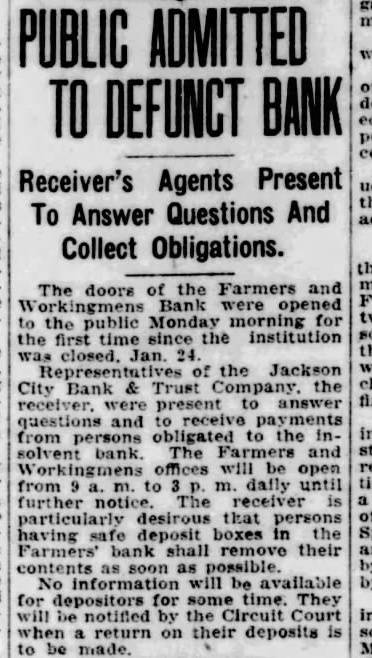

Article Text

PUBLIC ADMITTED TO DEFUNCT Receiver's Agents Present To Answer Questions And Collect Obligations. The doors the were the public Monday for the the institution closed. the Jackson City Bank the from obligated to the bank. and be from daily receiver deposit boxes in the Farmers' bank remove their No be available by for depositors for the Circuit on their deposits to be