1.

January 5, 1906

The Birmingham Age-Herald

Birmingham, AL

Click image to open full size in new tab

Article Text

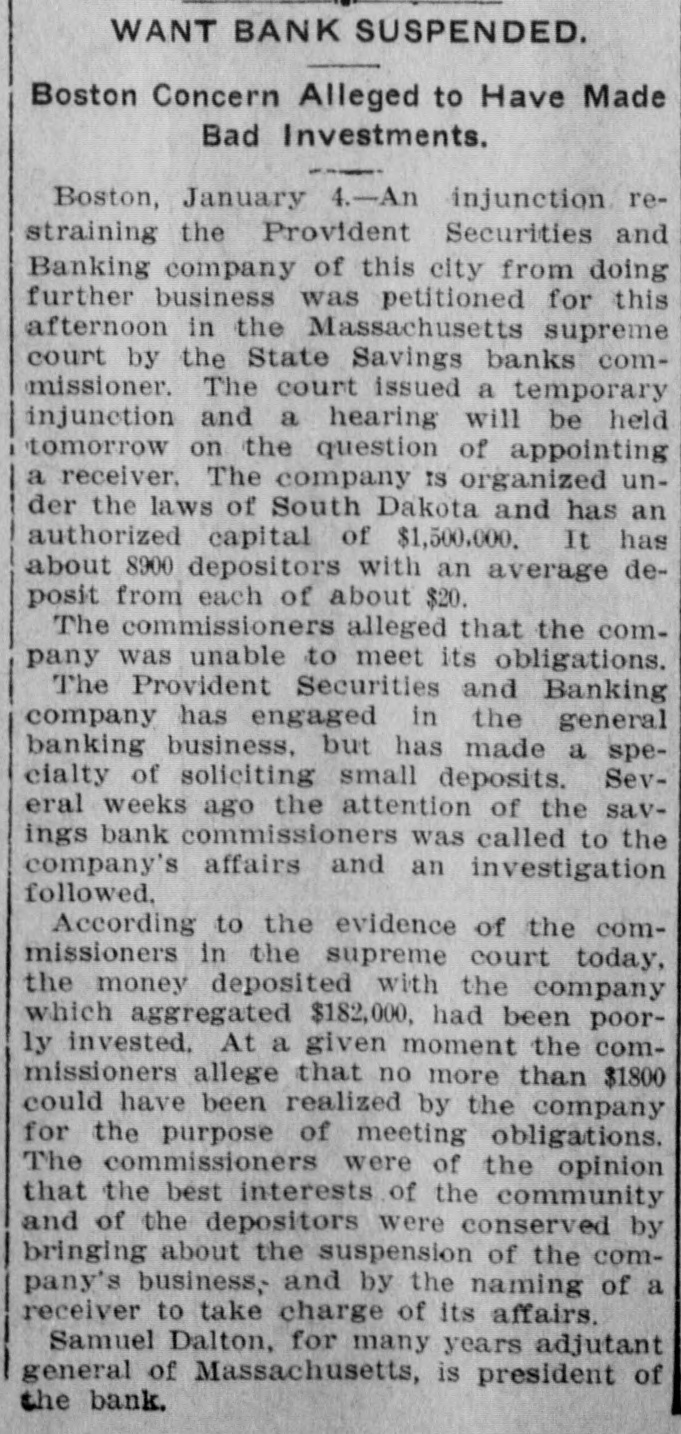

WANT BANK SUSPENDED. Boston Concern Alleged to Have Made Bad Investments. Boston, January 4.-An injunction. restraining the Provident Securities and Banking company of this city from doing further business was petitioned for this afternoon in the Massachusetts supreme court by the State Savings banks commissioner. The court issued a temporary injunction and a hearing will be held tomorrow on the question of appointing a receiver. The company IS organized under the laws of South Dakota and has an authorized capital of $1,500,000. It has about 8900 depositors with an average deposit from each of about $20. The commissioners alleged that the company was unable to meet its obligations. The Provident Securities and Banking company has engaged in the general banking business, but has made a specialty of soliciting small deposits. Several weeks ago the attention of the savings bank commissioners was called to the company's affairs and an investigation followed, According to the evidence of the commissioners in the supreme court today, the money deposited with the company which aggregated $182,000. had been poorly invested. At a given moment the commissioners allege that no more than $1800 could have been realized by the company for the purpose of meeting obligations. The commissioners were of the opinion that the best interests of the community and of the depositors were conserved by bringing about the suspension of the company's business, and by the naming of a receiver to take charge of its affairs. Samuel Dalton, for many years adjutant general of Massachusetts, is president of the bank.

