Article Text

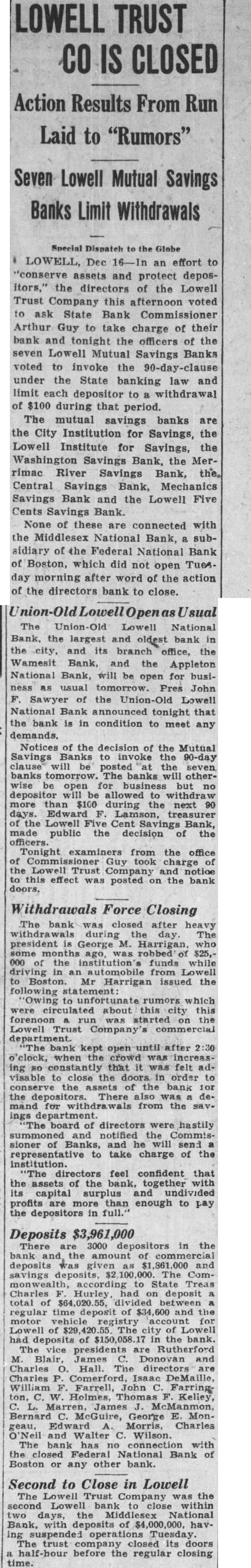

LOWELL TRUST CO IS CLOSED Action Results From Run Laid to "Rumors" Seven Lowell Mutual Savings Banks Limit Withdrawals Special Dispatch to the Globe I LOWELL, Dec 16-In an effort to "conserve assets and protect depositors," the directors of the Lowell Trust Company this afternoon voted to ask State Bank Commissioner Arthur Guy to take charge of their bank and tonight the officers of the seven Lowell Mutual Savings Banks voted to invoke the 90-day-clause under the State banking law and limit each depositor to withdrawal of $100 during that period. The mutual savings banks are the City Institution for Savings, the Lowell Institute for Savings, the Washington Savings Bank, the Merrimac River Savings Bank, the, Central Savings Bank, Mechanics Savings Bank and the Lowell Five Cents Savings Bank. None of these are connected with the Middlesex National Bank, subsidiary of the Federal National Bank of Boston, which did not open Tuesday morning after word of the action of the directors bank to close. The Union-Old Lowell National Bank, the largest and oldest bank in the city, and its branch office, the Wamesit Bank, and the Appleton National Bank, will be open for business as usual tomorrow. Pres John F. Sawyer of the Union-Old Lowell National Bank announced tonight that the bank is in condition to meet any demands. Notices the decision the Mutual Savings Banks to invoke the 90-day clause will be posted "at the seven banks tomorrow. The banks will otherwise be open for business but no depositor will allowed withdraw more than $100 during the next 90 days. Edward F. Lamson, treasurer the Lowell Five Cent Savings Bank, made public the decision of the officers. Tonight examiners from the office of Commissioner Guy took charge of the Lowell Trust Company and notice to effect was posted on the bank Withdrawals Force Closing The bank was closed after heavy withdrawals during the day. The president is George M. Harrigan, who some months ago, was robbed $25,000 of the institution's funds while driving in an automobile from Lowell to Boston. Mr Harrigan issued the following "Owing to unfortunate rumors which were circulated about this city this forenoon was started on the Lowell Trust Company's department. "The bank kept open until after 2:30 o'clock, when the crowd was increasing so constantly that it was felt advisable to close the doors in order to conserve the assets of the bank for the depositors. There also was demand for withdrawals from the savings The board of directors were hastily summoned and notified the Commissioner of Banks, and will send representative to take charge of the "The directors feel confident that the assets of the together with capital surplus and undivided profits more than enough to pay the depositors in full." Deposits $3,961,000 There are 3000 depositors in the bank and, the of deposits was given as and savings deposits, $2 100 The Commonwealth, according to State Treas Charles Hurley had on deposit total of $64,020.55, divided between regular time of and the motor vehicle registry account for Lowell of The city of Lowell had deposits of $150,058.1 in the bank. The vice presidents are Rutherford M Blair, James Donovan and Charles O. Hall. The directors are Charles P. Comerford, Isaac DeMaille, William F. Farrell, John C. Farrington. W. Holmes, Thomas F. Kelley L. Marren, James J. McManmon, Bernard George E. Mongeau, Morris, Charles O'Neil and Walter C. Wilson. The bank has no connection with the closed Federal National Bank of Boston or any other bank. Second to Close in Lowell The Lowell was the second Lowell bank to close within two days, the Middlesex National Bank, with deposits of $4,000,000. havIng suspended operations Tuesday. The trust company closed its doors half-hour before the regular closing time.