Article Text

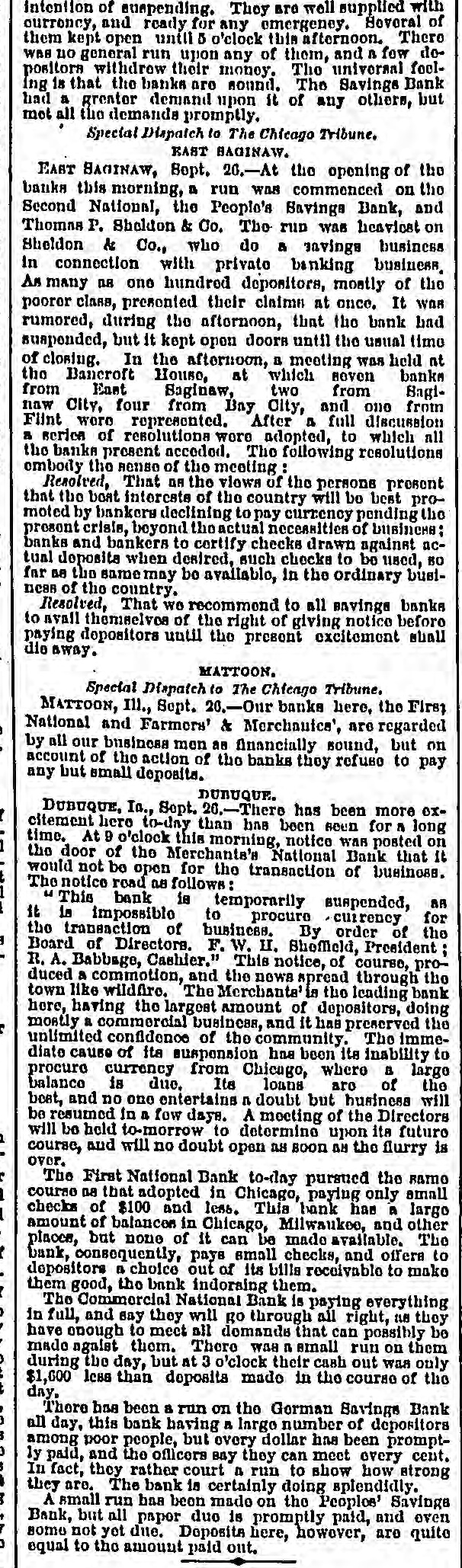

intention of suspending. They are well supplied with currency, and ready for any emergency. Beveral of them kept open until 5 o'clock this afternoon. There was no general run upon any of them, and n fow depositors withdrew their money. The universal fooling is that the banks are sound. The Savings Bank had a grenter demand upon it of any others, but met all the demands promptly. Special Dispatch to The Chicago Tribune. EAST BAGINAW. EART BAGINAW, Sept. 26.-At the opening of the banks this morning, a run was commenced on the Second National, the People's Savings Bank, and Thomas P. Sheldon & Co. The run was heaviest on Sheldon & Co., who do & savings business In connection with private banking business. An many as one hundred depositors, mostly of the poorer class, presented their claimn at once. It was rumored, during the afternoon, that the bank had suspended, but it kept open doors until the usual time of closing. In the afternoon, a meeting was held nt the Bancroft House, at which seven banks from East Saginaw, two from Baginaw City. four from Bay City, and one from Flint were represented. After a full discussion a series of resolutions were adopted, to which all the banks present acceded. The following resolutions embody the sense of the meeting : Resolved, That DA the views of the persons present that the boat interests of the country will be best promoted by bankers declining to pay currency pending the present crisis, beyond the actual necessities of business; banks and bankers to certify checks drawn against actual deposits when desired, such checks to be used, 80 far as the samemay be availablo, in the ordinary bustness of the country. Resolved, That we recommend to all savings banks to avail themselvos of the right of giving notice before paying depositors until the present excitement shall die away. MATTOON. Special Dispatch to The Chicago Tribune, MATTOON, Ill., Sept. 20.-Our banks here, the First National and Farmers' & Merchanica', are regarded by all our business men as financially sound, but on account of the action of the banks they refuse to pay any but small deposits. DUBUQUE. DUBUQUE, In., Sept. 20.-There has been more OXcitement here to-day than has been seen for a long time, At o'clock this morning, notice was posted on the door of the Merchante's National Bank that it would not be open for the transaction of business. The notice road as follows: This bank is temporarily suspended, BR it is impossible to procure currency for the transaction of business. By order of the Board of Directors. F. W. II. Shefield, President . A. Babbage, Cashier." This notice, of course, produced a commotion, and the nows spread through the town like wildfire. The Merchants' is the leading bank here, having the largest amount of depositors, doing mostly a commercial business, and it has preserved the unlimited confidence of the community. The immediate cause of its suspension hns been its inability to procure currency from Chicago, where a large balance is due. Its loans are of the best, and no one entertains n doubt but business will be resumed in a fow days. A meeting of the Directors will be held to-morrow to determine upon its futuro course, and will no doubt open as soon as the flurry is over. The First National Bank to-day pursued the same course as that adopted in Chicago, paying only email checks of $100 and less. This bank has a largo amount of balances in Chicago, Milwaukee, and other places, but none of it can be made available. The bank, consequently, pays small checks, and offers to depositors a choice out of its bills receivable to make them good, the bank indorsing them. The Commercial National Bank is paying everything in full, and say they will go through all right, as they have enough to meet all domands that can possibly be made agaist them. There was n emall run on them during the day, but at 3 o'clock their cash out was only $1,000 less than deposits mado in the course of the day. There has been a run on the Gorman Savings Bank all day, this bank having a largo number of depositors among poor people, but every dollar has been promptly paid, and the oflicers Bay they can meet every cent. In fact, they rather court a run to show how strong they are. The bank is certainly doing splendidly. A small run has been made on the Peoples' Savings Bank, but all papor due is promptly paid, and oven some not yet due. Deposits here, however, are quite equal to the amount paid out,