2.

January 5, 1906

The Cairo Bulletin

Cairo, IL

Click image to open full size in new tab

Article Text

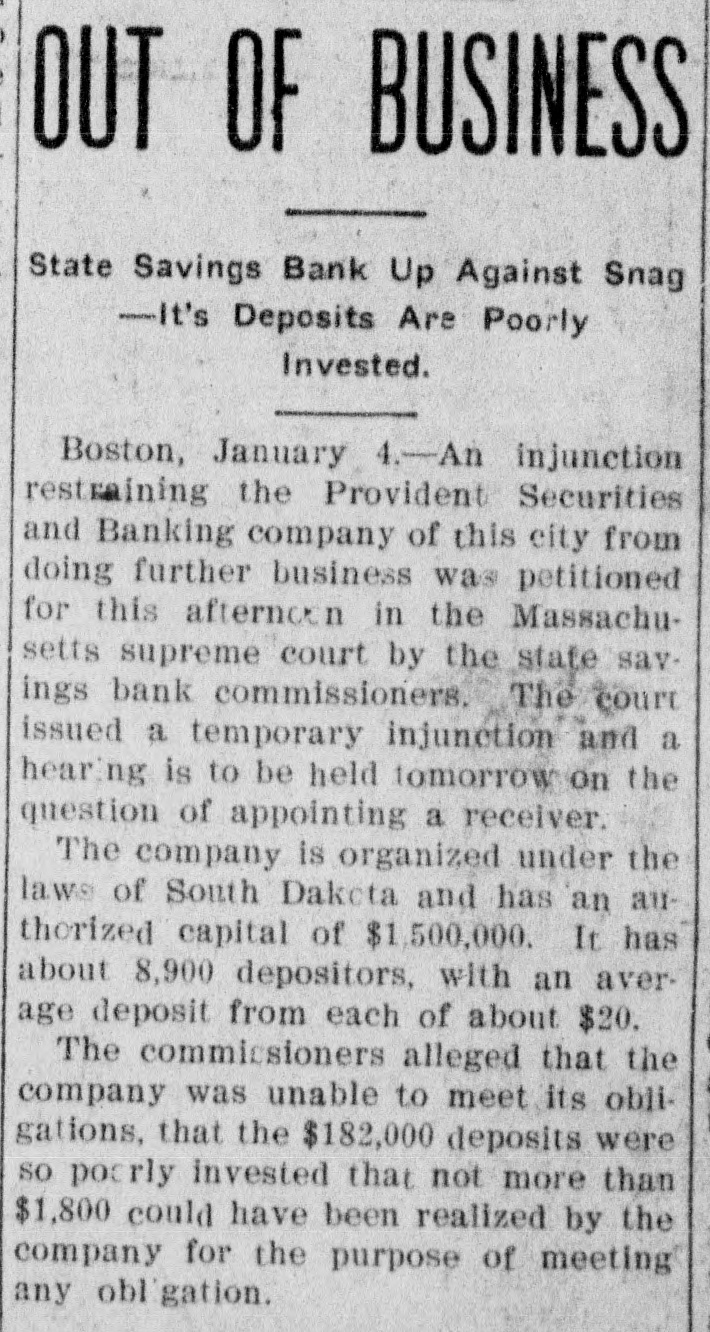

OUT OF BUSINESS State Savings Bank Up Against Snag - It's Deposits Are Poorly Invested. Boston, January 4.-An injunction restraining the Provident Securities and Banking company of this city from doing further business was petitioned for this afternoon in the Massachusetts supreme court by the state savings bank commissioners. The court issued a temporary injunction and a hearing is to be held tomorrow on the question of appointing a receiver. The company is organized under the laws of South Dakota and has an authorized capital of $1,500,000. It has about 8,900 depositors, with an average deposit from each of about $20. The commissioners alleged that the company was unable to meet its obligations, that the $182,000 deposits were so poorly invested that not more than $1,800 could have been realized by the company for the purpose of meeting any obligation.

3.

