Article Text

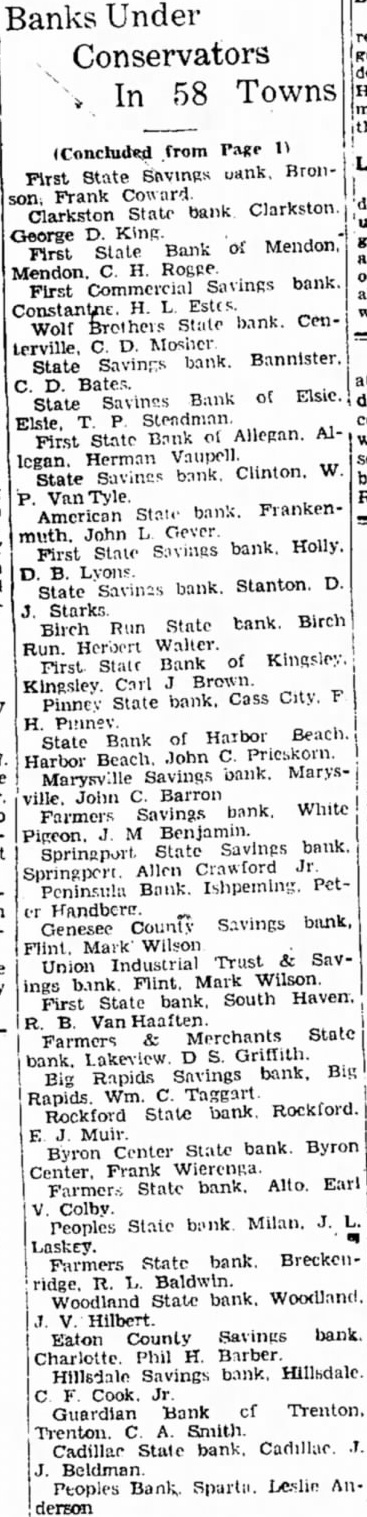

Banks Under Conservators In 58 Towns (Concluded from Page 1) First State SAVINGS bank. Bronson, Frank Coward Clarkston State bank Clarkston. D. King George First State Bank of Mendon, C. H. Rogge Mendon. First Commercial Savings bank Wolf Brothers State bank. Centerville, C. D. Mosher State Savings bank. Bannister. C. D. Bates. State Savings Bank of Elsic. First State Bank of Allegan. Allegan. Herman Vaupell State Savines bank. Clinton. W. P. Van Tyle. American State bank. Frankenmuth. John L Gever First State Savings bank. Holly. B. State Savinas bank. Stanton D. Birch Starks Run State bank. Birch Run. Herbert Walter. First State Bank of Kingsley. Kingsley. Carl J Brown Pinney State bank. Cass City. F State Punney Bank of Harbor Beach. Harbor Beach John C. Prieskorn. Marysville Savings bank. Marysville. John C. Barron Farmers Savings bank. White Pigeon. J. M Benjamin. Springport State Savings bank. Springpert. Allen Crawford Jr Peninsula Bank. Ishpeming. PetGenesee County Savings bank, Flint. Mark Wilson Union Industrial Trust & Savings bank Flint. Mark Wilson First State bank, South Haven. R. B. Van Haaften Farmers & Merchants State bank. Lakeview D S. Griffith. Big Rapids Savings bank. Big Rapids. Wm. C. Taggart Rockford State bank. Rockford. E J. Muir Byron Center State bank. Byron Center. Frank Wierenga. Farmers State bank. Alto. Earl V. Colby. Peoples State bank Milan. J. Laskey. Farmers State bank. Breckenridge. R. L. Baldwin. Woodland State bank. Woodland. J. V. Hilbert Eaton County Savings bank Charlotte Phil H. Barber Hillsdale Savings bank. Hillsdale C F. Cook. Jr. Guardian Bank cf Trenton. Trenton. C. A. Smith Cadillac State bank. Cadillac J. J. Beldman Peoples Bank Sparts. Leslie Anderson