Article Text

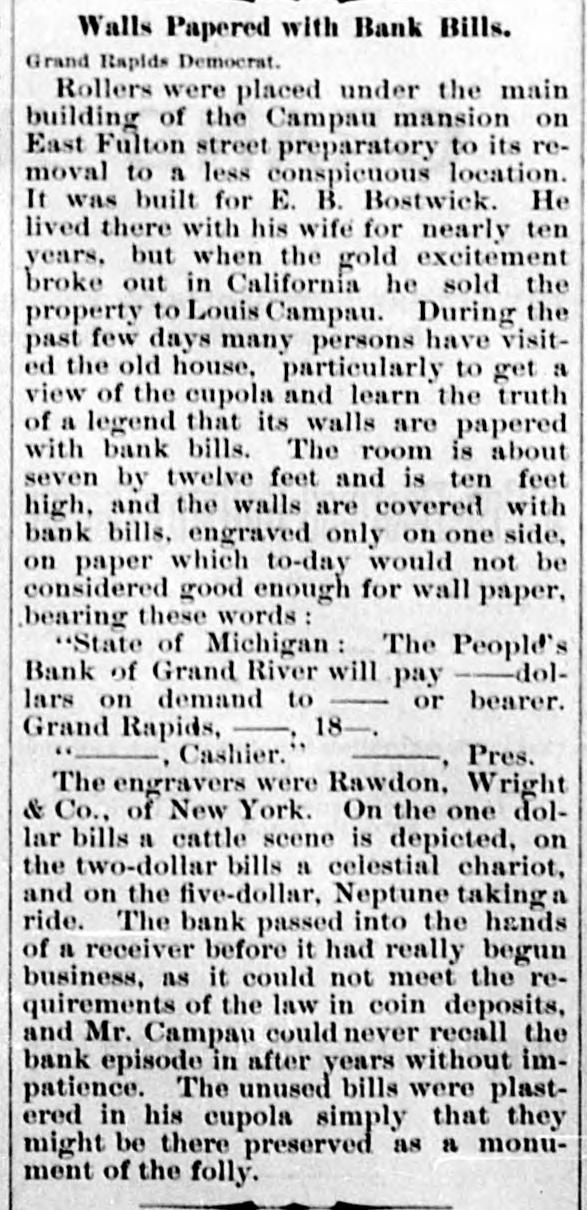

Walls Papered with Bank Bills. Grand Rapids Democrat. Rollers were placed under the main building of the Campau mansion on East Fulton street preparatory to its removal to a less conspicuous location. It was built for E. B. Bostwick. He lived there with his wife for nearly ten years, but when the gold excitement broke out in California he sold the property to Louis Campau. During the past few days many persons have visited the old house, particularly to get a view of the cupola and learn the truth of a legend that its walls are papered with bank bills. The room is about seven by twelve feet and is ten feet high, and the walls are covered with bank bills. engraved only on one side, on paper which to-day would not be considered good enough for wall paper, bearing these words: *State of Michigan : The People's Bank of Grand River will pay -dollars on demand to - or bearer. 18Grand Rapids, . Cashier. , Pres. The engravers were Rawdon. Wright & Co., of New York. On the one dollar bills a cattle scene is depicted, on the two-dollar bills a celestial chariot, and on the five-dollar. Neptune taking a ride. The bank passed into the hands of a receiver before it had really begun business, as it could not meet the requirements of the law in coin deposits, and Mr. Campau could never recall the bank episode in after years without impatience. The unused bills were plastered in his cupola simply that they might be there preserved as a monument of the folly.