January 5, 1906

The Providence News

Providence, RI

Click image to open full size in new tab

Article Text

ONLY $3000 OF ASSETS IS CASH Boston, Jan. 5.-Action upon the receivership petition brought by the Savings bank examiners against the Provident Securities and Banking company of this city, which was filed yesterday and referred until next Wednesday by Judge Braley of the Massachusetts supreme court today. The case came up, but on representations of S. K. Hamilton, representing the bank, that the right of the examiners to close the institution was in doubt, the case was permitted to go over until Jan. 10. A temporary injunction restraining the company from doing business, pending a hearing granted by the court yesterday, remained in force. The question raised by Attorney Hamilton was whether the power legally conferred upon the savings bank examiners extended beyond that of making examina. tion and his request for a postponement was based on his desire to consult authorities on this point. The office of the bank on Franklin street was closed today. There was no note or announcement in sight to satisfy the anxiety of a score or more of depositors who were in the corridors nc the bank's usual opening (hour. *The doors were locked. After waiting a while most of the depositors withdrew, though some remained for nearly an hour. In connection with the case before Judge Braley, Assistant District Attorney De Goosh, presented the information that the company had assets of a par value of $609,707. of which about $2000 or $3000 was in cash, and the remainder of securities of a doubtful value. The company had between 6000 and 9000 depositors, he said, who had placed with the company cash to the amount of about $182,000. MANY LYNN FOLK AFFECTED. Lynn, Mass., Jan. 5.-Although the extent of the business done in this city, by the Provident Securities and Banking company of Boston is not known, it was learned today that hundreds of factory employes had deposited money in the bank. The company rented an office at 16 Central avenue, but this office was only opened on Saturday of each week, at which time an officer of the bank came here from Boston, and collected the savings from the small banks, with which each customer of the bank was provided. These small banks were distributed by several local factory employes. 40 cents of the first dollar deposited being paid as the commission by the company. Many depositors, it was learned today. withdrew their savingfis from the bank during the Christmas holidays.

4.

January 5, 1906

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

THE BOSTON BANK FAILURE. Action on Receivership Petition Deferred-Statement of Financiers. BOSTON, January 5.-Action upon the receivership petition brought.! by the savings bank examiners against the Provident Securities and Banking Company of this city, which was filed yesterday, was deferred until next Wednesday by Judge Braley of the Massachusetts supreme court today. The case came up, but on representations of S. K. Hamilton, counsel for the bank, stating that the right of the examiners to close the institution was doubtful, the case was permitted to go over. A temporary injunetion restraining the company from doing business, pending a hearing, granted by the court yesterday, remained in force. In connection with the case, Assistant Attorney de Goosh for the state informed the court that the company had total assets of a par value of $609,707, of which about $2,000 or $3,000 was in cash and the remainder securities of doubtful value. The company had between 8,000 and 9,000 depositors, he said, who had placed with the company cash to the amount of about $182,000. The office of the bank on Franklin street was closed today. Hundreds of factory employes at Lynn had deposits in the bank. A number of them. it was learned today, withdrew their savings during the Christmas holidays.

5.

January 5, 1906

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

ACT AGAINST BANKING COMPANY. I Massachusetts Commissioners Get Injunction to Prevent Further Business. Boston, Jan. 4.-An injunction restraining the Provident Securities and Banking Company. of this city, from doing further business was petitioned for this afternoon in the Massachusetts Supreme Court by the State Savings Bank Commissioners. The court issued a temporary injunction, and a hearing will be held to-morrow on the question of appointing a receiver. The company is organized under the laws of South Dakota, and has an authorized capital of $1,500,000. It has about 8,900 depositors, with an average deposit from each of about $20. The commissioners allege that the company is unable to meet its obligations. James S. Otis. of Malden, one of the commissioners, stated to-night that the board had found the Provident Securities and Banking Company in "a deplorable state." "We found." said Mr. Otis, "that the institution on December 31 had deposits amounting to $182,000. with assets which were problematical in value. The cash on hand on that date amounted to about $3,000. The principal asset of the company was 140,000 shares in the Shenandoah Irrigation Company, of Colorado. A further examination showed that dividends, salaries and expenses of the company had been paid out of deposits.

6.

January 5, 1906

The Montgomery Advertiser

Montgomery, AL

Click image to open full size in new tab

Article Text

RECEIVER FOR BANK. Application Before the Supreme Court of Massachnsetts. Boston, Jan. 4.-An injunction restraining the Provident Securities and Banking Company of this city from doing further business, was petitioned for this afternoon in the Massachusetts Supreme Court by the State Savings Bank Commissioner. The court issued a temporary injunction and a hearing will be held tomorrow on the question of appointing a receiver, The company is organized under the laws of South Dakota and has an authorized capital of $1,500,000. The Provident Securities and Banking Company has been engaged in the general banking business, but has made a specialty of soliciting small deposits. Several weeks ago the attention of the Savings Bank Commissioner was called to the company's affairs and an investigation followed. According to the evidence of the Commissioner in the Supreme Court today, the money deposited with the company which aggregated $182,000, had been poorly invested. At a given moment the Commissioner alleges that no more than $1,800 could have been realized by the company for the purpose of meeting any obligations. The Commissioners were of the opinion that the best interests of the community and of the depositors were conserved by bringing about the suspension of the company's business and by the naming of a receiver to take charge of its affairs. Samuel Dalton, for many years Adjutant-General for Massachusetts, is President of the bank.

