Click image to open full size in new tab

Article Text

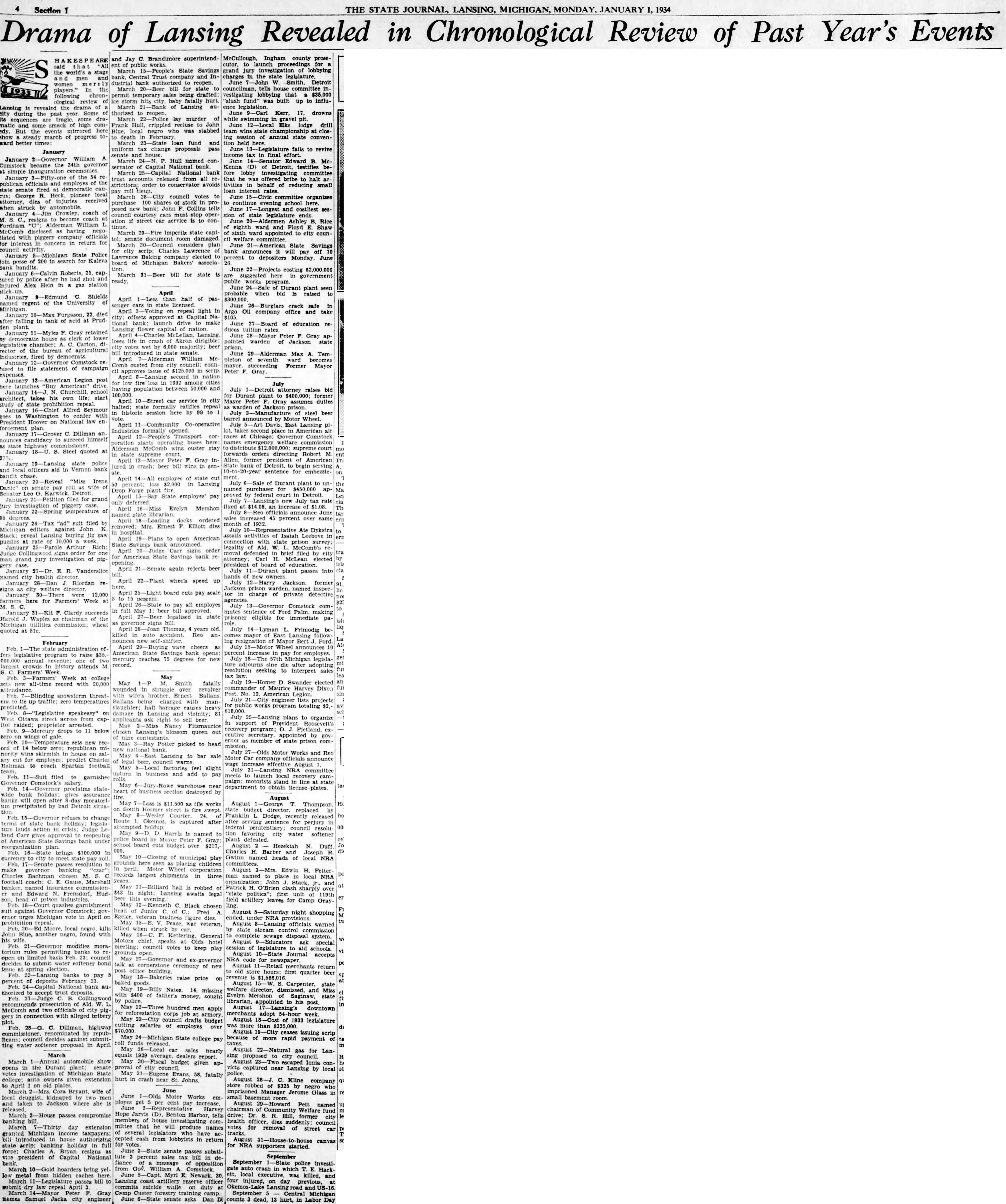

THE STATE JOURNAL, LANSING, MICHIGAN, JANUARY Drama Revealed Review Year's Events in Past of Lansing Chronological of the world's men women following chronological review Lansing revealed drama during past year. Some some matic and some smack high comedy. But events mirrored show steady march of progress ward better times:

