Article Text

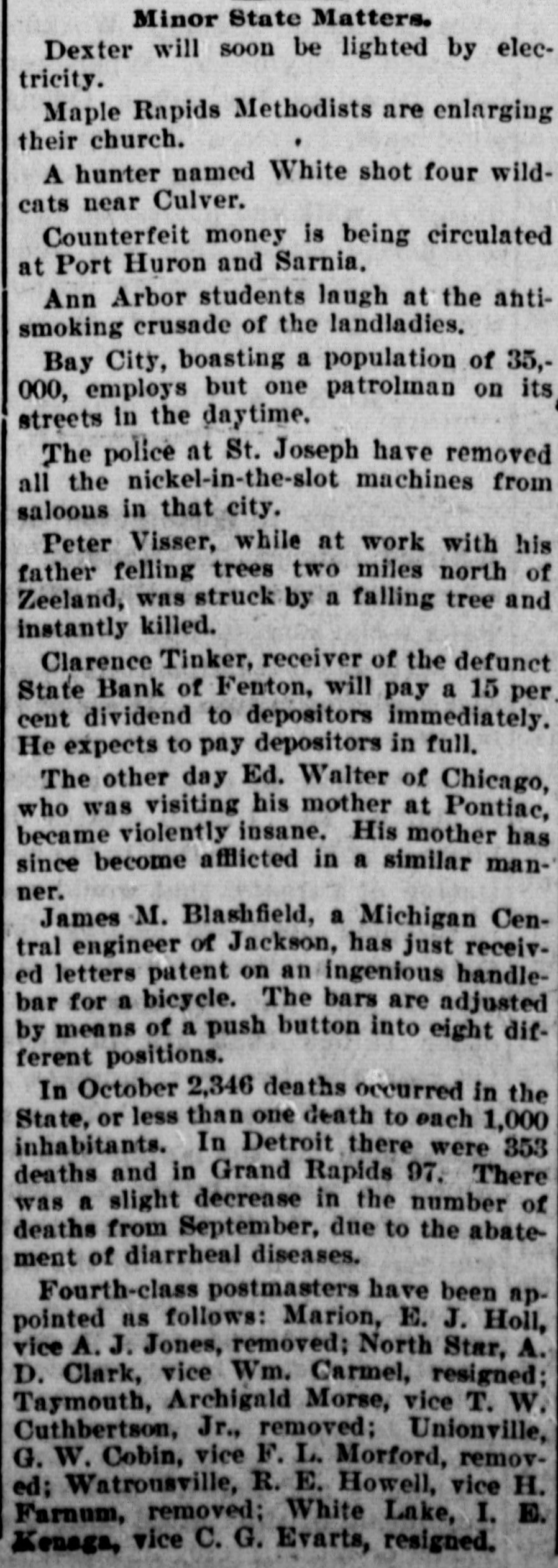

Minor State Matters. Dexter will soon be lighted by electricity. Maple Rapids Methodists are enlarging their church. A hunter named White shot four wildcats near Culver. Counterfeit money is being circulated at Port Huron and Sarnia. Ann Arbor students laugh at the antismoking crusade of the landladies. Bay City, boasting a population of 35,000, employs but one patrolman on its streets in the daytime. The police at St. Joseph have removed all the nickel-in-the-slot machines from saloons in that city. Peter Visser, while at work with his father felling trees two miles north of Zeeland, was struck by a falling tree and instantly killed. Clarence Tinker, receiver of the defunct State Bank of Fenton, will pay a 15 per. cent dividend to depositors immediately. He expects to pay depositors in full. The other day Ed. Walter of Chicago, who was visiting his mother at Pontiac, became violently insane. His mother has since become afflicted in a similar manner. James M. Blashfield, a Michigan Central engineer of Jackson, has just received letters patent on an ingenious handlebar for a bicycle. The bars are adjusted by means of a push button into eight different positions. In October 2,346 deaths occurred in the State, or less than one death to each 1,000 inhabitants. In Detroit there were 353 deaths and in Grand Rapids 97. There was a slight decrease in the number of deaths from September, due to the abatement of diarrheal diseases. Fourth-class postmasters have been appointed as follows: Marion, E. J. Holl, vice A. J. Jones, removed; North Star, A. D. Clark, vice Wm. Carmel, resigned; Taymouth, Archigald Morse, vice T. W. Cuthbertson, Jr., removed; Unionville, G. W. Cobin, vice F. L. Morford, removed; Watrousville, R. E. Howell, vice H. Farnum, removed; White Lake, I. E. Kenaga, vice C. G. Evarts, resigned.