7.

January 6, 1906

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

MONEY OF POOR IN CLOSED BANK Depositors in Boston Provident Concern Principally Factory and Store Girls. Boston, Jan. 5-Action upon the receivership petition brought by the savings bank examiners against the Provident Securities and Banking Company, of this city, was deferred until next Wednesday. by Judge Braley, of the Massachusetts Supreme Court, to-day. A temporary injunction restraining the company from doing business remains in force. Mr. DeGoosh, Assistant Attorney General, informed the court that the company had total assets of a par value of $609,707, of which about $2,000 or $3,000 was in cash and the remainder securities of doubtful value. The company had between eight thousand and nine thousand depositors, he said, who had placed with the company cash to the amount of about $182,000. There are nearl 3,000 depositors in Brocton, Their deposits range from $1 to $250, the average being estimated at about $5. Most of the depositors are minors, including hundreds of girls employed in the stores and shoe factories there. In Lynn hundreds of factory employes had deposited money in the bank. Each customer was provided with a little bank. These were distributed by several factory employes, forty cents of the first dollar deposited being paid as a commission by the company.

8.

January 11, 1906

The Bon Homme County Independent

Tabor, SD

Click image to open full size in new tab

Article Text

BANK IS IN TROUBLE Petition for a Receiver for a Massa. chusetts Bank with South Dakota Charter. Boston, Jan. 9.-An injunction restraining the Provident Securities and Banking company, of this city, from doing further business was petitioned for late yesterday afternoon in the Massachusetts supreme court by the state savings bank commissioners. The court issued a temporary injunction and a hearing will be held on the question of appointing a receiver. The company is organized under the laws of South Dakota and has an authorized capital of $1,500,000. It has about 8,900 depositors, with an average deposit from each of about $20. The commissioners alleged that the company was unable to meet its obligations. The Provident Securities and Banking company was engaged in the general banking business, but has made a speclalty of soliciting small deposits. Several weeks ago the attention of the savings bank commissioners was called to the company's affairs and an investigation followed. According to the evidence of the com+ missioners in the supreme court the money deposited with the company which aggregated $182,000. had been poorly invested. At a given moment the commissioners allege that no more than $1,800 could have been realized by the company for the purpose of meeting any obligations. The commissioners were of the opinion that the best interests of the community and of the depositors were concerned by bringing about the suspension of the company's business and by naming a receiver to take charge of its affairs. Samuel Dalton, for many years adjutant general for Massachusetts, is presdent of the bank.

9.

January 11, 1906

The Citizen-Republican

Scotland, Parkston, SD

Click image to open full size in new tab

Article Text

BANK IS IN TROUBLE. Petition for a Receiver for a Massachusetts Bank with South Dakota Charter. Boston, Jan. 9-An injunction ,restraining the Provident Securities and Banking company, of this city, from doing further business was petitioned for late yesterday afternoon in the Massachusetts supreme court by the state savings bank commissioners. The court issued a temporary injunction and a hearing will be held on the question of appointing a receiver. The company is organized under the laws of South Dakota and has an authorized capital of $1,500,000. It has about 8,900 depositors, with an average deposit from each of about $20. The commissioners alleged that the company was unable to meet its obligations. The Provident Securities and Banking company was engaged in the general banking business, but has made a specialty of soliciting small deposits. Several weeks ago the attention of the savings bank commissioners was called to the company's affairs and an investigation followed. According to the evidence of the commissioners in the supreme court the money deposited with the company which aggregated $182,000. had been poorly invested. At a given moment the commissioners allege that no more than $1,800 could have been realized by the company for the purpose of meeting any obligations. The commissioners were of the opinion that the best interests of the community and of the depositors were concerned by bringing about the suspension of the company's business and by naming a receiver to take charge of its affairs. Samuel Dalton, for many years adjutant general for Massachusetts, is presdent of the bank.

10.