January

January 2-Governor William Comstock became the 34th governor simple inauguration January the and employes the publican senate fired democratic pioneer local George attorney. injuries received when struck coach January resigns become coach Fordham Alderman William McComb disclosed having negotiated with company officials piggery interest concern in return for council activity State Police January 200 in for Kaleva bandits. January Roberts, tured police after had shot injured Alex Hein gas station January Shields named regent of the University January Furgason, died falling in tank acid Prudplant. January Gray retained democratic house lower legislative chamber; rector agricultural industries, fired democrats January fused file statement of campaign expenses. January Legion post American' drive. January Churchill, school architect, takes his life: start study state prohibition repeal. Alfred Seymour Washington confer with President Hoover on National law forcement January Dillman candidacy succeed himself nounces highway January Steel quoted

January state police local officers aid Vernon bank January "Miss Irene Senator filed for grand piggery case January temperature January suit filed Michigan editors against John Stack: reveal Lansing buying jig puzzles January Arthur Rich: Judge signs order for grand investigation of pig case. January Vanderslice named health January Riordan January 12,000 here for Farmers' Week January Clardy succeeds Harold Waples chairman Michigan utilities commission; wheat quoted

February state legislative program raise annual revenue: largest crowds history attends Farmers' Week Week at college all-time record with 20,000 snowstorm up temperatures speakeasy" raided: proprietor drops to below wings sets new republican nority skirmish house predict Bahman to coach Spartan football filed garnishee Comstock's bank holiday: gives assurance precipitated bad Detroit situarefuses to change terms state bank holiday: legisla crisis: Judge Carr approval reopening Savings bank brings $100,000 passes make governor banking Charles Bachman chosen M. football coach: Gauss, Marshall named and Edward N. Frensdorf, Hudhead prison garnishment against Michigan vote in April local kills Blue, another negro, found modifies morabanks limited basis council decides submit water softener bond spring election. Feb. banks to pay deposits February bank accept of Ald. McComb of city pig. in connection with alleged bribery C. Dillman, highway commissioner. republicans: council decides submitting water softener proposal in April.

March March show the votes Michigan State college: given extension April old plates March Cora Bryant, wife local druggist, kidnaped taken Jackson where she released. March passes compromise banking bill. March day extension Michigan income introduced house authorizing acrip: banking holiday in full force: Charles Bryan resigns president Capital National March bring yelfrom caches March bill Peter Gray Samuel Jacka city engineer

Jay Brandimore superintendMarch State Savings bank, Trust Industrial bank authorized reopen. March state temporary sales being drafted: storm baby fatally hurt. March of Lansing thorized reopen. March lay murder Frank Hull, crippled recluse John local negro who was stabbed death February March 23-State fund and uniform change proposals pass senate March Hull named conCapital March bank trust from all to conservator avoids roll March council votes to purchase 100 shares stock posed bank: John Collins tells council courtesy must stop ation street car service continue. March imperils state capisenate document room damaged March considers plan city scrip: Charles Lawrence Lawrence Baking elected board Michigan Bakers' associa March bill for state ready.

April April half of senger licensed. April repeal light offsets tional bank: launch make Lansing April Lansing. loses life Akron votes 6,000 beer state senate. April William Comb ousted from council: approves issue scrip April second nation for low 1932 among cities having population between and 100,000. April service in city historic session here by 99 April Co-operative formally April Transport buses Alderman ouster stay state supreme April Peter Gray jured in beer bill wins in April employes state cut percent: Lansing Drop Forge plant April State employes' pay deferred April Evelyn Mershon librarian. April ordered removed: Mrs. Ernest Elliott dies April to open American State April signs order American State Savings bank opening April again rejects beer April wheels speed up April board cuts pay scale April pay all employes full May beer approved April legalized in state governor April Thomas, years killed accident. Reo April cheers American State opens: reaches 75 degrees for new record.

