Article Text

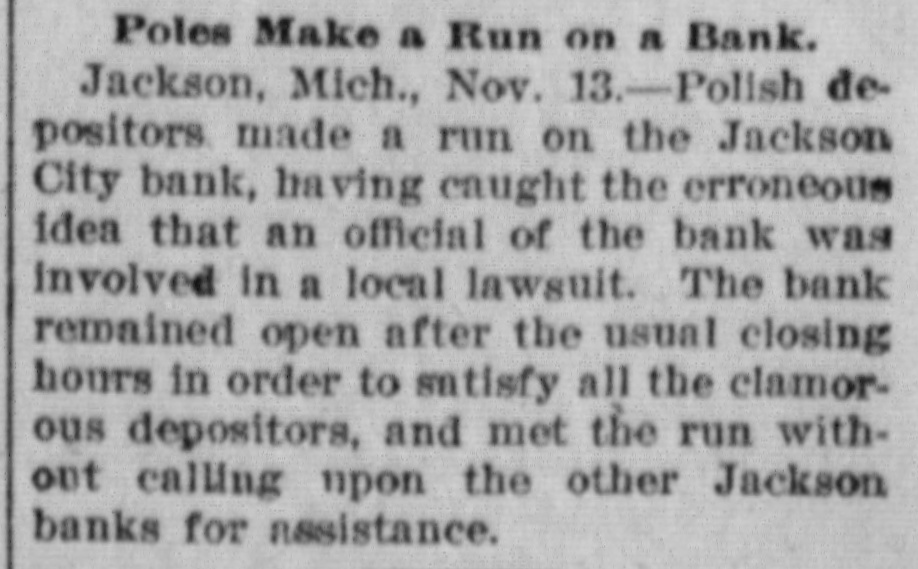

Poles Make a Run on a Bank. Jackson, Mich., Nov. 13.-Polish depositors made a run on the Jackson City bank, having caught the erroneous idea that an official of the bank was involved in a local lawsuit. The bank remained open after the usual closing hours in order to satisfy all the clamorous depositors, and met the run without calling upon the other Jackson banks for assistance.