January 12, 1906

The Daily Morning Journal and Courier

New Haven, CT

Click image to open full size in new tab

Article Text

WANTS BANK EXAMINERS REMOVED FROM OFFICE BOSTON DISTRICT ATTORNEY ACCUSES THEM OF GROSS CARELESSNESS. Also of Wilful Neglect in Connection With the Affairs of the Provident Securities and Banking Company Which Recently Suspended-Sends Letter to Governor Guild Asking Accused Removal-Depositors Call Upon the Chief Executive to Assist Them. Boston, Jan. 11.-As the result of his investigation to-day of the recent suspension of the Provident Securities and Banking company of this city, District Attorney John B. Moran to-night sent a letter to Governor Curtis Guild, jr., asking that the Massachusetts savings bank commissioners be removed from office. In his letter Mr. Moran charges that the commissioners, James o. Otis of Malden, Frederick B. Washburn of Wellesley Hulls and Warren E. Lock of Norwood, were "grossly careless and wilfully- negligent" in connection. with the affairs of the Provident company and other institutions. Mr. Moran maintains that the savings ibank commissioners had full power under the law of 1902 to inquire into the affairs of the company, and that if they had done so they would have uncovered the condition of affairs which has been revealed by the suspension, and thus have prevented possible losses affecting over 8,000 depositors, the majority of whom are laboring men and women, and children. About 150 depositors of the bank waited upon Governor Guild and asked him to assist them. The governor, however, stated that the matter was in the hands of the courts, and that he could not lawfully interfere at this time.

11.

January 12, 1906

The Montgomery Advertiser

Montgomery, AL

Click image to open full size in new tab

Article Text

ATTACK ON OFFICIALS. Moran Asks Removal of Massachusetts Bank Commissioner. Boston, Jan. 11.-As the result of his investigation today of the recent suspension of the Provident Securities and Banking Company of this city, District Attorney John B. Moran tonight sent a letter to Governor Curtis Guild, Jr., asking that the Massachusetts Savings Bank Commissioners be removed from office. In his letter Mr. Moran charges that the Commissioners, James O. Otis of Maldin, Frederick B. Washburn of Wellesley Hills and Warren E. B. Lock of Norwood, were "grossly careless and wilfully negligent" in connection with the affairs of the Provident company and other institutions. Mr. Moran maintains that the Savings Bank Commissioners had full power under the law of 1902 to Inquire into the affairs of the company and that if they had done this they would have uncovered the condition of affairs which has been revealed by the suspension, and thus have prevented possible losses affecting over 8,000 depositors, the majority of whom are laboring men and women and children.

12.

January 12, 1906

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

ATTACKS BANK COMMISSIONERS. Moran, Boston's Jerome, Demands Their Removal for Incompetence. Boston, Jan. 11.-As a result of his investigation to-day of the recent suspension of the Provident Securities and Banking Company, of this city, District Attorney John B. Moran to-night sent a letter to Governor Curtis Guild, jr., asking that the Massachusetts Savings Bank Commissioners be removed from office. In his letter Mr. Moran charges that the Commissioners, James O. Otis, of Malden; Frederick B. Washburn, of Wellesley Hills, and Warren E. Lock, of Norwood, were "grossly careless and wilfully negligent" in connection with the affairs of the Provident company and other institutions.

13.

January 14, 1906

The Minneapolis Journal

Minneapolis, MN

Click image to open full size in new tab

Article Text

Special Correspondence of The Journal. OSTON, Mass., Jan. 11.-The savings banks commissioners of this B state are under fire because of their failure to have proper supervision over a concern known as the Provident Securities and Banking company, thru the failure of which over 9,000 depositors have lost about $200,000. The company had been doing business since 1902, among the officers being some of the most prominent men in Boston, including former Adjutant General Samuel Dalton and Colonel 'Sidney M. Hedges, all of whom got out of the concorn before the crash came. The company did business by distributing metal banks, which depositors took home, and in which they placed their loose change until they had enough of it to deposit. The names of the. directors seemed to be sufficient guarantee of the stability of the concern, and the number of small depositors grew rapidly. Under the laws of the state the company could not use the word savings, but it seems to have got along famously without it. The savings bank commissioners paid very little attention to it, and when the end was reached it was found that the company was largely in the hands of office boys; that it had been formed to finance schemes of the Shenandoah Irrigation company, and that all sorts of complications had resulted. The offices of the company have been besieged with depositors, many of whom have gone to the statehouse to make personal appeals to Governor Guild. The public has become so much stirred over the matter that the savings banks commissioners have been placed in an unpleasant position, and preparations are being made to guard against companies of the kind doing business in the state in future. Its name was so like that of the Provident Institution for Savings, one of the very oldest and soundest of the savings banks, that there came near being a run on that institution. Mayor Fitzgerald has begun his agitation for a busier Boston in a most energetic manner, and has already turned his attenBeston's Mayor tion to the New York, New Haven Stirs & Hartford railroad, which he declares does not Things Up give Boston proper representation in its management. This road has practically a monopoly of the business in the east, but its headquarters are in New Haven, and business men have been complaining for years about the service between this city and New York. The mayor has also created a sensation by refusing to allow a religious sect called the Holy Jumpers" to have meetings in Boston. While it is ad mitted that the meetings held by these were as as most remen women it people ligious going thru exercises, all not kinds the orderly of contortions, and was not until the mayor refused to allow them to meet that much attention was paid to them. Then clergymen of differ ent denominations set up a protest about