May May Smith fatally wounded struggle over revolver Ernest Ballans being charged with manbarrage heavy damage and vicinity; to May Nancy Fitzmaurice chosen Lansing's queen out contestants. May Potter picked to head May Lansing to bar sale council May factories feel slight upturn in business add pay May warehouse near heart of business destroyed May is tile works fire Courter Route after captured May named board board cuts budget $217,May of municipal play grounds here seen placing children peril: Motor Wheel corporation records largest shipments in three hall robbed night: Lansing awaits legal evening May Black chosen Junior Fred business war veteran, killed when May General Motors chief Olds hotel council votes to keep play grounds May and cornerstone of new building May raise price baked goods May Nates 14. missing with $400 father's sought police. May hundred men apply reforestation job armory. May council drafts budget salaries employes over $70,000. May State college pay car sales nearly equals 1929 report. May given city May 58, fatally hurt in crash near Johns.

June June Motor Works ployes cent increase. June Harvey Hope Jarvis Benton Harbor, tells members house investigating committee produce names several legislators cepted cash from lobbyists in return for June senate passes substipercent sales fiance message opposition from Comstock. June Newark. Lansing officer commits while duty Camp June senate asks Dan

McCullough, Ingham county prosecutor, to proceedings grand jury investigation of lobbying charges the legislature. June Smith, Detroit councilman, tells committee vestigating lobbying that $35,000 "slush fund" built up to influlegislation. June Kerr, drowns while swimming gravel June 12-Local lodge drill team wins state championship closing session of annual state convenheld June to revive income final effort. June McKenna (D) of Detroit. fore lobby investigating that he offered to halt behalf of reducing small June committee organizes continue evening school here. June costliest sion legislature June Ashley Rice eighth ward Floyd Shaw sixth ward appointed to city counJune State Savings bank will pay off to depositors Monday, June 26.

June costing suggested here government public program. June plant probable when bid raised June crack safe Oil company office June of education June Peter Gray appointed warden of Jackson state prison. June Max Tem pleton seventh ward becomes succeeding Former Mayor Peter Gray.

July attorney raises bid Durant plant to $400,000; former Mayor Peter Gray assumes duties Jackson prison. July steel beer by Wheel. Davis, East Lansing place Chicago: Comstock names emergency commission forwards orders directing Robert Allen, former president bank begin serving sentence for embezzleJuly of Durant plant to named purchaser $450,000 proved federal court Detroit. July rate increased over month 1932. July Ate Dykstra activities Isaiah Leebove connection state prison legality moval defended brief filed McLean elected president board of July plant passes into July former prison tor charge of private detective agencies July Comstock commutes sentence Fred Palm. making prisoner eligible for immediate July Frimodig becomes mayor East Lansing resignation Mayor Bert Ford. July Wheel announces increase employes. July legisladie seeking interpret sales Swander elected commander Maurice Harvey Dixon Post. No. American lists projects public works program totaling July plans to organize support of President Roosevelt's recovery program; Fjetland, ecutive secretary, appointed by member of state prison comJuly Motor Works and Reo Motor launch local paign: line state department to obtain

August August Dodge, after for tion favoring city water softener plant defeated. August Hezekiah Duff. Charles Joseph Gwinn named heads of local committees August Edwin Fetter man named place NRA Patrick O'Brien clash sharply "state first 119th artillery leaves for Camp GrayAugust 5-Saturday night shopping ended. NRA provisions. August officials warned state stream commission complete system. August special legislature aid schools. Journal accepts for August merchants return old hours: first quarter beer revenue $1,566,016 August Carpenter, state welfare director, dismissed, and Miss Evelyn Mershon Saginaw, librarian, appointed to his post. ing August downtown merchants adopt August 1933 legislature more than August ceases issuing scrip because of more rapid payment August gas for LanAugust victs near Lansing by local August Kline company by Jerome August Pett named Community fund former health officer, dies council votes for removal of street tracks. August canvas NRA supporters started.

September September police crash Hackett, local killed, and four injured, day September Michigan dead, 13 hurt, in Labor