per cent payments on their deposits, which have been tied up for two years, left them with the bank. Others showed a disposition to take their money out. The receiver has paid about 600 of the 1225 non-consenting depositors. President Frank McCutchen, Vice President Callahan and Secretary Huntington said tonight they believed the bank would start out with a successful run of business.

23.

September 3, 1910

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

COURT ORDER REOPENS BANK CLOSED 3 YEARS Dissolution of Injunction Restores Long Beach Institution to Full Powers LONG BEACH, Sept. 2.-The news from Los Angeles today that the court had dissolved the injunction against the Citizens Savings bank and restored it to its old position with full banking powers led to the congratulation this afternoon of the men whose work is said to have been responsible for the re-establishment of the bank. Under the court's order the receiver who wa's retained to pay the nonconsenting depositors their money will turn over to the bank the $3007.43 he has yet on hand, and with this action he will be relieved of his duties, the receivership becoming a matter of history. He will do this at once, The state bank superintendent and the court agreed that the bank should be empowered to pay out the rest of the money. The injunction against the bank caused the closing of its doors three years ago. The injunction was removed in part when practically all of the depositors agreed to a plan whereby the bank could reopen, the receiver being authorized to reimburse from money raised by an assessment of stockholders those depositors who did not agree to the reopening.