14.

January 18, 1906

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

BANK RECEIVER ASKED. Insolvency of Provident, of Boston, Alleged. Boston, Jan. 17. --Assistant Attorney General De Goosh to-day petitioned that a receiver be appointed for the Provident Securities and Banking Company, which was placed in the hands of custodians about ten days ago by the State Supreme Court. The petition was offered because of an alleged visit by Lorenzo W. Burlen, the treasurer, to the company's offices, and the alleged removal of property on the evening of January 4, application for an injunction to restrain the company from doing business having been filed by the State Savings Bank Commissioners on the afternoon of that day. The appointment of custodians was made by Judge Holmes after application by the bank commissioners for a receiver, on representations by counsel for the bank that a considerable return might be made to the nine thousand depositors who had intrusted to the institution deposits aggregating $182,000 by a sale of securities. The motion made to-day was opposed by counsel for the bank on the same ground. Assistant Attorney General De Goosh told the court that of the $182,000 which was deposited with the company there remains now, the custodians say, but $450 in actual cash. Counsel for the company stated that Burlen would be back in Boston by Friday. and a hearing was set for that day. Counsel for Burlen and the custodians of the bank held a conference, and one custodian sala that, so far as he and his fellow custodians could tell from the books, nothing of value belonging to the company was removed by Burlen on January 4. After the conference it was stated that counsel for the bank had said that there was a possibility of raising $50,000 to distribute to depositors. Montreal, Jan. 17.-L. W. Burlen arrived here last night. He said he came to Canada on the advice of his attorney in search of rest and to avoid embarrassment.

15.

January 18, 1906

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

Neto Work Daily Gribune THURSDAY, JANUARY 18, 1906. THE NEWS THIS MORNING. CONGRESS-Senate: Mr. Tillman attacked the President in connection with the case of Mrs. Minor Morris, and was rebuked by Mr. Hale and House: The day was devoted to others. pension legislation, 166 bills being passed. FOREIGN.-Birmingham returned Joseph Chamberlain and his seven candidates, giving rise to Unionist hints of making the champion of fiscal reform the leader of the party in place of Mr. Balfour; the Liberals gained twenty-two more seats, twelve of them being in London. M. Fallières, President of the Senate, was elected President of the French Republic on the first ballot by the National Assembly at Versailles; the vote was: M. Fallières, 449; M. Doumer, 871; scattered, 28. Venezuelan officials prohibited M. Taigny, the French chargé d'affaires, from landing again in Venezuela, and also expelled the heads of the French cable disoffices at Caracas and La Guayra. A patch from St. Petersburg said that great interest was being taken in the National Assembly, and that the registration period had been efforts to crush the revolt seem to successful, except have extended; been fairly in the Caucasus and some of the Baltic islands. Baron von Richthofen, the German Secretary for There was no Foreign Affairs, is dead. session of the delegates to the Moroccan conference at Algeciras yesterday, the members preparing for the discussion of the question of contraband arms, which is the first subject to be taken up. DOMESTIC.-David B. Hill requested that his connection with the Equitable Life Assurance Society be investigated by a committee of the State Bar Association. Joseph H. Choate and General Horace Porter were warmly reA ceived by the State Senate at Albany bill was introduced at Albany striking at the Belmont-Ryan merger by making holding companies illegal. Application was made in Boston for the appointment of a receiver for the Provident Securities and Banking Company. The Carnegie Fund Commission in its second annual meeting, in Pittsburg was unable to find a hero among all the cases examined. Two Chicago cable car lines were tied up by the city, and it was said that suits for $2,000,000 had been filed against the two street railMidshipmen way companies in that city. Marzoni, Foster and Coffin were dismissed from The the navy for hazing at Annapolis. 200th anniversary of the birth of Benjamin Franklin was celebrated in Boston and PhilaSeven members of a family were delphia. supposed to have perished in a fire near Pembroke. N. H. Justice CITY.-Stocks were irregular. Deuel, under cross examination in the libel suit brought against Norman Hapgood. of "Collier's Weekly," told of a large loan made by the Equitable Life Assurance Society to "Town It was said that Senator McTopics." Carren was anxious to get on the Hearst band Copper stocks fell sharply, simulwagon. taneously with a telegraphic bombardment of The Wall Street by Thomas W. Lawson. insurance report of the Armstrong committee is The nearly ready, it was announced here. Mayor's cabinet met and every commissioner present asked more money for improvements. Professor Sparth, of Princeton, spoke at a rally in memory of Benjamin Franklin, held in Cooper Union. A special train, carrying the body of Marshall Field started for Chicago. There was a good attendance and brisk bidding at the first day of the Bishop sale. William M. Ivins delivered an address on ballot reform at the meeting of the State Bar AsLewis Nixon reached sociation in Albany. this city on his return from Russia. THE WEATHER.-Indications for to-day: Rain, The temperature yesterday: Highest, 38 degrees: lowest, 32.

16.

January 20, 1906

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

RECEIVER FOR BOSTON BANK. Provident Securities Company Said To Be Hopelessly Insolvent. Boston, Jan. 19.-Judge Braley to-day ordered that e receiver be appointed for the Provident Securities and Banking Company, recently closed by a temporary injunction of the court. The judge was informed by the custodians of the bank, Charles F. Weed and Alfred F. Hall, that the affairs of the Institution were hopelessly involved. S. K. Hamilton, counsel for the bank, informed the court that certain plans by which it was hoped to realize funds for the payment of depositors had not been realized, whereupon the judge directed that counsel for the State and for the bank should agree upon one of the present custodians to become receiver. The bank has nearly nine thousand depositors, whose accounts aggregate $182,000. The assets include $450 in cash, 142,500 shares of stock of the Shenandoah Irrigation and Land Company, and notes of the Franco-American Gelatine Company. The liabilities are $198,000, of which $182,000 are to the depositors. It was said that to save his brother, President C. D. Gurley of the Provident, R. A. Gurley, of Denver, president of the Gurley Investment Company of Denver and of the Shenandoah Irrigation and Land Company of Colorado offered that the Shenandoah company assume the liabilities of the defunct Boston bank and pay dollar for dollar if the company were allowed to take over the assets.

17.

January 23, 1906

The Providence News

Providence, RI

Click image to open full size in new tab

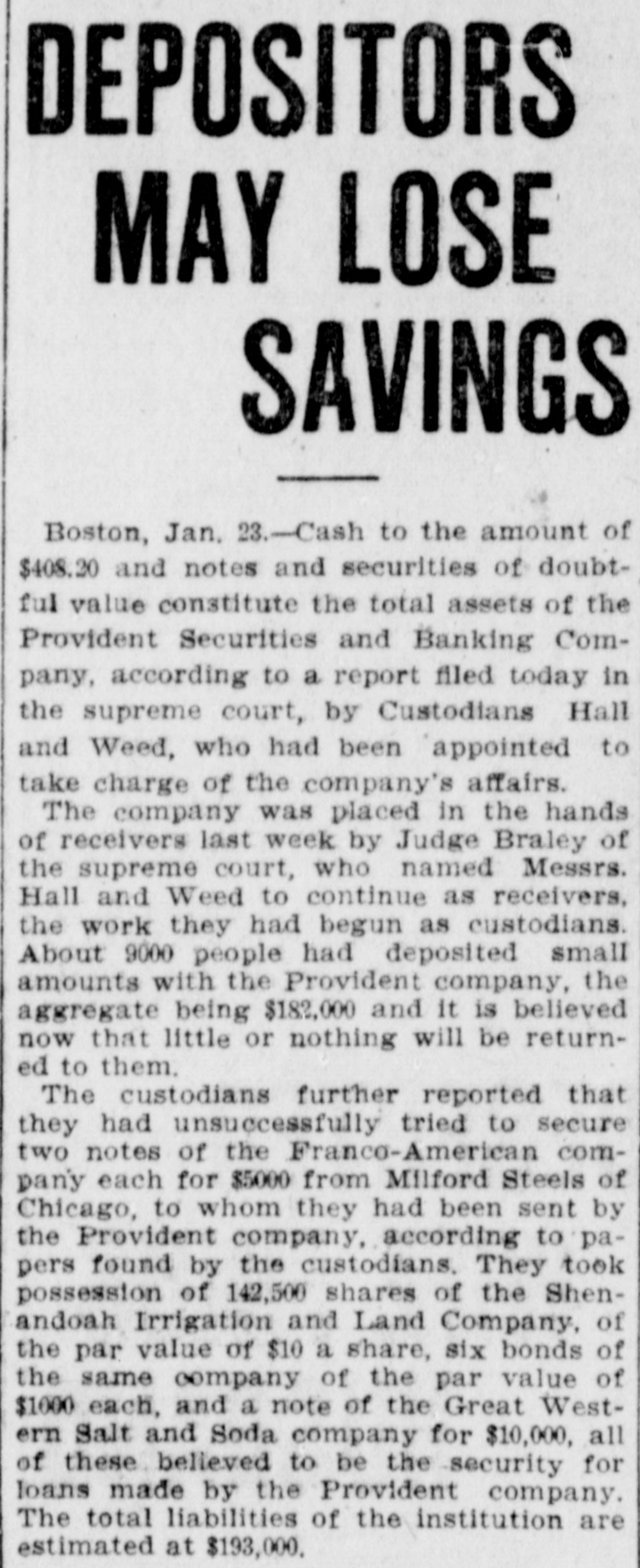

Article Text

DEPOSITORS MAY LOSE SAVINGS Boston, Jan. 23.-Cash to the amount of $408.20 and notes and securities of doubtful value constitute the total assets of the Provident Securities and Banking Company, according to a report filed today in the supreme court, by Custodians Hall and Weed, who had been appointed to take charge of the company's affairs. The company was placed in the hands of receivers last week by Judge Braley of the supreme court, who named Messrs. Hall and Weed to continue as receivers, the work they had begun as custodians. About 9000 people had deposited small amounts with the Provident company, the aggregate being $182,000 and it is believed now that little or nothing will be returned to them. The custodians further reported that they had unsuccessfully tried to secure two notes of the Franco-American company each for $5000 from Milford Steels of Chicago, to whom they had been sent by the Provident company, according to papers found by the custodians. They took possession of 142,500 shares of the Shenandoah Irrigation and Land Company, of the par value of $10 a share, six bonds of the same company of the par value of $1000 each, and a note of the Great Western Salt and Soda company for $10,000, all of these believed to be the security for loans made by the Provident company. The total liabilities of the institution are estimated at $193,000.

18.

February 17, 1906

Spirit of the Age

Woodstock, VT

Click image to open full size in new tab

Article Text

THURSDAY, February 15, 1906. Mrs. Annie A. Leveridge of South Boston burned to death in her home. Miners and coal operators to open their conference in New York Thursday. New Bedford, Mass., official shuts I water off from state armory because of unpaid bill. I Grand Army encampment concluded ? with a banquet at which Gov. Guild, Mayor Fitzgerald, Corp. Tanner and I others spoke. Mrs. Lue Stuart Wadsworth wins 3 the three-conered contest for department junior vice-president of the Mas; sachusetts W. R. C. t Walter Penney of Lynn, Mass., chos1 en division commander of the Sons of Veterans. a Senate committee may report the railroad rate bill with its most important feature, the court review section, . unacted upon; Cullom sick; remainder evenly divided. Observance of the 25th anniversary t of Christian Endeavor. Ex-President John A. McCall of the New York Life rallies slightly and de/ fends himself and his work. Heinze interests in the copper truce , : to be paid between $30,000,000 and $40,000,000 in money. Dr. W. H. Murphy, famous Yale atht lete and coach, dead. 5 Germany challenges for a series of yacht races off Marblehead. Subscriptions to Irish parliamentary t fund coming from all parts of United States. Boston merchants' association divided on whether Mayor Fitzgerald is do1 ing good or harm to city by his disclosures. 0 National senate passes the ship subr sidy bill, 38 to 27; many important t amendments; bill starts 13 new contract mail lines. Boston immigration figures for January show a decrease of 731 from the same month of last year. n Receivers of the Provident securities t and banking company, of Boston, bring a bill in equity to recover $1000 alleged to have been unlawfully paid as divi3. dend to a stockholder; other similar actions may follow.